On February 9th, Cameco (TSX: CCO) reported its full-year 2021 financial results. The company reported full-year revenues of $1.47 billion, down 18% from 2020. Gross profits came in at $1.93 million, down from $106.45 million last year, or down 98.2%. The company saw a negative operating profit of -$132.41 million, and reported a net income of -$102.58 million or an earnings per share of -$0.26.

The company noted that the company’s operations have been interrupted by COVID, with a 4-month suspension at Cigar Lake taking place as a precaution, which only produced 6.1 million pounds below their committed sales. They also saw a $40 million care and maintenance cost due to this closure.

Cameco currently has 14 analysts covering the stock with an average 12-month price target of C$36.91, or a 30% upside to the current stock price. Out of the 14 analysts, 4 have strong buy ratings, 7 have buy ratings and the other 3 analysts have hold ratings. The street high sits at C$40.50, which represents a 42% upside to the current stock price and the lowest 12-month price target comes in at C$30.

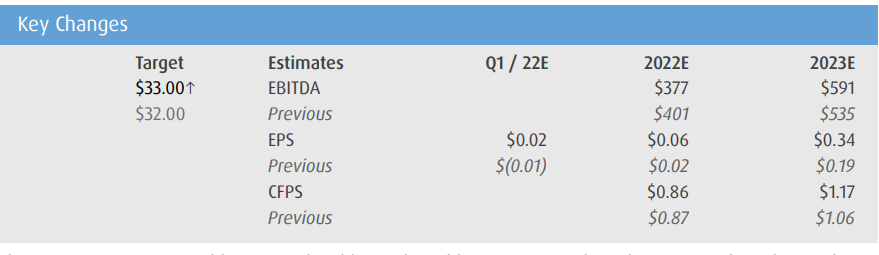

In BMO Capital Markets’ note, they reiterate their market performance rating and raised their 12-month price target from C$32 to C$33, saying that Cameco signing an additional 40mlb of contracts “is clearly positive to the market sentiment.”

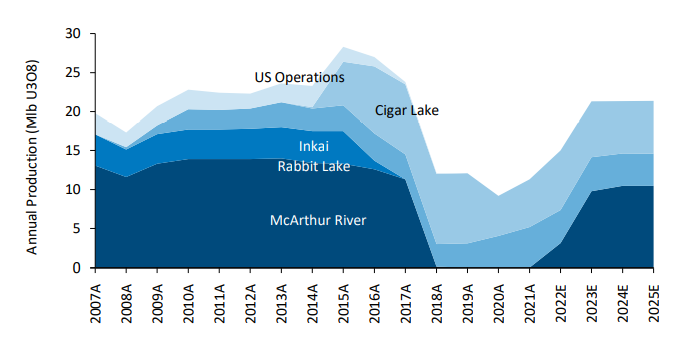

They add, “there are a number of reasons to get more constructive on Cameco,” which includes the restarting of its McArthur River mine. Even with the mine restarting, BMO says that their 2023/2024 production estimates are roughly 4mlb lower than previous. The initial rate for McArthur River is capped at 15 mlb versus their 18 mlb expected previously. This puts BMO’s attributable production to 21.3mlb for 2023/2024.

Below you can see BMO’s updated full-year 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.