Last night, Kirkland Lake Gold (TSX: KL) released their third quarter results. Within the quarter, Kirkland produced 339,600 ounces versus the BMO estimate of 356,800 ounces. The lower than expected number was primarily based on the missed production numbers at Macassa, which did 38,000 ounces versus the 60,800 ounce estimate.

However, this miss was partially offset by the beat at their Fosterville facility, which did 161,500 ounces versus the 143,600 ounces forecast. Kirkland also announced that they would be raising their dividend by 50% to U$0.1875 per share. In BMO’s note to investors this morning, they say that in their opinion the results were mixed.

In the morning note, Brian Quast, BMO’s mining analyst, reiterated their outperform rating and $97.00 12 month price target on the stock. In connection with this, he stated, “Despite lingering effects of COVID-19 on Macassa in Q3/20, KL is still on course to hit FY2020 production guidance of 1,350-1,400 Koz. We reiterate our Outperform rating and $97 target.”

He gives a few key takeaways from last night’s earnings. He first hits on the announcement of the results “that point to a possible continuous corridor of mineralization between the Main and West Pit at Detour Lake,” as well as commenting that the drilling results from the Swan Zone in Fosterville had visible gold.

The second point he hits on is why production numbers were the numbers they were. He says that lower mining rates and grades at Macassa have to do with the earlier recall of production, COVID-19 safety protocols, and reduced equipment availability due to COVID-19. Meanhile the substantial production numbers over at Fosterville were driven by better mining rates, improved ventilation, and paste fill.

The last thing Quast hits on in this note is how the cash balance increased by 58%. Kirkland has U$848 million in cash and generated excellent cash flow from operations. Kirkland sold 332,000 ounces of gold at an average realized price of US$1,907 per ounce.

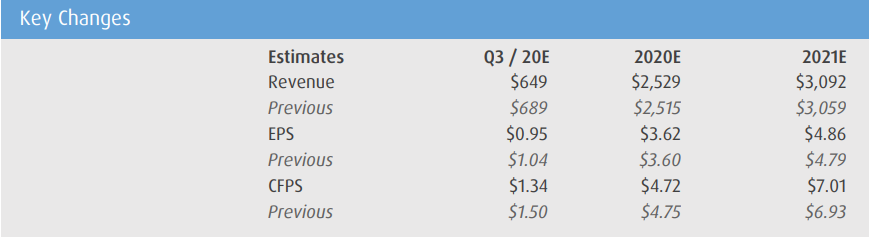

Quast made some slight forecast adjustments for Kirlands fiscal 2020 and 2021 estimates as well, which can be seen below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.