Beyond Meat (NASDAQ: BYND) gained its 21st analyst coverage at the beginning of February. BMO Capital Markets initiated coverage on the name with a $68 12-month price target, or a 2% return at the time and a market perform rating on the stock. They initially say that they believe Beyond Meat has passed the worst of the macro headwinds, and expect the companies revenue to grow at +20% CAGR over the next three years.

Beyond Meat currently has 21 analysts covering the stock with an average 12-month price target of US$71.94, or a 24% upside to the current stock price. Out of the 21 analysts, 1 has a strong buy rating, 1 has a buy rating, 14 analysts have hold ratings and the last 5 analysts have a sell rating on the stock. The street high sits at U$106, which represents an 83% upside to the current stock price while the lowest 12-month price target comes in at US$45.

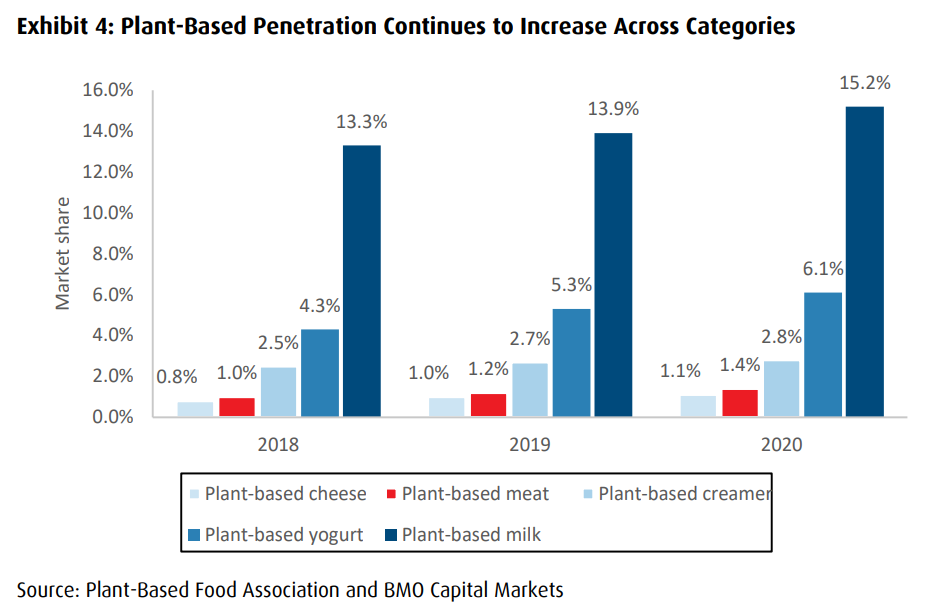

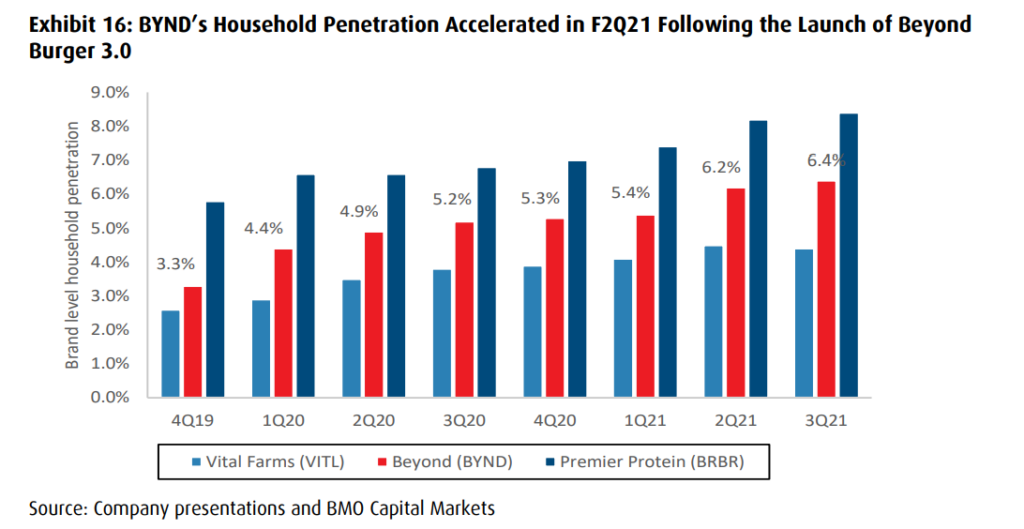

BMO believes that Beyond Meat will generate higher sales growth over the long term for a number of reasons. The first one is the very slow increase in demand for plant-based meats as more people shift towards sustainable food products. The second is the first mover and leading market share advantage Beyond Meat currently has.

The third is the ability to appeal to a wider consumer base through better and greater advertising. Fourth is the ability to scale up better retail distribution as it takes market share away from real meat. And the fifth reason is that more foodservice and global restaurant chains are accelerating their partnerships with fake meat companies.

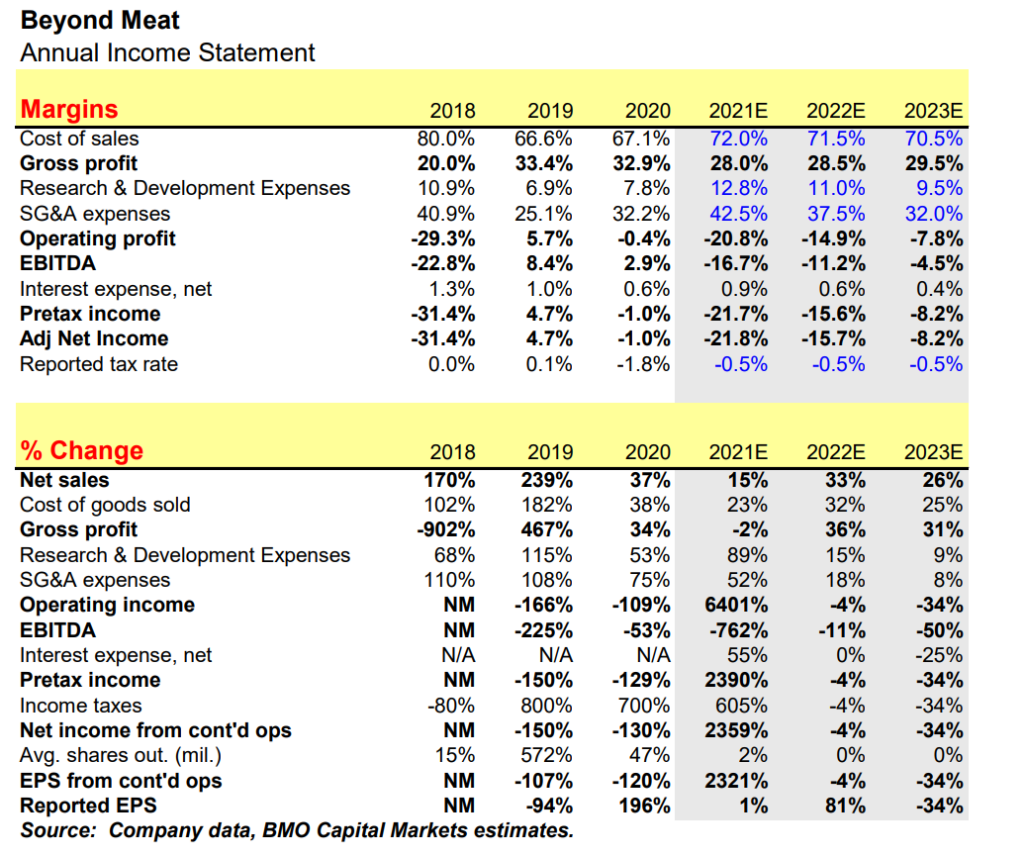

Although BMO is not as bullish as the last paragraph seems, they continue in the note saying, “BYND continues to face pricing headwinds from many angles, including its strategic cost down strategy and its mix shift toward foodservice, particularly QSRs and McDonald’s.” They expect Beyond Meat to struggle to obtain its mid-teens EBITDA and mid-30% gross margins that it seeks out over the long term.

Below you can see BMO’s three-year estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.