On November 9th, Nuvei Corporation (TSX: NVEI) announced its third quarter financial results. The company reported quarterly revenues of $183.93 million, a 3.2% quarter-over-quarter increase but a 96% year-over-year increase. Gross profits were reported at $145.6 million or a 79.2% profit margin, flat quarter over quarter while adjusted EBITDA was $80.9 million.

The company produced a net income of $27 million or earnings per share of $0.19. Nuvei also noted that total dollars processed by merchants were $21.6 billion, an increase of 88% year over year, of that volume 83% came from eCommerce.

Off the back of this quarter, the company raised its full-year guidance to $717 – $723 million from $690 – $705 million and expects adjusted EBITDA to be $312 – $316 million, up from $295 – $305 million previously. The company also reiterated its medium-term revenue outlook of +30% of total volume and adjusted EBITDA margins of >50% long term.

A number of analysts raised their 12-month price targets on Nuvei, bringing the average up to US$131.09, up from US$125.84 before the results. The company currently has 13 analysts covering the stock, with 3 analysts having strong buy ratings, 8 having buy ratings and the other 2 have hold ratings. The street high sits at US$151 while the lowest comes in at US$144.

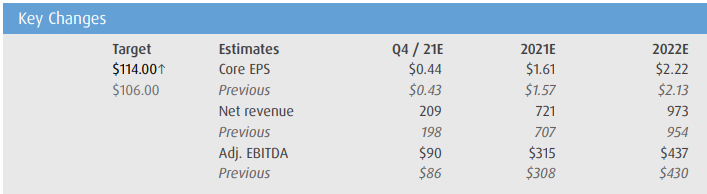

In BMO Capital Markets third quarter review, they reiterate their Market Perform rating and raised their 12-month price target to $114 from $106, writing, “after re-rating during the pandemic, payment stock valuation multiples are now transitioning, perhaps back down to levels implied by the pre-pandemic industry-wide relationship between organic revenue growth potential and P/E.”

For the quarter, Nuvei beat BMO’s estimated adjusted earnings per share of $0.40, while they beat on revenues, which offset the higher than expected costs. BMO is surprised by Nuvei’s volume growth and notes that it was broad-based and not driven by a specific location, with NA volumes up 118%, EMEA up 62%, APAC up 93%, and LatAm up 140% year over year.

BMO calls Nuvei’s third quarter “eventful” as the company wrapped up its U.S IPO and three acquisitions in Mazooma, Simplex, and Paymentez. The company additionally launched card issuing in Europe, Visa Direct and Mastercard Send payouts in North America.

Lastly, the company raised its price target and estimates off the back of management raising their own guidance. Below you can see their updated fourth quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.