Last week, Haywood Securities initiated coverage on Cresco Labs (CSE: CL) with a C$14.00 price target and a buy rating. Although they have their price target of C$14.00, they also give a scenario analysis for Cresco Lab’s share’s to be as low as C$5.50.

Neal Gilmer, Haywood’s cannabis analyst, says, “we believe the company is positioned to demonstrate improving operating leverage in the business,” and that their previous purchase of Origin House “increased its exposure to what is already the worlds largest state cannabis market in California.”

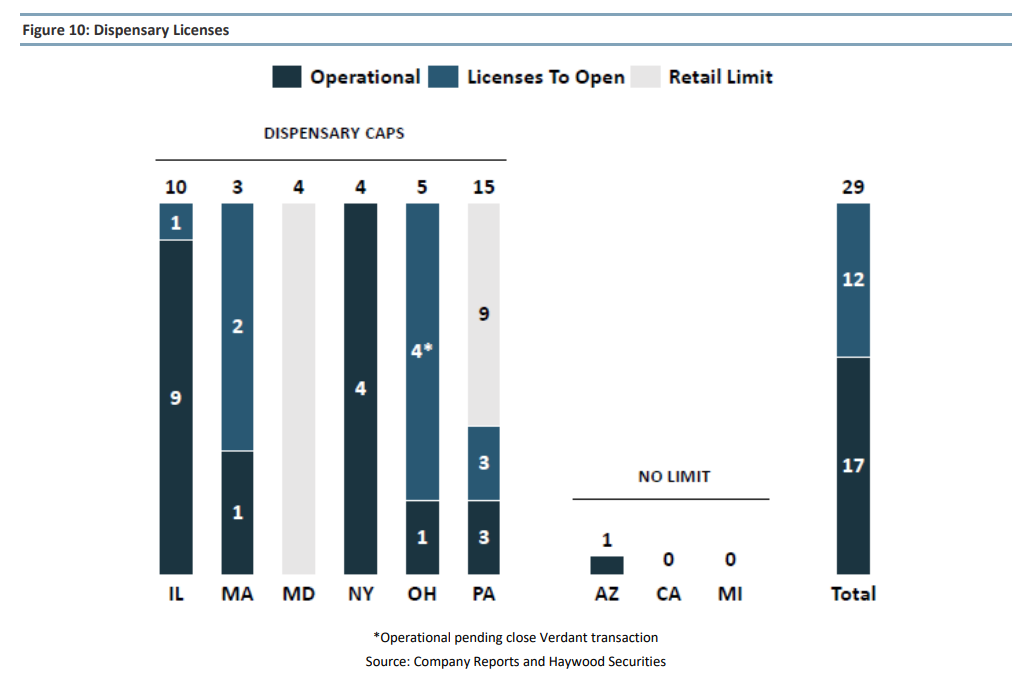

Further, Gilmer comments that despite vertical integration, the company is the largest wholesaler of branded cannabis products, with the company also expanding heavily in terms of capacity in the key states of Illinois and Pennsylvania. Below you can see Cresco Lab’s dispensary license breakdown.

Gilmer says, “We forecast the company to post strong growth over the next few quarters,” due to Cresco Labs having exposure to the very high growth markets that are Illinois, Pennsylvania and California.” Gilmer is forecasting quarter over quarter revenue growth to be 28% for the third quarter which he says, “we believe could be conservative.” The current forecast is expecting revenues of $120.4 million and adjusted EBITDA of $26.4 million for the three month period.

Onto their fourth-quarter estimates, Haywood is forecasting revenue will grow 21% quarter over quarter. Their full-year 2020 and 2021 revenue estimates are $426.4 million and $748.2 million, respectively. Earnings per share are forecasted to be ($0.07) and then turning positive to $0.25 for 2020 and 2021, respectively.

Finally, Gilmer comments that Cresco Labs has a strong management team with, “extensive experience in the CPG sector,” and believes that this should significantly enable the company to capture market share through its brands.

The current $14.00 price target placed on Cresco Labs assumed a 17x EV/EBITDA multiple for the multi state operator based on 2021 EBITDA estimates, which is then discounted by 5%. Comparatively, the downside case of $5.50 per share uses a multiple of 5x in the same scenario.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.