Yesterday, IAMGOLD Corp (TSX: IMG) announced a temporary workforce reduction to the tune of 437 workers or roughly 70% of its underground workforce at their Westwood mine. This comes after a seismic event happened, which was reported on November 2. IAMGOLD provided minimal commentary, instead indicating, “an update will be provided in early 2021.”

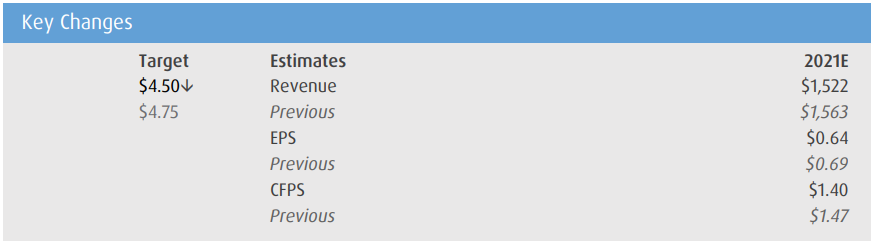

Jackie Przybylowski, BMO’s metals and mining analyst, downgraded their 12-month price target from C$4.75 to C$4.50 while maintaining their market perform rating on the company.

She says that the event might have a, “more meaningful and longer-term impact than we had previously assumed.” Therefore she anticipates a, “more gradual ramp-up of the higher-grade underground material through 2021,” which will be helped along by lower-grade material from the stockpiles.

Przybylowski expects the update that is promised to come in early 2021 to be announced alongside IAMGOLD’s 2021 outlook, which is likely to come in mid-January. She says that by that time, the company should have a clearer understanding of Westwood’s plans for the following years. She mentions that the update could include, “timing of the restart, any impact on the mine reserve if ore must be left unmined (e.g., due to dangerous ground conditions or to act as ground support), and effects on the mine plan including volumes and grade.”

Przybylowski is now forecasting a longer ramp-up period as she says, “The company’s relatively significant cuts suggest a longer outage than we had previously envisioned.” They now expect that the impacts will cut IAMGOLD’s average grades and their 2021 estimated production at Westwood by 20% to 82,000 ounces, down from 103,000 ounces.

Below you can see the 2021 full-year adjustments Jackie has made to incorporate this new scenario.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.