This morning, BMO Capital Markets released a note to investors updating their forecast and model ahead of Nuvei Corporation’s (TSX: NVEI) third quarter earnings, which are expected to be released on November 11th before market open. This is also Nuvei’s first release of result as a public company. BMO has a C$46 price target and a market perform rating on the company.

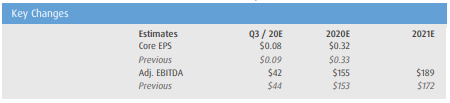

BMO notes that they are slightly changing their third-quarter and full-year 2020 core earnings per share (EPS) and Adjusted EBITDA estimates, while maintaining their 2021 and 2022 core EPS estimates at $0.87 and $1.02, respectively.

They now expect core EPS to be $0.08, down 1 penny from previous estimates, while adjusted EBITDA is now forecasted to come in at $42 million versus the prior estimate of $44 million. This slight change is due to their, “updated 3Q20E reported EPS of -$0.58 include nonrecurring finance charges of $80 million related to NVEI’s recent IPO.”

The main reason for the slight adjustments is due to them incorporating non-recurring charges due to the IPO into their EPS calculations.

James Fotheringham, BMO’s analyst, highlights a “positive read-across from peers,” as Visa, Mastercard and Paypal all had better than expected volume growth. Roughly 70% of Nuvei’s revenues are from online transactions, resulting in marginal impact from current pandemic conditions.

For the third quarter, BMO expects $97 million in net revenues, along with a gross profit of $81 million, based on total payment volumes of $10.5 billion. Core operating expenses are estimated to be $73 million, along with non-recurring finance charges amounting to $80 million in connection with the recent IPO. In terms of the current price target, BMO ascribes the company a 44.7x two-year-forward price to earnings multiple.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.