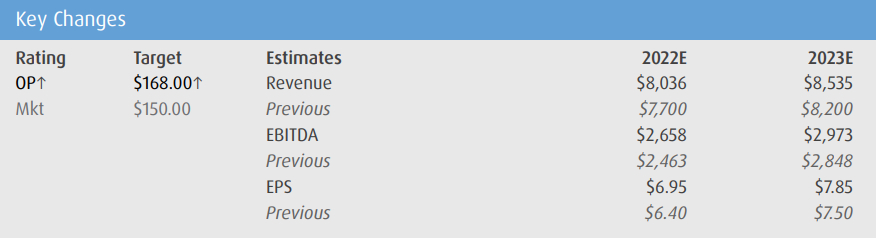

Last week BMO raised their 12-month price target and rating on Electronic Arts (NASDAQ: EA), betting that the video game space remains more sticky coming out of the pandemic than people think. They raised their price target to $168 from $150, and their rating to outperform from market perform.

Electronic Arts currently has 34 analysts covering the stock with an average 12-month price target of $164.12. The street high sits at $184 and the lowest comes in at $135. Out of the 34 analysts, eight have strong buy ratings, 15 have buy ratings and 11 have hold ratings.

BMO believes that video game engagement and spending should come in higher out of the pandemic than most investors are expecting. They also note that it is mainly only America coming out of the pandemic, so many international regions will continue to see the video game spending that was experienced within the US over the last year.

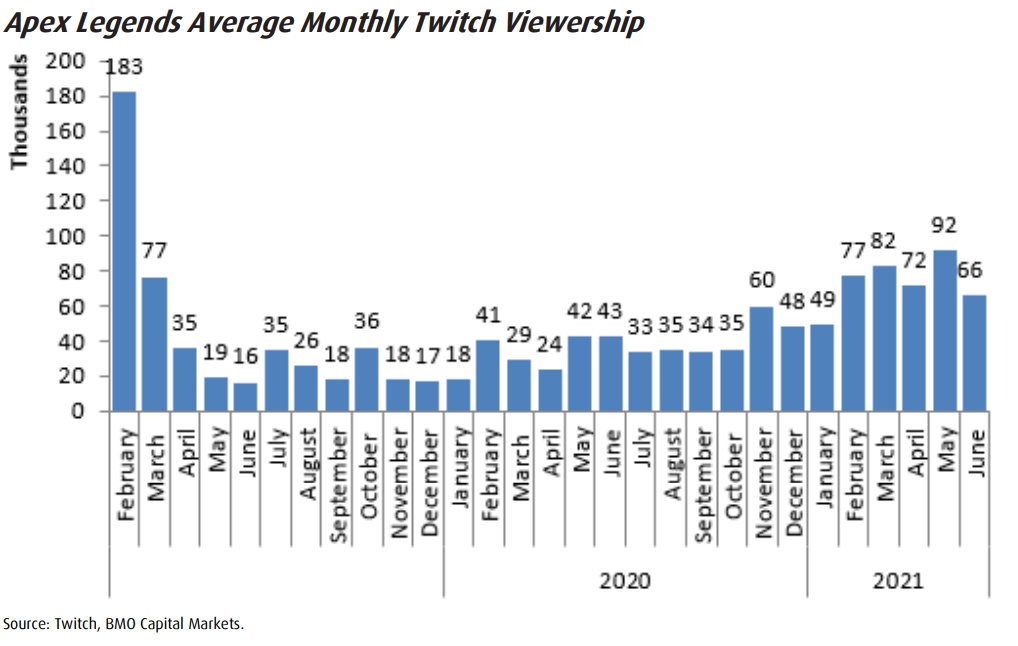

EA’s most prominent online game, Apex Legends, continues to trend higher through 2021, BMO says. This is primarily due to two strong seasons, new game modes, and streamers returning to the game. With the new game mode, Twitch viewership hit a peak of 92,000 average monthly viewers in May. This is up from May 2020’s 16,000 average monthly viewers.

BMO makes a good note around the biggest risk to EA, which is something slightly out of their hands – whether customers can get ahold of the next-generation consoles. This factor will determine the majority of sales for FIFA, Madden, and NHL 22, all of which are major game franchises. They also mention that EA has done a few acquisitions totaling $5 billion year to date, so there could be some integration and execution risk.

Below you can see BMO’s updated 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.