On September 23, Salesforce.com (NYSE: CRM) announced that they are raising their fiscal full-year 2022 guidance and introduced the fiscal year 2023 guidance. Salesforce now expects fiscal 2022 revenues to come in between $26.25 billion and $26.35 billion. They are also guiding for $31.65 billion to $31.80 billion in revenue for 2023. The operating margin is being guided at 3-3.5% and the non-GAAP margin is guided to come in at 20%.

After this news, many analysts raised their 12-month price target, raising the average to $314.06 from $296.58, or a 16% upside. There are currently 50 analysts covering the stock, with 15 analysts having strong buy ratings, 28 have buy ratings and 7 analysts have hold ratings. The street high sits at $375 from Evercore ISI while the lowest comes in at $211.86.

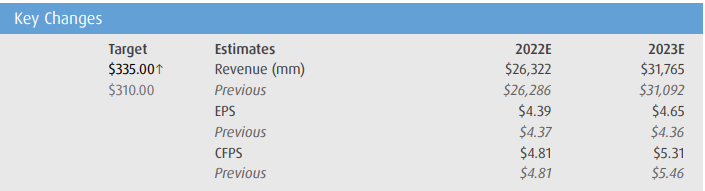

BMO Capital Markets sent out a note raising their 12-month price target to $335 while reiterating their outperform rating which mainly talks about Salesforce’s annual analyst event. They say that the event went well and that there were 3 top takeaways. Takeaways consists of “1) less focus on M&A, 2) the potential for ongoing margin accretion, consistent with improving margin guidance for FY23, and 3) the power of the portfolio, including Slack, and Customer 360.”

They believe that these points are Salesforce trying to change the narrative of the stock. BMO says that Salesforce has grown revenue and margins in-organically throughout the years, thanks to the company spending billions on acquisitions with the $28 billion acquisition of Slack to top it off. BMO believes that this has frustrated investors, but with the company announcing that they will focus less on M&A, it will help calm those frustrated investors.

BMO Capital Markets believes that, although the price was high for Slack, it was a positive acquisition, commenting, “we think hybrid is here to stay, and we think Slack are key enablers. We believe that salesforce can drive slack usage and revenue by leveraging the installed base and global reach, similar to MuleSoft.” BMO believes that Slack will be able to include more workflow capabilities which will make the acquisition look better in the long run.

Below you can see BMO’s updated 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.