Over the weekend, Cenovus Energy (TSX: CVE) announced that they would be buying Husky Energy (TSX: HSE) in an all-stock transaction valued at $23.6 billion, including debt. Cenovus valued Husky Energy at $3.8 billion, a 21% premium to Friday’s close. Cenovus said that they expect to yield cost synergies totaling $1.2 billion and give the company increased scale and relevance.

In a note sent out on October 26th, BMO’s analyst Randy Ollenberger reiterated their $7.50 12-month price target and outperform rating on the stock. He comments, “While the near-term market reaction may be mixed, we believe the transaction puts Cenovus in a better position to strengthen its balance sheet, generate free cash flow, and increase future returns to shareholders.”

Ollenberger says that Husky has $5.8 billion in net debt based on their estimates as of the first quarter of 2021. The 0.7845 Cenovus share’s Husky shareholders will receive represents a 21% premium to the share price on Friday’s close. He also says that this deal values Husky at 5x 2021 EBITDA, which, “is at the low end of its peer average. We view the transaction as being accretive to cash flow.”

This acquisition will make Cenovus the third-largest producer in Canada and, “give it the most refining capacity of the Canadian integrated producers,” says Ollenberger.

Ollenberger says that although the M&A might come as a surprise to some people, “we believe the proposed transaction makes sense from both an operational and financial perspective. Cenovus’ oil sands expertise should unlock considerable value in Husky’s thermal asset base while Husky’s integrated corridor provides opportunities to enhance the value of Cenovus’ oil sands production.”

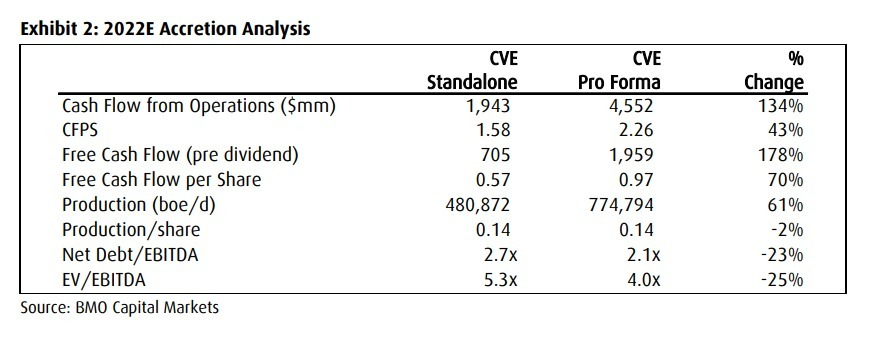

Below you can see the Pro Forma numbers that BMO has forecasted. Most notable would be the new Cash Flow from Operations increasing by 134%, and Free Cash Flow per dividend will be up 178%.

Ollenberger has also slightly changed 2020 and 2021 EPS while upgrading CFPS and EBITDA for 2021. Ollenberger now forecasts that EPS will be ($2.06) and ($0.68) compared to their previous estimates of ($1.91) and ($0.51), respectfully. In comparison, CFPS and EBITDA are expected to be $1.47 and $3.38 billion in 2021 compared to the old estimate of $1.18 and $1.85 billion.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.