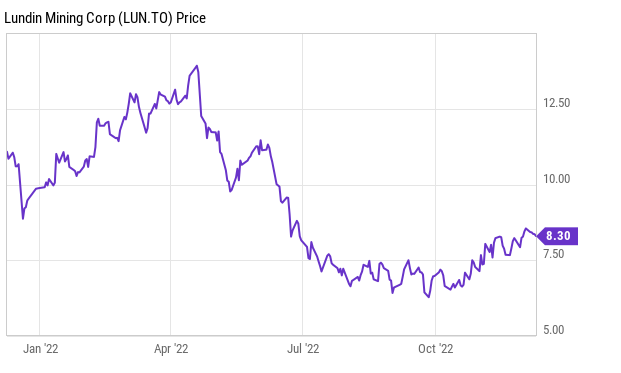

Lundin Mining Corporation (TSX: LUN) is having a strong rally into year-end, seeing its stock price rise 18% since the fourth quarter started, outperforming the general market. Lundin shareholders are probably very excited about the strength of the stock. BMO Capital Markets‘ analysts are saying that the stock is fully valued at the present time.

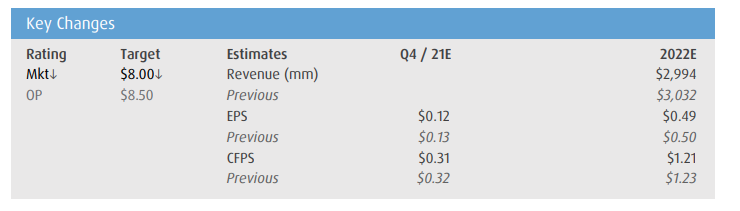

As a result, BMO Capital Markets downgraded Lundin Mining from an outperform rating to a market perform rating while cutting their 12-month price target down to $8 from $8.50. They add that currently, investors prefer low-risk stocks over value stocks. Saying, “market sentiment could shift to the higher-beta equities if confidence in the near-term macro outlook improves.”

Lundin Mining currently has 22 analysts covering the stock with an average 12-month price target of C$8.75, or an 11% upside. Out of the 22 analysts, three have strong buy ratings, and another three have regular buy ratings. Fifteen analysts have hold ratings, and a single analyst has a sell rating on the stock. The street-high price target sits at C$13, or an upside of 55%.

To piggyback on investor preference, BMO believes that investors continue to crowd into a select group of “large, liquid, and defensive / high-quality names.” They believe everyone currently wants some exposure to the sector just in case of a global recovery in demand.

BMO expects that investors might change their tune on the sector due to China reopening or when global economic data starts to turn positive.

On a positive note, BMO reiterates its bullish view on Lundin’s Josemaria mine, saying that the mine will give the company a first-mover advantage in the Vicuña district, Argentina. However, the company has announced that the development has been delayed by six months. BMO believes that additional clarity on potential partners will serve as an “important de-risking activity from both financial and execution risk perspective.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.