On Friday, Cineplex Inc (TSX: CGX) reported their third quarter results. Cineplex’s revenue was $61 million compared to 2019 third quarter’s revenue of $418.4 million, and while the reported loss per share came in at $1.91. They also announced that their financial covenant suspension will be extended until the second quarter of 2021 and that there was $460 million outstanding under credit facilities.

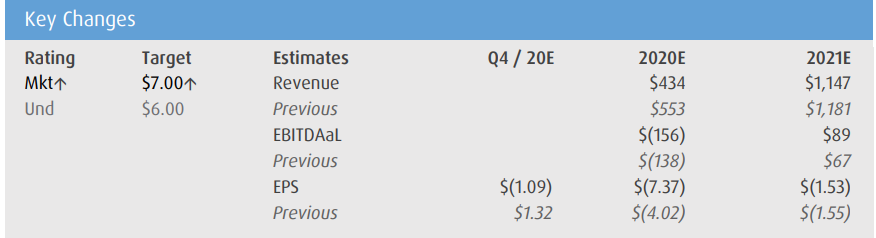

BMO Capital Markets released a note today, increasing its 12-month price target and rating on Cineplex. They now have a C$7 price target and market perform ratings, up from C$6 and underperform. Tim Casey, BMO’s analyst, comments, “encouraging developments regarding vaccines provide incremental optimism that consumers will return to theatres next year.” Although he accepts that a “return to normal” scenario is a much longer-term thought, the excellent vaccine data reduced what he calls a “value-destroying liquidity event.”

Casey expects financials will remain weak in the fourth quarter, “given current pandemic realities regarding closures in much of Canada and a lack of new product from Hollywood,” and that everything, “hinges on a recovery from the pandemic,” in 2021.

Casey calls the new credit agreement with lenders a favorable scenario and believes Cineplex must generate between C$27 and C$30 million in annualized EBITDA in 2021 to clear the covenant test next year. He adds, “A liquidity test of a minimum $100mm through 1/31/21 seems to be a much easier bar to reach.” He forecasts that in the second quarter of 2021, cash burn improves to being flat while the business operates at 50% revenue compared to the same quarter in 2019.

He adds that they expect the industry to recover to a sustainable level that is lower than pre-COVID levels and says, “Longer-term challenges remain.” He adds that he believes COVID just accelerated the industry’s headwinds from the demand and supply side.

With the price target and rating increase, BMO raised its 2020 and 2021 estimates, which can be seen below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.