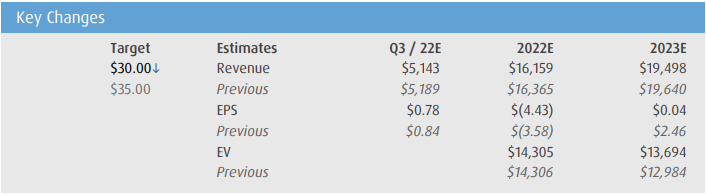

BMO Capital Markets this past week lowered their price target on Air Canada (TSX: AC), saying that several headwinds have emerged which have put pressure on their 2023 estimates. As a result, they cut their 12-month price target to C$30 from C$35 while maintaining their outperform rating on the stock.

Air Canada currently has 16 analysts covering the stock with an average 12-month price target of C$26.20, representing an upside of 53%. Out of the 16 analysts, four have strong buy ratings, and nine have buy ratings, and the last three analysts have hold ratings on the stock. The street-high price target sits at C$40, or an upside of 134%.

In the note, BMO says that one of the most significant headwinds to their estimates is the falling Canadian dollar versus the US dollar. This will inevitably pressure the company’s CASM, or operating expenses per available seat miles. This is because several of Air Canada’s expenses are denominated in US dollars and, when converted for earnings, represent a higher-than-average expense number.

Though BMO does say that even with their updated estimates, the recent 5% pullback in the shares, “is likely to prove too pessimistic, definitely – in the context of a more normalized earnings power in F2024/F2025 timeframe.”

Another headwind is the need for Air Canada to increase their pricing. They say that “other industry participants say that price stimulation has been needed in recent weeks to support seasonally weaker demand.” Though Air Canada has seen strong demand for the past couple of weeks, they note that there are signs that the pace of “demand improvement is moderating,” for which they point to these price increases as a reason for the slower demand.

The last headwind BMO points to is the higher average jet fuel costs compared to the summer months. Though BMO writes, “we continue to see a path to significant improvement in profitability in 2023, with EBITDA approaching pre-pandemic levels by 2024.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.