Last week, Bombardier (TSX: BBD.b) reported second quarter 2020 financials, reporting $2.7 billion in revenues versus the Refinitiv consensus estimate of $2.48 billion. Revenues were down 37% year over year, while loss per share came in at $0.13 and adjusted loss per share came in at $0.30. They currently have ~$3.5 billion in liquidity that includes $1.7 billion in cash, $738 million on an available revolver and up to $1.0 billion from a recent senior secured credit facility.

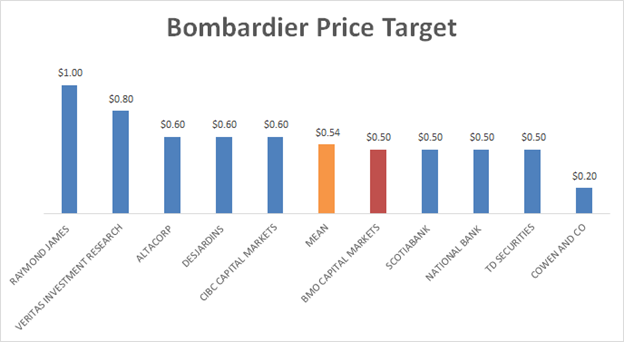

After their financials, three analysts changed their 12-month price targets on Bombardier’s Class B common shares.

- TD Securities raised their 12-month price target from C$0.45 to C$0.50.

- Veritas Investment Research raised their 12-month price target from C$0.50 to C$0.80.

- BMO cuts their 12-month price target from C$0.60 to C$0.50.

There are currently 17 analysts covering Bombardier. Of these, one analyst has a buy rating, while a majority of 15 analysts have a hold rating on the stock and one has a sell rating. The mean 12-month price target on the company is C$0.54, or a 28% upside. Steve Hansen of Raymond James holds the highest 12-month price target, which is C$1.00 or a 135% upside with a hold rating and the lowest being from Cowen & Co with a C$0.20 price target or a downside of 53%. Cowen currently has a hold rating on the stock.

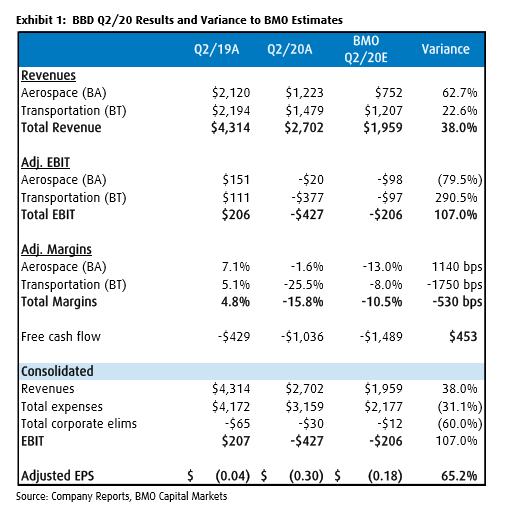

In the note sent to investors on last week, Fadi Chamoun of Bank of Montreal said, “BT Takes Another Charge; Completing Planned Divestitures Is Key to Survival.” Chamoun notes that the second-quarter results were weaker than expected. However, Bombardier beat all three revenue estimates that BMO forecasted as well as adjusted earnings per share, but margins weighed on the quarter. He mentions that the 3.5 billion in liquidity is “adequate,” as going into the second half of 2020 is always stronger than the first half due to seasonality.

Bombardier revenue came in 38% above BMO’s estimates of $1,959 million, mainly driven by the massive beat in Aerospace revenue. That division reported revenues 63% above forecasts at $1,223 million, while BMO’s estimate was only $752 million. Transportation revenue came in 23% above estimates at $1,479 million versus a $1,207 million estimate.

Chamoun states that the aerospace and transportation divestitures are critical to lowering the debt and interest costs while supporting a sustainable path forward for Bombardier. Bombardier’s transportation wing recently received conditional approval by the EU for the sale of the division. It is on track to close in the first half of 2021 while the sale of the aerostructure assets to Sprint is expected to close in the fall of 2020, which will give Bombardier $4.7 billion and help reduce the pro-forma debt burden by roughly 10 billion.

BMO downgraded its 12-month price target to C$0.50, or an 18% upside, while reiterating its market perform rating on Bombardier.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.