Brazil’s new left-leaning president Luiz Inácio Lula da Silva (Lula) doesn’t appear to be phased by the country’s surging inflation, and is even going as far as to propose the draconian measure of raising the inflation target.

As if taken right out of the playbook of Turkish president Recep Erdogan’s authoritarian rule over the Central Bank of the Republic of Turkey, Lula’s temptation to take control of Brazil’s money printer appears to be growing. In an interview with national TV broadcaster Globo TV, Brazil’s new president played down the idea that a central bank needs to be autonomous. “There was a lot of discussion in this country to have an independent central bank, believing that it would be better,” he said.

However, according to him, “it’s silly to think that an independent central bank governor is going to do more than when the president appointed him.”

Brazil: When Argentina is seen as a role model- “Lula praised the economy and politics of Argentina, a country with almost 100% inflation, 40% of the population in poverty and insisting on absurd measures such as freezing prices, issuing currency and increasing public spending.” https://t.co/vleoXFt9Zx

— BullionStar (@BullionStar) January 24, 2023

Up until 2021, Brazil’s central bank didn’t have its own independence, during when Lula granted the bank’s chief, Henrique Meirelles autonomy during his initial two terms in office. However, just as we would expect of the kind of socialism Lula is slowly attempting to peddle into the country, simply raising the inflation target requires a lot less work than tightening monetary policy!

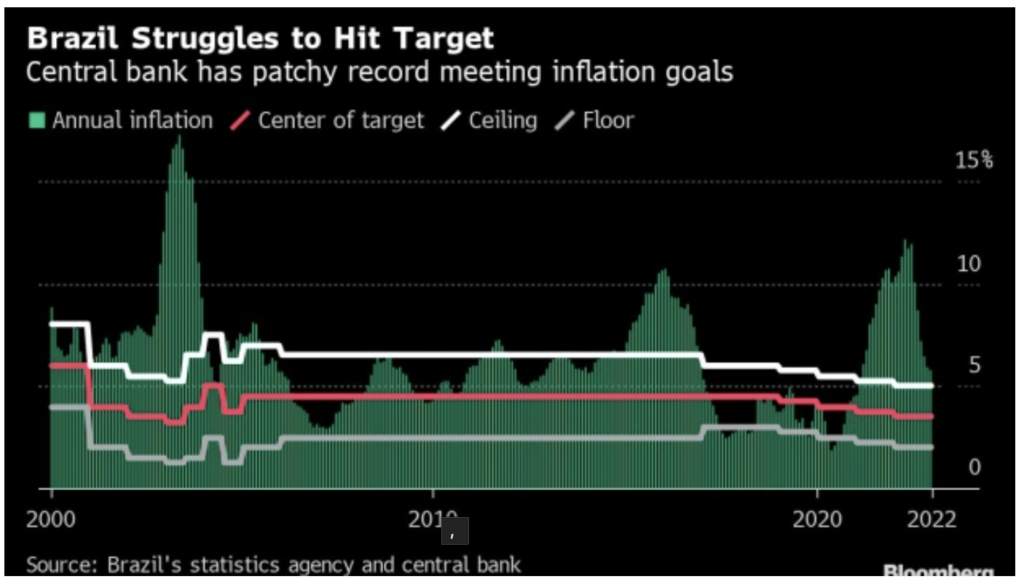

Lula, who took office on January 1 after beating now-former president Jair Bolsonaro by a slim margin in the highly-contested presidential elections, wants to spur Brazil’s economy and eradicate poverty; however, that would be difficult to achieve since the South American country’s inflation rate currently sits at 5.79%— well above the central bank’s target of 3.25% for 2023 and 3% for 2024. In response, Lula proposed a simple solution, one where the target range is set higher, such as 4.5%.

Certainly, like most profound monetary policy overhauls, the success pivots on an accompanying social crisis to concern the masses— which is exactly what happened a few weeks ago. During the interview, Lula also addressed the recent storming of the presidential palace and subsequent government buildings by pro-Bolsonaro protestors, which he referred to as a coup orchestrated by Brazil’s former president who has currently taken up refuge in Florida.

“His decision to keep quiet after losing the election, weeks and weeks of not saying anything; his decision not to hand the sash to me, to leave for Miami as if he were running away in fear of something; and his silence even after what happened here, gave me the impression that he knew everything that was happening, that he had a lot to do with what was happening,” said Lula, as cited by Bloomberg.

Foreign economists, meanwhile, observe with concern, citing risks of even higher inflation should Lula’s vision actually come to fruition. “Lula’s decision to publicly state twice that the inflation target should be higher did not go unnoticed, and may further reinforce increasing inflation expectations over longer periods,” said JPMorgan economist Cassiana Fernandez in a note quoted by Bloomberg.

Information for this briefing was found via Bloomberg and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.