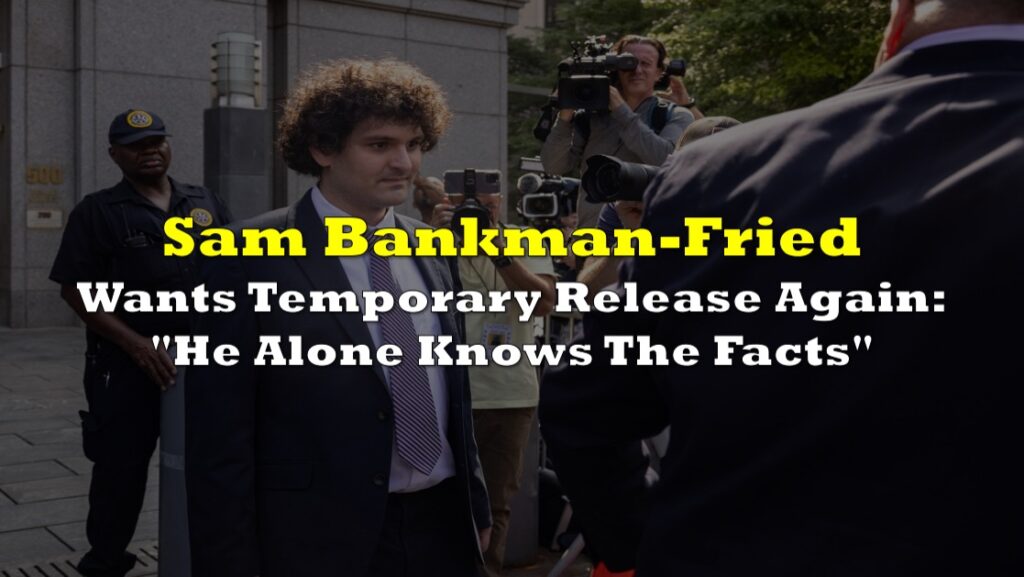

Sam Bankman-Fried, once the head of one of the world’s largest cryptocurrency exchanges, has been found guilty of fraud and money laundering following a month-long trial in New York. The jury reached its verdict after a single day of deliberations, marking a significant downfall for the former billionaire and one of the most prominent figures in the crypto industry.

Judge Kaplan: Madam Foreperson, I understand the jury has reached a verdict. Please hand it to Andy. Thank you. The clerk will publish the verdict. Please rise.

— Inner City Press (@innercitypress) November 2, 2023

Count 1: Guilty.

Count 2: Guilty.

Count 3: Guilty.

The 31-year-old entrepreneur’s troubles began when he was arrested last year in the wake of FTX, his firm, going bankrupt. This once-vibrant entrepreneur now faces the prospect of spending decades behind bars.

Prosecutors leveled serious allegations against him, accusing Bankman-Fried of deceiving investors and lenders while embezzling billions of dollars from FTX, which ultimately led to its demise. The charges against him included seven counts of fraud and money laundering.

Bankman-Fried, despite pleading not guilty, maintained that while he might have made errors in judgment, his actions were driven by good faith. However, the odds seemed stacked against him from the very start of the trial, especially after three of his former close associates, including his ex-girlfriend Caroline Ellison, pleaded guilty and agreed to testify against him to reduce their potential sentences. The sentences for these individuals are yet to be determined.

These associates presented compelling evidence that Bankman-Fried’s cryptocurrency trading company, Alameda Research, had accepted deposits on behalf of FTX customers during the early days of the exchange when traditional banks were reluctant to engage with them. Instead of safeguarding these funds, as he had publicly promised to do, he used the money to repay Alameda’s creditors, purchase property, make investments, and even contribute to political campaigns.

When FTX declared bankruptcy in November of the previous year, the debt from Alameda to FTX amounted to a staggering $8 billion.

Assistant US attorney Nicolas Roos emphasized in his closing arguments, “He took the money. He knew it was wrong. He did it anyway because he thought he was smarter and better and could find a way out of it.”

Bankman-Fried opted to take the witness stand in his own defense, aiming to convince the jurors that the prosecution had failed to prove any criminal intent on his part. His defense attorney, Mark Cohen, acknowledged “bad judgment” but argued that it did not equate to a criminal act.

Bankman-Fried defended the financial transfers between his companies as “permissible” and claimed he was largely unaware of the financial difficulties described by his subordinates until just a few weeks before FTX’s collapse the previous year. Unfortunately, the repercussions of this collapse left numerous customers unable to recover their funds.

Legal teams involved in the bankruptcy case have since reported that they have successfully recovered the majority of the missing funds.

Bankman-Fried’s trial attracted significant attention for its potential implications for the entire cryptocurrency industry, which has been struggling to rebound from the market turbulence of the previous year. He was seen as a symbolic figure representing the challenges and issues plaguing the sector, a view shared by top regulators in the United States who have labeled it as susceptible to criminal activities.

Prior to the collapse of his enterprises, Bankman-Fried was recognized for his high-profile associations with celebrities and frequent appearances in Washington and the media. He often sported casual attire and had a distinctive head of wild curls, earning him the moniker “the king of crypto” due to FTX’s rapid growth and his remarkable deal-making during a period of market downturn, setting him apart in the cryptocurrency world.

This story is developing. Please stay tuned for more updates.

Information for this briefing was found via Yahoo! and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.