FTX debtors confirms $415-million hack and shortfall of customer funds but Sam Bankman-Fried insists the shortfall “claims are wrong.”

Court filings by the restructuring team at the defunct crypto exchange FTX have shed more light into the financial position of the firm, essentially claiming that there are “material shortfalls” in customer funds for both the international and the US-based exchanges.

The FTX debtors, represented by law firm Sullivan & Cromwell (S&C), announced that they met with the members of and advisors to the Official Committee of Unsecured Creditors where their presentation highlighted the standing of the crypto exchange’s financials.

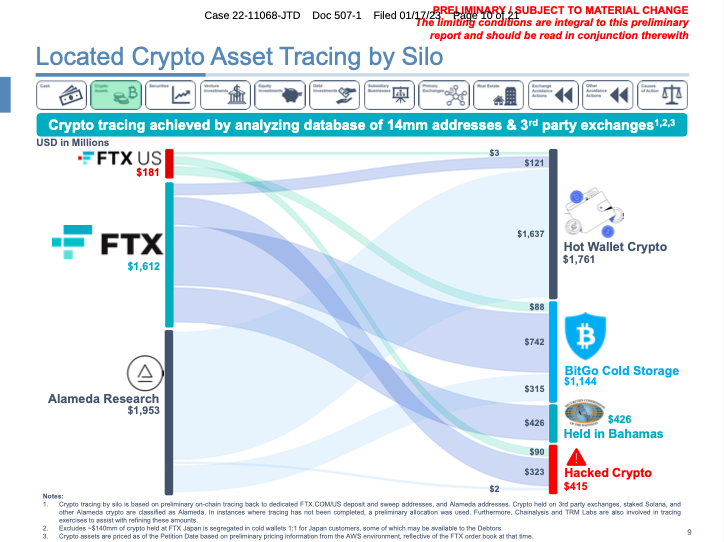

The presentation, which was also filed on the docket in the chapter 11 case, pointed out that the FTX debtors have identified only $1.6 billion of digital assets associated with FTX.com and only $181 million of digital assets associated with FTX US as of the petition date in November 2022.

“[Based] on current estimates of the amount of digital assets associated with the FTX.com and FTX US exchanges as of the Petition Date, there is a substantial shortfall of digital assets at both exchanges,” the FTX debtors said in a statement.

The FTX debtors also confirm the hack that had transpired around the same time, disclosing the amount to be around $415 million. Of this, around $323 million is from FTX.com while the other $90 million is from FTX US.

Combining the located crypto assets of the international and US exchanges, the total balance of crypto assets come in at around $1.79 billion. The crypto assets balance located in FTX’s sister hedge fund Alameda Research totals $1.95 billion, making up a sum of around $3.5 billion in crypto assets.

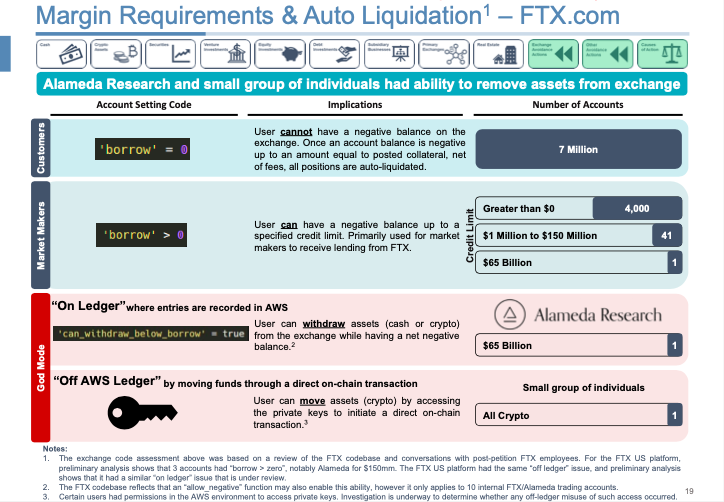

In the presentation, FTX debtors also claimed that they discovered how Alameda was able to borrow effectively infinite sums from clients without collateral, as well as how a small group of individuals were able to remove digital assets from the exchange without being recorded on the exchange ledger.

Normally, customers aren’t allowed to have negative balances on their FTX accounts while market makers are allowed to have a negative balance up to a certain credit limit.

But FTX debtors discovered a written code allowing Alameda to have up to $65-billion in artificial collateral, which it can withdraw even with a negative balance.

A certain small group of individuals can also move crypto assets by accessing the private keys to initiate a direct on-chain transaction, allowing withdrawals without record on the exchange ledger.

In terms of illiquid crypto assets–tokens whereby the market cap and volume is low or where FTX holds a significant portion enough to affect coin market value upon liquidation–topping the list is the firm’s holdings in Serum token valued at $1.99 billion as of the petition date. This is followed by holdings in Solana ETH at $561 million, MAPS at $521 million, and Solana BTC at $237 million.

The top 20 illiquid tokens held by FTX–valued at around $3.75 billion–compose 98% of the illiquid value.

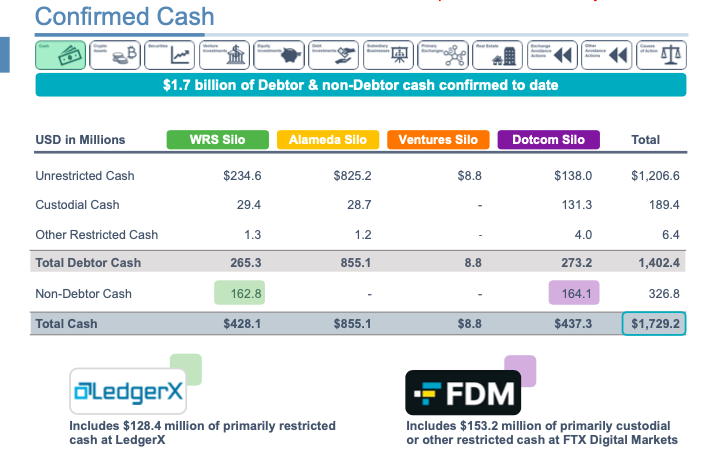

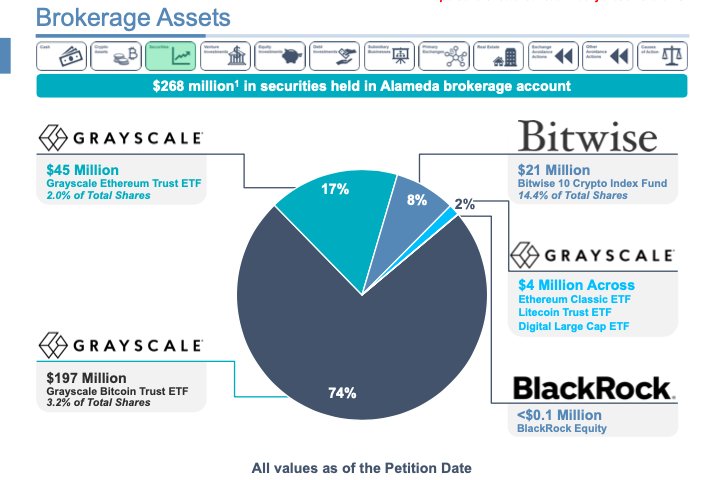

On top of the crypto asset balances across FTX entities and Alameda, the debtors also identified approximately $1.7 billion in cash and around $268 million in liquid securities held at the Alameda brokerage. Of the securities, around $197 million is held in Grayscale Bitcoin Trust ETF and $45 million is held in Grayscale Ethereum Trust ETF; combined, these comprise around 91% of the liquid securities.

Overall, the presentation highlights that a “total of approximately $5.5 billion of liquid assets have been identified.”

READ: FTX Advisors Recover Over $5 Billion in Liquid Assets

In maximizing liquidation, the FTX debtors are considering “potential monetization of over 300 prepetition investments with book value of approximately $4.6 billion.” This would include equity or debt investments like in Genesis, Stocktwits, and Anchorage Digital; and fund investments like in Sino Global, Skybridge, and Sequoia.

Historical transactions made by the firm are also in review, including around $2 billion in loans to FTX insiders, the $2.1 billion payment from FTX to repurchase its Series A shares from Binance, around $93 million of political donations, $446 million of transfers with Voyager, and the Robinhood shares with BlockFi that are allegedly pledged for outstanding Alameda loans.

The FTX share repurchase from Binance was a point of contention between the latter’s CEO Changpeng Zhao and celebrity businessman, standing as FTX founder Sam Bankman-Fried’s unofficial advocate, Kevin O’Leary.

READ: Changpeng Zhao: “He Doesn’t Make Sense”; Kevin O’Leary: “He’s Part Of The Story Too”

In addition, it was recently reported that only 19 out of 196 members of Congress who received donation from the fallen crypto exchange are committed to return the funds.

BREAKING: Only 19 of 196 Congresspeople who took money from FTX have stated they will return the funds.

— unusual_whales (@unusual_whales) January 18, 2023

Voyager Digital, after its bankruptcy filing, was supposed to be bought by FTX through an auction for $1.4 billion. But following FTX’s downfall, Voyager went back to the bidding process that saw Binance as the highest bidder. However, Binance’s plans to acquire what remains of the bankrupt crypto lender could be delayed or blocked as the US Committee on Foreign Investment in the United States lodged national security concerns on the deal.

READ: Binance Deal To Buy Voyager Faces Looming Threat Of US National Security Review

Meanwhile, the US government is in the middle of seizing around $460 million-worth of Robinhood shares as part of the fraud prosecution against Bankman-Fried. The FTX founder is fighting to stay the seizure, arguing that the equity could be utilized to pay for his defense.

READ: SBF: Users Losses Are “Only Economic”, Fights To Keep Robinhood Shares To Pay Defense Bill

The debtors are also looking into liquidating other four FTX subsidiaries: crypto derivatives exchange LedgerX, US-based clearing house Embed, and FTX’s subsidiaries Cyprus-licensed FTX EU and Japan-registered FTX JP.

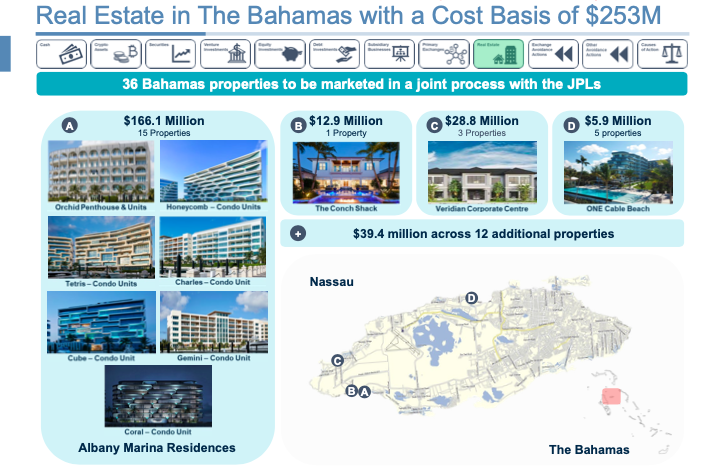

Around 36 properties in the Bahamas that are linked to FTX are also being considered to be marketed in a joint process with the joint provisional liquidators. The portfolio of real estate in the country in estimated to have a total cost basis of $235 million.

SBF: These claims are wrong

After a few days of silence since his not guilty plea, Bankman-Fried launched a substack, hoping to air his side of the financial story. In response to the presentation by the FTX debtors, the FTX founder stated that some of the information “is extremely misleading.”

“[Claims of shortfall] by S&C are wrong, and contradicted by data later on in the same document,” Bankman-Fried wrote. “FTX US was and is solvent, likely with hundreds of millions of dollars in excess of customer balances.”

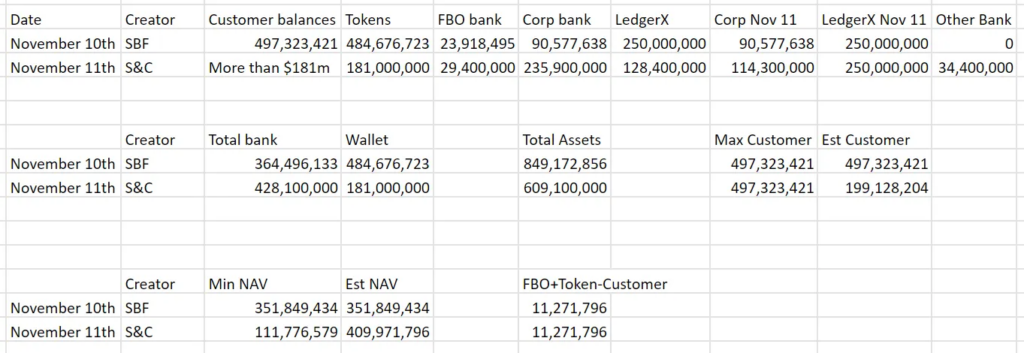

In measuring up the $181 million of digital assets associated with FTX US against the customer balances–which the debtors claim to be substantially larger, thus the shortfall–Bankman-Fried claimed that S&C “failed to include $428 million in FTX US’s bank accounts as an asset.” In his calculation, there’s roughly $609 million of total assets in the crypto firm’s US subsidiary.

“Customer balances are likely around $199 million, and certainly less than $497 million (which they were a day earlier before massive withdrawals),” he added. “Thus, FTX US had at least $111 million, and likely around $400 million, of excess cash on top of what was required to match customer balances.”

TL;DR:

— SBF (@SBF_FTX) January 18, 2023

1) S&C files, claiming FTX US is insolvent

2) S&C forgot to include bank balances, ~$428m

3) Once you add those back in, you get in the neighborhood of my prior balance sheet (~+$350m)

4) Other slides in the same filing demonstrate (2)

As Bankman-Fried explained, “their statement would merely be saying that full customer balances, including USD, were larger than digital wallet assets, excluding bank balances, and that the ‘shortfall’ might simply be customer balances that are fully backed by dollars in one of FTX US’s bank accounts—not a real shortfall at all.”

“FTX US was solvent when it was turned over to S&C, and almost certainly remains solvent today,” the founder reiterated.

The FTX debtors are still attempting to secure assets related to the exchanges and to trace digital assets back to the exchanges whenever possible.

“We are making important progress in our efforts to maximize recoveries, and it has taken a Herculean investigative effort from our team to uncover this preliminary information,” said John J. Ray III, the Chief Executive Officer and Chief Restructuring Officer of the FTX Debtors. “We ask our stakeholders to understand that this information is still preliminary and subject to change. We will provide additional information as soon as we are able to do so.”

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.