For those that follow Lightning Ventures (CSE: LVI), you’re well aware that this past week was subject to a wave of volume. This was a result of free shares becoming free trading as of October 28th. These shares and warrants were from their June private placement, obtained at a price of $0.02 a piece with one full warrant to be exercised at $0.05. The justification for this raise was to enhance their marketing team to better sell their products. This in turn will (hopefully) allow them to pay their debts.

Lets talk about those debts.

Put simply, Lightning Ventures is behind on its debts. However, these initials debts are not the fault of the company themselves. These debts are a result of the acquisition of Lightning Industries, the subsidiary of the parent company. Unfortunately for the company, they assumed these debts upon the acquisition.

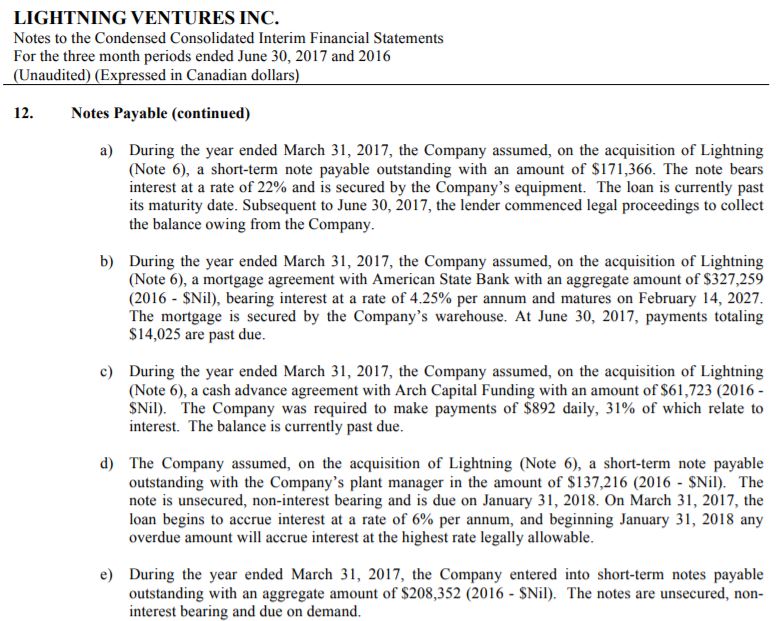

How much debt are we talking? Specifically, we are referencing the notes payable portion of their balance sheet, which amounts to just over $905,000. They also have an additional $1.5M in accounts payable that is outstanding as of June 30th, 2017. Here’s a snapshot of these long term debts:

As seen above, the company is in a bit of a pickle. On four out of five payables, payment is currently overdue. No payments were made to these debts in the previous three months either, as the figures matched that of their annual financial report. This is also indicated on page 17 of their latest quarterly report.

Furthermore, there is a concern related to that of the interest rates on the loans. Twenty two percent interest on a secured loan is something that should not be glanced over, especially when it relates to the equipment that enables you to generate revenue. Furthermore, the threat of potential legal action related to this should be a red flag to investors. As should be a loan that threatens to increase its interest rate to the highest legally allowed rate on the advent of February 2018.

How to move forward?

As it stands, the easiest way to pay off these debts would be to issue shares – however that would have devastating dilution at current share prices. So it appears the company is attempting to do it the way best for shareholders – by increasing sales.

Lightning Ventures is making some progress towards this goal. On September 20th, it was announced that they had appointed a VP for sales and marketing in the Mexico region. On October 17th, they appointed an advisor with experience in Indonesia, in hopes of increasing its sales in the Asian markets. Finally, on November 1st it was announced that a contract was being finalized for a sizable job in the southern United States.

This may not be an instant solution to resolving their overdue debt. However, it should provide a solid footing to get on the right path. If they spend their profits wisely, they just may be able to strengthen their balance sheet.

One last tidbit.

On a final unrelated note. As a show of strength, three insiders purchased shares in the last two months when the stock was a bit beaten down. Furthermore, two also exercised options priced at $0.10 – the 52 week high of this stock is only $0.09. See it for yourself here. That’s a strong indicator for the stock moving forward. We’ll watch if any disposed of shares this last week during the high volume that Lightning Ventures experienced.

Read the financials. Examine the details. Dive deep.

Information for this briefing was found via Sedar, The CSE and Canadian Insider. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell.