Let’s face it. You were to lazy to review the filing statement for DMG Blockchain Solutions Inc (TSXV: DMGI). As a result, you missed out on 204 pages worth of excellent investment information, putting you at a disadvantage. Fear not though, as we took the time to open it up and peek inside.

Admittedly, we didn’t read the whole thing. In fact, we only read a quarter of it. However, within we discovered many things related to the company and we can only fit so much into one article. We found what we were after for now, but may have to revisit it later.

For now, we’re focused on the bitcoin mining operations of DMG Blockchain. There are many more aspects to this company however, and it’s simply too much to cover in one single briefing.

DMG Blockchain: A Briefing on Mining Operations

DMG Blockchain’s mining rig count is rapidly increasing

When looking at cryptocurrency mining operations, the first thing investors always look at is undoubtedly the mining rig count. This is the revenue generation tool of the company, so it’s only natural that its the focus of investors. Without mining rigs, no mining is performed. Thus there are no coins to sell, and no revenues to achieve.

The good news for DMG Blockchain’s investors, is that the rig count is growing – rapidly. Since setting up operations DMG has acquired 300 ASIC miners, 245 of which are operational. Based on a February 15 news release, it is believed that these are solely S9 rigs, one of the best available in the industry.

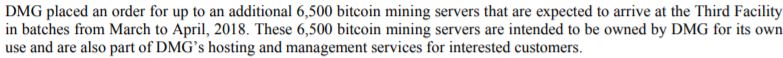

However, this is not the impressive figure. Nor is the recently ordered 1,600 mining servers, of which 500 will be for the company and the remainder are for a client. This here, is the impressive figure:

You read that right. 6,500 mining rigs are on order to be delivered in the next one to two months. With the current delays seen with the delivery of these mining servers across the industry, we can likely push that timeline back by a month or two to be on the safe side. When it’s all said and done, DMG Blockchain will have roughly 7,300 mining rigs set up.

Assuming they are all Antminer S9 units, that results in a hashing power of roughly 94,900 TH/s, assuming each unit has a rate of 13TH/s. At the time of writing, this would equate to roughly $27 million in revenues each year based on a Bitcoin price of $9,630.

DMG Blockchain has 3 mining facilities

As it currently stands, DMG Blockchain leases three separate facilities within Western Canada, all for the purpose of Bitcoin mining.

- First Facility: Located in Edmonton Alberta, the facility is 3,600 square feet. Currently, rent is paid at a rate of $3,937.50 per month. This is the location of DMG’s 300 mining rigs, of which 245 are currently operational.

- Second Facility: Based in Trail, BC, DMG Blockchain’s second facility is 3,400 square feet in size. Rent is at an undisclosed rate. 600 mining rigs currently operate out of this facility, which are owned by one of DMG’s clients.

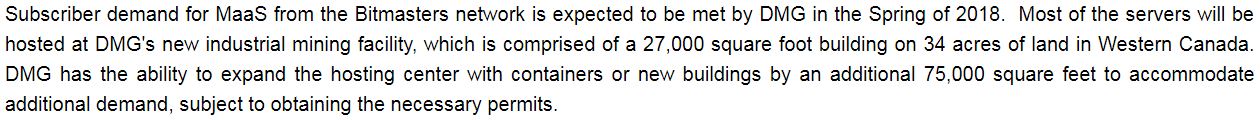

- Third Facility: Currently leased from Creekside Industries, the location of the third and newest facility is undisclosed. However, based on some Google sleuthing it is believed that it is located in Christina Lake, BC. The facility itself is 27,000 square feet, and comes with 34 acres of land. DMG pays rent of $6,000 per month for the facility, plus utilities and taxes, and has the option to purchase the facility for $950,000. No operations have been established here as of yet, however it is in the process of being established.

By all accounts, DMG Blockchain intends to make the third facility it’s only facility. Upon establishing operations at this facility, everything from the Edmonton location will be relocated to here. Based on the success of this, the second facility will likely be relocated to here in a short time frame as well. An application has been made to receive 40 MW servicing at the facility, and investor presentations indicate there is the capability for it to be upsized to as large as 85 MW.

In its current state, this remotely located facility can currently accommodate 14,000 to 20,000 mining rigs according to the companies filing statement. This is based on a building footprint of 27,000 square feet. However, in a December 14, 2017 news release the company stated that it can be expanded by up to 75,000 square feet as seen above. As such, this facility will be able to grow with the company for an extended period of time, due to the minimal spacial requirements for the companies operations.

DMG Blockchain has an excellent cash position

As a result of the recent transaction that occurred to bring DMG Blockchain public, the company has excess cash on hand at the present point in time. However, all of these funds have already been allocated for various projects which are expected to move the company forward.

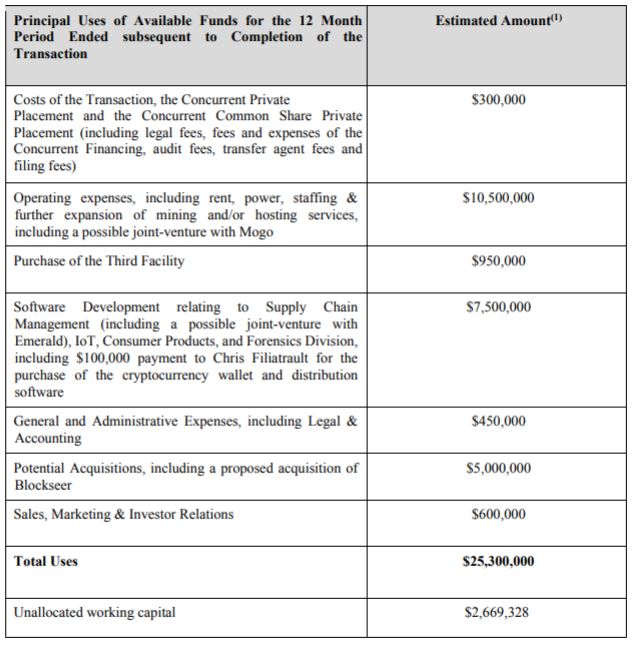

In total, as of January 31 the company had $27,969,328 in funding available for use. It has allocated these funds as follows.

In total, $25.3 million of current funds have been designated a purpose. Of note, is the $10.5 million used for operations as well as for advancing the mining aspect of the business. Further to this, it’s been made clear that the company intends to exercise the option on the facility for a sum of $950,000 before it expires.

We’d also like to make it explicitly clear that these figures do not include the projected revenues of the company. Just from the mining side of the operation, this is estimated to be over $27 million annually based on current Bitcoin prices. The multiple potential joint ventures the company has engaged in are not factored in to this projected revenue figure either. Provided the price of Bitcoin can stabilize in the current range, this could be a very profitable venture.

Closing Remarks

When it comes to blockchain related companies, we prefer the mining operations. Why? It’s easy to understand, and easy to apply an estimated valuation to. However, this exposes an investment to a high level of risk due to current price instability in the cryptocurrency market. Therefore, it is the companies that combine both aspects of the sector that may be a best-fit for the current time being.

In specific regards to DMG Blockchain, we’ve been a fan of the company since before it first went public. Seemingly we are not alone, as the company is held in a high regard within the investment community. We addressed just one aspect of the company in our analysis, however there is much more to this company that investors should make themselves aware of. Items such as forensic analysis, and software development broaden the depth of the company in the current market and add additional revenue streams to the company. And a diversified investment, is something that we are a fan of.

Look for well-rounded companies to invest in. Diversity is a good thing. Dive Deep.

Information for this analysis was found via SEDAR, TMX Money, CryptoCompare, Business Directory of British Columbia, and DMG Blockchain Solutions. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.