Newstrike Resources Ltd (TSXV: HIP) is known by investors for one of two reasons. First, is the connection to The Tragically Hip. Second, is its role as a poison pill for the Aurora Cannabis (TSX: ACB) hostile takeover of CanniMed Therapeutics (TSX: CMED). Aside from this basic information, it appears that investors are relatively unaware of what the company does or what it has to offer to investors.

It seems that Newstrike Resources commonly gets pushed to the side by the markets. While the rest of the sector was making massive gains for the months of November and December, HIP was still slowly moving up comparable to what the rest of the sector did back in September. It wasn’t until the advent of 2018 that the company finally managed to get some momentum going behind it. What this tells us, is that although the company has been in the news frequently thanks to that of CanniMed and Aurora, investors don’t really know much about the company.

The Latest Developments on Newstrike Resources

Newstrike Resources shareholders approve of proposed CanniMed arrangement

Perhaps the most significant item relating to Newstrike Resources at the moment, is that last night shareholders approved the planned arrangement with CanniMed Therapeutics. The decision was almost entirely unanimous among shareholders, with only 0.60% of the shares voting out of favour with the proposed arrangement.

Now that Newstrike has completed its end of the deal, the fate of the company lies in that of CanniMed shareholders. For them, they need to decide whether they would rather see CanniMed remain as an independent company with a new licensed producer under its belt, or if they would rather become a subsidiary of Aurora Cannabis. Aurora has publicly stated that they will walk away from their bid for CanniMed should shareholders approve the acquisition of Newstrike Resources.

Should CanniMed approve of the acquisition of Newstrike, current shareholders will receive 33 shares of CanniMed Therapeutics for every 1000 shares they currently hold of Newstrike Resources. Based on CanniMed’s closing price of $27.82 on January 17, it places a value of $0.91806 on each Newstrike Resources share.

With HIP’s closing price of $1.12 for the same day, this represents a loss of just over $0.20 per share for current shareholders. However, should CanniMed reject the proposed transaction, it’s likely that Newstrike’s share price would suffer as a result just the same. On the bright side, they’d be subject to receiving funds via the termination fee.

Up Cannabis receives its license to sell cannabis

On January 5, 2018, Newstrike Resources issued a press release. Within, it indicated that their subsidiary Up Cannabis had received its license to sell dried cannabis for its Brantford, Ontario facility. The facility was previously issued a license to cultivate marijuana in December of 2016.

The facility itself currently consists of 14,000 square feet of indoor growing space, and a vault with a capacity of 625 KG of product. This equates to approximately 3,000 KG of cannabis production a year, with a cost of roughly $1.75 per gram as per the companies July 2017 investor presentation. Based on this cost of production, even at a very conservative estimated price per gram of $5 the company would be able to achieve margins at roughly 65%. Using this figure again, it would equate to annual revenues of roughly $15 million for this single facility.

In addition to the Brantford facility, Newstrike Resources has two additional facilities in the process of acquiring a license to cultivate cannabis. The first of which, is its Creemore facility, which is currently in the pre license inspection stage of licensing. It is anticipated that this facility will initially be 10,000 square feet, with planned expansions to 40,000 square feet. At maximum, it will be capable of producing roughly 12,000 KG annually.

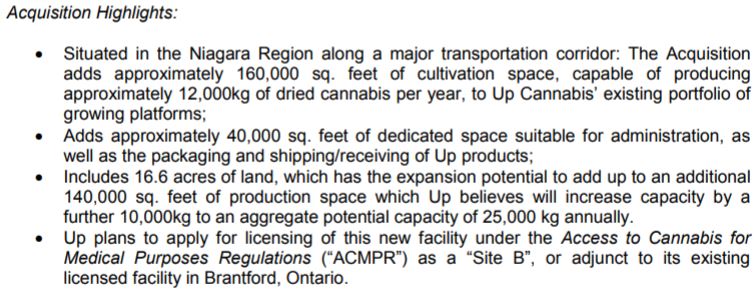

The third facility, which was acquired by Newstrike Resources as of August 1, 2017, will initially consists of 160,000 square feet of growing space. Oddly however, the company only expects to yield 12,000 KG per yer from this facility. This doesn’t align with the estimated production rate at their own facility that is planned to be a quarter of the size with the same production estimate. The company aims to double both of these figures by 2019. Due to this facilities location, it will be able to license it as a “Site B” location to its current Brantford facility, expediting the licensing process.

In total, Newstrike Resources plans to have an annual production figure of 39,000 KG of dried cannabis by 2019. Based on our conservative pricing estimate of $5.00 per gram, it would equate to roughly $195 million in annual revenues for Newstrike.

Newstrike Resources agreement with The Feldman Agency

If thee is one key item that Newstrike Resources is focused on within its business model aside from cannabis production, it is its branding. This is blatantly clear based on the companies current strategic partnership with that of The Tragically Hip, which is ingrained within the company right down to its ticker symbol. To further this focus of the company, it recently signed an exclusive partnership with The Feldman Agency on January 11, 2018.

What is The Feldman Agency? The Feldman Agency is an talent agency representing individuals and acts in the music and entertainment industry. It’s clients consist of a range of well known acts, from the likes of Lil Jon, to Rush, to Magic!. Under the terms of the partnership, The Feldman Agency will work with Newstrike to establish future partnerships that are beneficial to the company, similar to that of Newstrike’s partnership with The Tragically Hip.

Closing Remarks

Undoubtedly, the best go forward path at this point in time for Newstrike Resources is for CanniMed to approve of the proposed arrangement. Although the company has some potential in its current form, it has much more acting as a subsidiary of CanniMed Therapeutics. It would bring further credibility to their operations at the very least, as right now they are largely an unknown in the sector.

There are also examples of how the company refuses to help itself in becoming more publicly aware that is detrimental to shareholders. Little information could be found on many aspects of the company. Its latest investor presentation, dated July 2017, outlines many planned events for the latter half of 2017. This included items such as facility build outs being completed, updates on expansion initiatives, and the advancement in the licensing process. However, aside from this dated presentation, it has left investors fairly in the dark on any progress made. That’s not to mention the fact that its company name still contains the word “resources” within it.

We’ll know by Tuesday of next week what the fate of Newstrike Resources is. Will it cease to be its own operation? Or will CanniMed shareholders vote to be acquired by Aurora Cannabis instead? Right now, it’s anyone’s guess. All we know, is that the market is tired of the dance that is occurring between the three parties.

Invest in companies that care about shareholders. Make sure the company is worth your dime. Dive Deep.

Information for this analysis was found via Sedar, TMXMoney, CanniMed Therapeutics and Newstrike Resources Ltd. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.