Yesterday, New Age Farm Inc (CSE: NF) experienced its highest volume traded ever. We have our suspicions as to how this volume may have seemingly came from nowhere, however that’s not the focus of today’s article. Instead, we aim to question investors on their latest investment in New Age Farm.

To perform this questioning, we’re going to use the most recent filings supplied by the company to SEDAR. This consists of the interim financial filings as of September 30, 2017, as well as the related management discussion and analysis. From here, we’ll take a glance at the company that demanded 22 million shares to trade hands yesterday.

New Age Farm Revenues

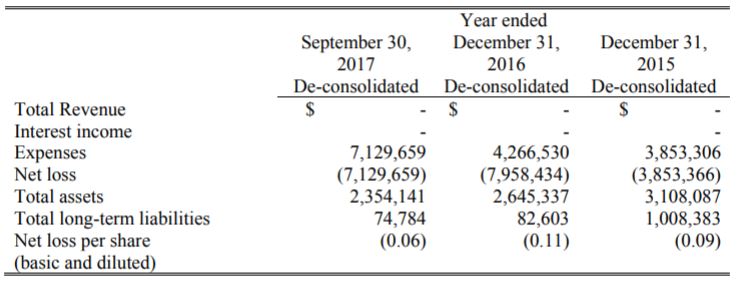

Lets begin our analysis on New Age Farm with a look at their revenues. This will give us an excellent starting point to base our opinions on the company. As it stands, the company currently owns three plots of land, which it rents out to growers. Essentially, the company acts as a landlord while providing additional resources to its clients. As of September 30, 2017, total revenues from this operation came out to $0.00.

In fact, according to this chart provided in the most recent MD&A, the company has never made revenues. Rather, it has instead incurred an increasing amount of related expenses while the value of their assets has consistently decreased. The only positive thing related to this chart, is the fact that long term liabilities have managed to decrease as well over the three time periods.

Filing Discrepancies

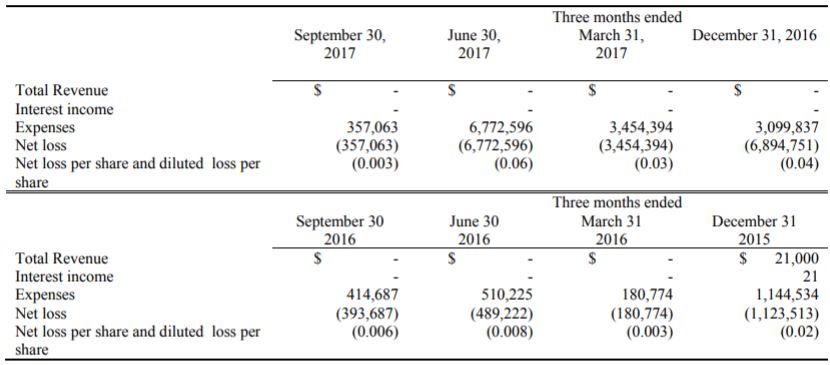

However, there are discrepancies present in the figures posted. Directly below this chart within the MD&A, they post the financials for the previous eight quarters.

The discrepancy relates to the revenue posted for the fourth quarter of 2015. With it listing revenues here, we can only assume that this report is based on consolidated figures. Comparatively, the previous figures were on a de-consolidated basis. If this is not the case, then there is an error evidently within the companies filings and brings the report into question.

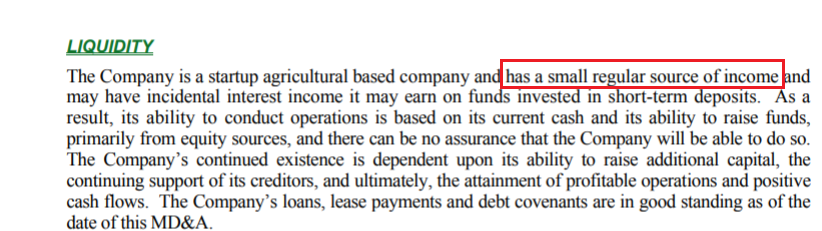

But wait – it gets better. The company then goes on to claim it “has a small regular source of income”. Based on the above information, where is this income placed? Why has it not been accounted for in the associated filings? Where does the income come from?

New Age Farm Management Compensation

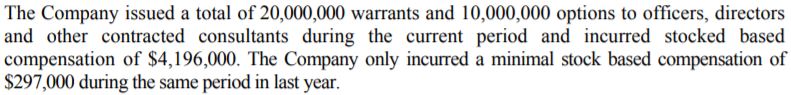

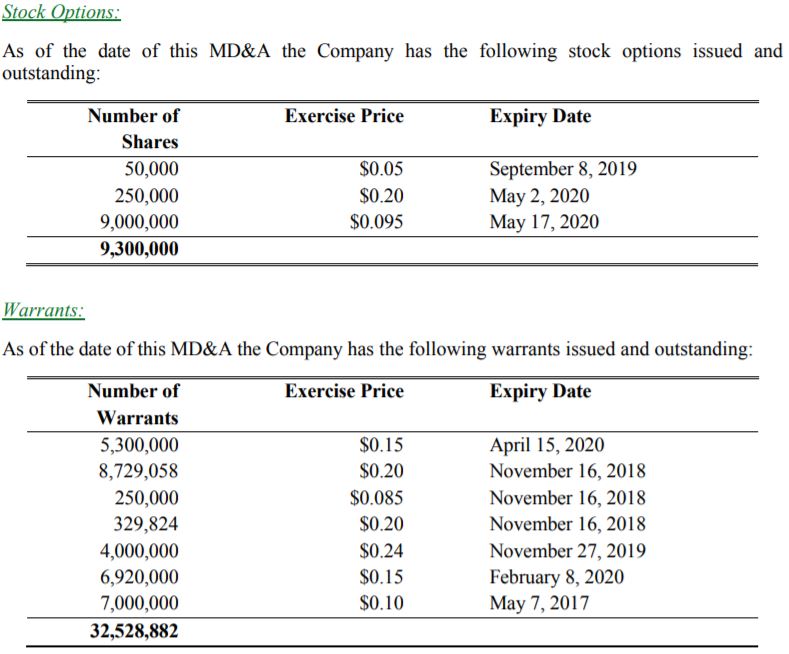

As a result of the stellar financials the company has produced this year, management felt it was appropriate to increase their compensation packages. This was completed in the form of stock based compensation, in an amount equal to over $4,000,000 in the nine month period.

As seen above, this was a significant increase over the prior year. It’s unclear what additional benefit it was exactly that management provided this year. It does indicate that a portion of this was also issued to “other consultants”, however it does not provide what service these consultants provided.

Overall, management compensation increased dramatically over the previous year. This is detailed in the above snapshot from New Age Farm’s MD&A report. One directors compensation alone rose by over $100,000. Again, based on the poor quality financials, it is unclear what benefit these executives have provided over the previous year. It’s certainly not easy to justify such significant increases in a short time frame.

New Age Farm’s Share Structure

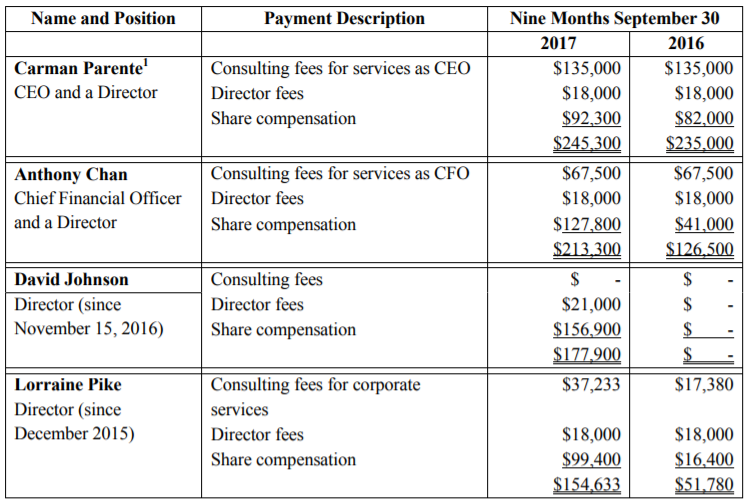

Finally, lets take a look at the share structure of New Age Farm. If your an avid reader of The Deep Dive, you know how we enjoy analyzing the share structure of a company. This one is no different. As per the MD&A published on November 29, 2017, the stated outstanding share count is 133,788,577. Be aware that this figure is as of November 29, not September 30 like it typically would be.

When currently outstanding options and warrants are accounted for, we get a fully diluted share count of 175,617,459. Based on yesterdays closing price of $0.115, New Age Farm has a market cap of approximately $20.2 million on a fully diluted basis. Based on outstanding shares, this figure is $15.4 million. Does this valuation seem appropriate for the revenues and assets posted by the company?

Also, please note that we believe the final line should read “May 7, 2020” as an expiry for the listed warrants. Editing is not this companies strong suit.

Closing Statements

When you get caught up in the hype, it’s easy to forget the fundamentals associated with a company. Or even what the company does for that matter. Often times, investors are just focused on the momentum a stock has seen, and they buy it without looking in to the company. Instead, they believe what they read in snippets via social media or bullboards in relation to the company. Before you know it, you’re stuck holding the bag that no one else wants.

If you are purchasing stock in a company with the aim of holding on to it for a period of time, take a minute to read in to them. It’s doubtful many investors would have piled in to New Age Farm yesterday had they acknowledged the recent filings by the company. We were able to quickly identify several issues within the company by these two documents, both filed under a week ago. Not to mention the poor quality of writing within the management discussion and analysis. There were sentences that were on the verge of being illegible, which should be a major red flag. If your going to put your hard earned money in to a company, take the five minutes to read the latest news on them at the very least. For everyone’s sake.

Finally, at the end of the day we’re left asking the question: Why New Age Farm?

Read the documents. Don’t invest blindly. Dive Deep.

Information for this analysis was found via The CSE, SEDAR, and New Age Farm. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.