Last week, Eight Capital launched coverage on a basket of psychedelic companies. This comes after they produced an industry primer during the summer months. The last company to be initiated on is Bright Minds Biosciences (CSE: DRUG), with an C$11.50 price target, or a 67% upside and a buy rating.

Eight Capital headlines the note, “A Bright Vision, Right Team, and the Right Assets, Makes a Gleaming Investment Opportunity.” They say that their investment thesis hinges on the companies flagship BMB-101 asset. BMB-101 is a drug to treat seizures in persons affected by developmental epileptic encephalopathies, which includes Dravet and Lennox-Gastaut syndrome. It also will potentially be used for broader issues such as binge eating disorder or opioid use disorder.

They call the Bright Mind Biosciences team “seasoned,” with the team full of science-focused members who have had past successes in all stages of clinical trials and drug developments. They write, “the bench strength of the management team and board speak highly of the Company’s future ability to execute on its highlighted timelines.” Below you can see the management team and their relevant experience.

Eight Capital says that, just like every other psychedelic company, their lead asset has been derisked and is well-positioned to tackle a notable unmet need. They explain, BMB-101 “is an agonist for the serotonin 5HT2C receptor,” and that the antiepileptic mechanism has been de-risked by Zogenix’s fintepla and Arena Pharmaceuticals belviq drugs. Eight Capital writes, “We believe BMB-101 benefits from robust activation of 5HT2C receptors as well as avoiding activation of 5HT2B receptors, which are linked to cardiovascular adverse events and the cause of fintepla’s black box and strict protocol.”

Additionally, Bright Minds Biosciences’ pipeline for BMB-101 provides optionality, since the central serotonin systems have been associated with the control of ingestive behavior and affect the behavior of psychostimulants, opioids, alcohol, and nicotine. This means that the addressable markets are potentially a lot larger than just what is currently in the scope of the business.

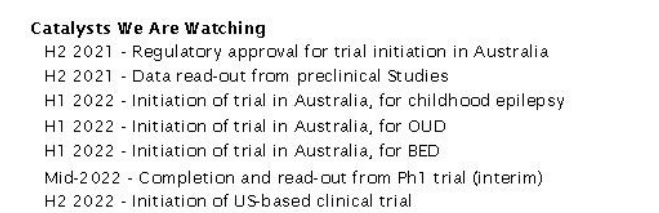

Below you can see Eight Capitals list of upcoming catalysts.

FULL DISCLOSURE: Bright Minds Biosciences is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Bright Minds Biosciences on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.