Recently, Brisio Innovations Inc (CSE: BZI) inked a definitive agreement that may have outstanding results for the company. On March 7, it was announced that they had signed a deal to acquire NameSilo, a rapidly growing domain registrar that we have admittedly never heard of before. However, it has some impressive figures attached to it’s financials which caught our eye. The trouble is though, the company has a major lack of attention on it.

As a result of being focused on the Canadian junior markets, we often find ourselves dealing with many flash in the pan companies. Essentially these are companies that come along, get a bit of investor excitement for a while, and then disappear without a trace. We’ve wrote on a handful of these – we won’t name names, but just traverse through some of our past articles to get a feel for what we mean. In regards to Brisio Innovations, we don’t as of yet know if it’ll be a name added to this growing list or not. Investor excitement has been minimal, and it’s off far more radars than it is on.

That being said, lets take a look at the company and see what they just might have to offer.

Brisio Innovations: The Value in NAV

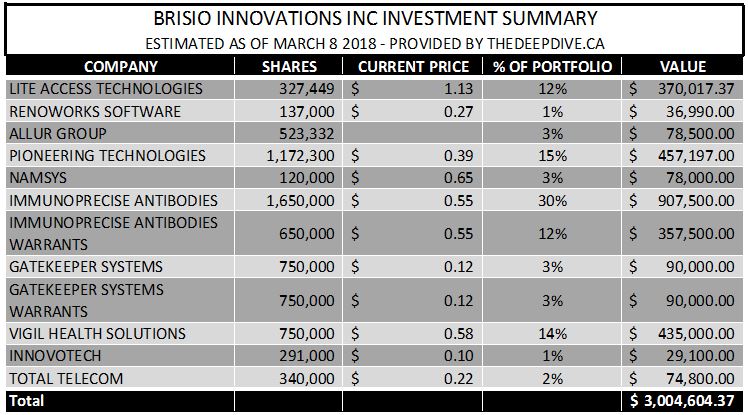

Brisio’s current investment value

One item that Brisio Innovations should be commended for, is their complete transparency. Due to their long term style of investing, they are able to update investors whenever a position is taken or relieved. They also openly share the amount of common shares and warrants in which they currently hold. Although beneficial to investors, it can be detrimental to the company when shareholders like to keep close tabs on them.

Take for instance, our calculated asset value of all investments in which the company currently holds.

As of the time of writing, the asset value of Brisio’s investment portfolio is an estimated $3,004,604.37. There is however some play in this figure as one investment that the company has is not publicly listed, thus requiring us to utilize the estimated value given in the latest financials. Overall, this current value equates to a 38.4% reduction in value since the September 30, 2017 stated value of $4,877,271.

Based on the currently 41,517,368 outstanding shares of Brisio Innovations, and net assets of $3,152,019 once all other assets and liabilities are factored in, this equates to a net asset value (NAV) of $0.07592 per share.

Brisio’s definitive share purchase agreement for NameSilo LLC

The big news for Brisio as of late is the recently announced share purchase agreement for all outstanding shares of NameSilo LLC. NameSilo, a domain name registrar, is currently named as one of the six fastest growing registrars in the world. It currently manages over 1.5 million domain names, through over 85,000 global customers. ICANN accredited, the firm is a low cost provider in the current market landscape.

Speaking to financials, the company currently has a growth rate of 65% versus the industry standard of 7% annual growth. Naturally, this resulted in the companies annual billings to explode to $11.1 million USD for 2017, versus the $6.9 million USD recorded in 2016. All while maintaining a high 87% retention rate.

Given the company’s current success, it’s puzzling as to how Brisio Innovations managed to secure a definitive agreement valued at $9.6 million USD. At less than one times the current earnings of NameSilo, it leaves a few yearning questions. Has 2018 tracked poorly relative to that of 2017? Were major customers lost to competitors, thus the sale of the company at a discount? Or is this just a true steal of a deal?

Irregardless, investors of Brisio Innovations should have their own set of questions. Primarily, how is Brisio going to fund the $12.3 million CDN purchase of NameSilo when their market cap in its entirety is currently only $14.1 million? Further to that, this market cap is based on assets worth roughly $3.15 million. Even if this news is well received by the market and the company is able to perform a say $12,500,000 private placement at $0.40 per share, it will still result in dilution in excess of 31,250,000 shares. This also doesn’t include the likely full warrants required to be issued, or the cut taken by the financiers of the raise itself.

Closing Remarks

With Brisio Innovations still under a self imposed trading halt, it’s anyone’s guess as to how the market will react. Will investors take the news at face value and rejoice, shooting the equity upward? Or will they sit and do the calculations on the impact such a deal will have to the structure of the company? Only time will give us the answer.

Perhaps the draw of a potential spinco will entice investors into becoming shareholders of Brisio. With the current outlook for NameSilo, it may be a lucrative investment should it continue to grow at the same rate as it did last year. Now may simply be the time to snag some cheap shares while they last, irregardless of the effect the deal might have on Brisio’s share structure. As investors, our role is to manage risk in each of our investments. The individual will need to determine whether this risk is worth the potential return.

Don’t lose sight of the net asset value of a firm, especially if they are an investment pool company. Dive Deep.

Information for this analysis was found via Sedar, The CSE, TMX Money, and Brisio Innovations Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.