Anheuser-Busch InBev (NYSE: BUD) reported its Q2 2023 financials, highlighted by $15.12 billion in total revenue, a jump from Q2 2022’s $14.79 billion.

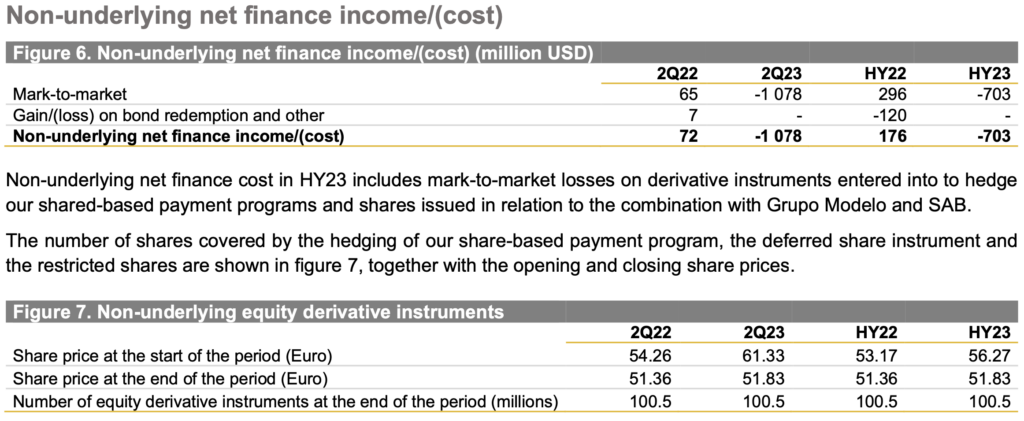

However, the beverage company saw its profit drop 70% down to $607 million for the quarter compared to $1.98 billion in the year-ago period. The decline was mainly driven by a $1.07-billion in non-underlying net finance costs due to “mark-to-market losses on derivative instruments entered into to hedge [its] shared-based payment programs and shares issued in relation to the combination with Grupo Modelo and SAB.”

The said share price dropped nearly 10 euros, which cost the firm nearly 1 billion euros on over 100 million shares of equity derivative instruments. Taking out non-underlying factors, profit ended at $1.45 billion compared to last year’s $1.47 billion.

The bottomline translates to $0.17 earnings per share compared to last year’s $0.79 per share. Discounting the non-underlying items, earnings per share for the quarter came in at $0.72 vis-a-vis previous year at $0.73.

The firm continues to anticipate its EBITDA to align with the medium-term projection of 4-8% growth, predicting its revenue to outpace EBITDA.

The falling US market

While the company reported growth in all other global markets, its United States market stood out with a 10.5% revenue decline impacted by volume performance. However, revenue per hectoliter (hl) increased by 5.2% due to the implementation of revenue management initiatives. Sales-to-wholesalers dropped by 15.0%, and sales-to-retailers declined by 14.0%, both underperforming the industry. The primary reason for the decline was the decrease in Bud Light volume.

“Since April, we actively engaged with over 170 000 consumers across the country through a third-party research firm and the data shows that most consumers surveyed are favorable towards the Bud Light brand and approximately 80% are favorable or neutral. As part of our long-term plan, we increased investments in our key brands, invested in measures to support our wholesalers and continued key initiatives such as partnerships with NFL, NBA, Folds of Honor and Farm Rescue,” the firm said.

The company is still reeling from the backlash caused by the Bud Light controversy when the beverage brand engaged transgender influencer Dylan Mulvaney. CEO Michel Doukeris, while admitting a decline in sales volume due to the issue, shrugged off the impact of conservative backlash.

Worldwide volume saw a decline of 2.1 million hl, with the largest decline driven by a 3.9 million hl fall from the North America market. This is partially compensated by a 2.4 million hl growth in the Asia Pacific segment.

The company, also known for brands like Budweiser and Michelob Ultra, confirmed last week that it would be trimming staff, but less than 2% of its approximately 18,000 US workforce would be affected, sparing its brewery and warehouse staff.

In June, Modelo Especial surpassed Bud Light as the leading beer in retail sales nationwide. Constellation Brands, the distributor of Modelo in the United States, recorded a remarkable 7.5 percent increase in beer volumes during its latest quarter, which ended on May 31, compared to the corresponding period the previous year.

Anheuser-Busch InBev last traded at $56.21 on the NYSE.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.