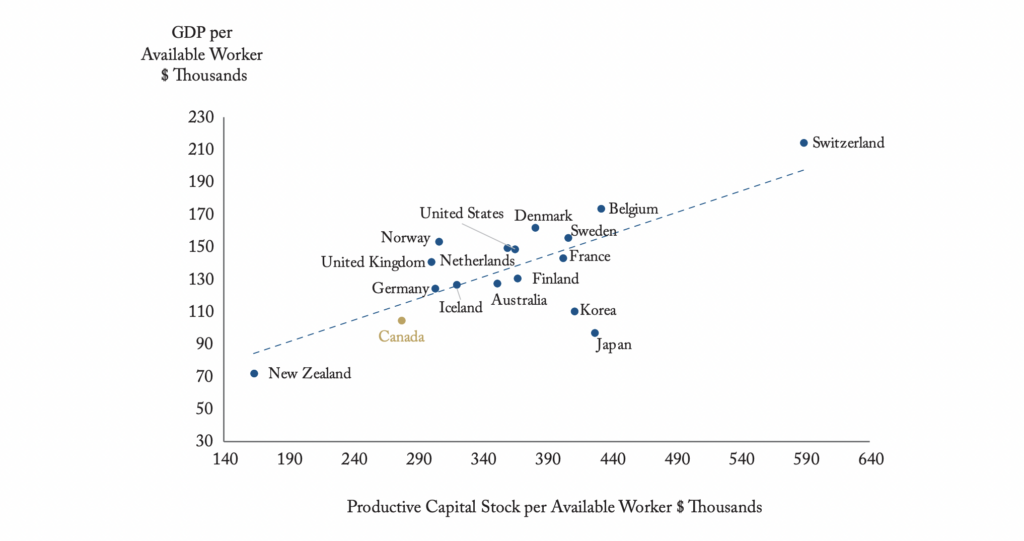

A recent C.D. Howe Institute study revealed that business investment in Canada — which has been weak since 2015 — has pushed down investment per available worker to half of what it is in the United States.

The study compares figures between Canada, the US, and countries that make up the Organization for Economic Cooperation and Development (OECD) and focuses on new investment per available worker. In 2022, workers in Canada will get only 73 cents of new capital for every dollar invested in workers in other OECD countries.

“Having investment per worker much lower in Canada than abroad tells us that businesses see less opportunity in Canada, and prefigures weaker growth in Canadian earnings and living standards than in other OECD countries,” according to the study authored by William B.P. Robson, chief executive officer of C.D. Howe Institute, and Mawakina Bafale, a research assistant.

This scenario has been unfolding since 2015 following the oil crash of 2014. Capital spending in the mining, quarrying, and oil and gas extraction industry has continuously declined since it peaked in 2014. Investment in structures was slashed by 61% from 2014 to 2021, while investment in machinery and equipment fell 53% during the same period.

The study points out that the recent increase in oil and natural gas prices did not result in a comparable rebound in capital spending. This can be attributed to a “hostile regulatory environment” and skepticism over the future of fossil fuels.

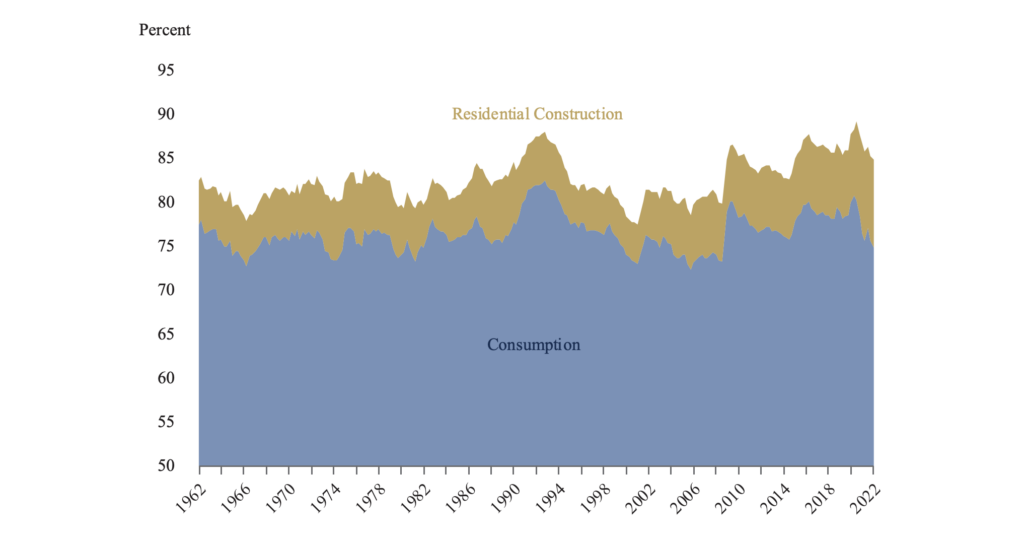

Another contributor to the low business investment — albeit in a more subtle manner, as the study’s authors described — may be low national savings, with an “outsized share” of funds going into residential investment. The government’s in-house spending and transfers to households have promoted consumption. Put together, consumption and residential investment have gone over 85% of GDP for an unprecedented seven years.

Robson and Bakale cited a few more potential factors contributing to the low business investment:

- Restricted access to finance for small and mid-size firms

- Uncompetitive corporate income taxes

- An uncongenial environment for intellectual property investment

- Regulatory uncertainty

- Unpredictable fiscal policy

The authors project that there will be $20,400 of new capital per worker for OECD countries this year, compared to only $14,800 in Canada.

Information for this briefing was found via the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.