This morning, Canaccord Genuity raised their estimates on WELL Health Technologies (TSX: WELL) off the back of a strong third quarter but kept their 12-month price target and rating at C$8.50 and a speculative buy.

Doug Taylor, Canaccord’s analyst, comments, “We remain positive on WELL Health following Q3 results, which featured a better revenue build than we previously forecasted.” WELL Health reported $12.2 million in revenue compared to the Street estimate of $11 million. They also reported an EBITDA loss of $0.2 million versus the estimate of $0.4 million. Taylor says that this beat was driven by sequential growth in clinic and virtual visits.

Taylor adds, “Increasing our forecasts for better growth and recent M&A.” He cites management saying that their current run rate is $68 million, which includes recent acquisitions. He says, “which we see as providing good support for our current model and expectations.”

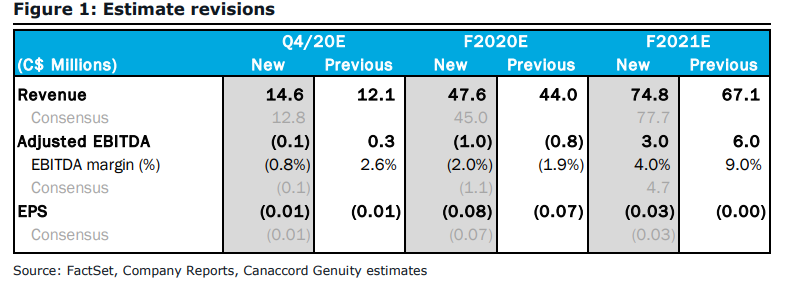

Canaccord increased its revenue estimates for the fourth quarter, 2020, and 2021, along with the estimates for adjusted EBITDA, and EPS. He comments, “We have also increased near-term opex to reflect expectations of additional advertising and promotional activity along with the absorption of INSIG’s operations.”

The firm is now forecasting revenue to be $14.6 million for the fourth quarter, $47.6 million for 2020, and $74.8 million 2021.

Taylor comments on the estimate changes by stating, “Near-term outlook boosted by organic growth and M&A activity.” Clinical volumes continue to grow, and telehealth is holding over their third-quarter levels. The company has also indicated that they could expand their existing clinical business by +40% without hitting any capacity constraints.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

hello Doug do you a possible M@A with Telus Health?