On November 30th, CloudMD Software & Services (TSXV: DOC) reported its third-quarter financial results. CloudMD reported record revenue of $3.4 million, up 55% year over year and a gross margin of 42%. They had a net loss of $2.7 million or ($0.02) per share this quarter.

CloudMD currently has four analysts covering the company with a weighted 12-month price target of C$3.38. This is up from the average at the start of the month, which was C$2.80. One analyst has a strong buy rating, while the other three have buy ratings on the company.

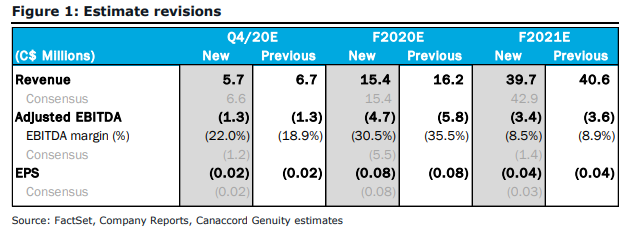

Doug Taylor, Canaccord’s analyst, says, “DOC released Q3 results after market close Monday that we see as in the range of expectations with a slightly narrower EBITDA loss than was forecasted.” Although these results do not include many of the most recent M&A, he says that the results were mixed versus expectations. Revenue of $3.4 million was as expected versus the consensus but missed Canaccord’s estimate of $3.7 million. CloudMD’s adjusted EBITDA loss of $1.3 million was slightly better than both the consensus and Canaccord’s estimates of -$1.7 million and -$1.8 million, respectively.

Taylor says that the revenue ramp should be in effect as deals close in the fourth quarter. Since June, the company has made ten different acquisitions, which management said will generate a $35+ million revenue run rate for 2021.

The company ended the third quarter with cash and equivalents of $33.9 million, but pro-forma, they likely have roughly $60 million in cash. Taylor comments, “With ~$60M cash on hand, we believe the company could comfortably outlay another $50M on additional accretive M&A targets to accelerate its growth profile and path to profitability.”

Taylor says that they recently went through and remodeled CloudMD and made small adjustments to include a later closing date for many outstanding acquisitions. You can see below their new 2020 and 2021 forecasts.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.