Canaccord Genuity initiated coverage on Artemis Gold (TSXV: ARTG) this morning with a Speculative Buy rating and a C$13 price target. Coverage was initiated after Artemis acquired the 12 million ounce Blackwater project from New Gold for consideration of $210 million.

The transaction will see $140 million paid in the form of cash up front. Shares will also be issued, valued at the lesser of $20 million and 9.9% of the issued and outstanding Artemis common shares at the time of closing.. There are also some stipulations in the acquisition where on the 12-month anniversary, there will be a $70 million cash payment to New Gold, less $20 million (the aggregate issue price of consideration shares) and they hold first ranking interest over Blackwater until the payment is made. New Gold also gets an 8% stream at 35% of the spot gold price, which goes down to 4% after 279,908 ounces, but Artemis holds the right of first refusal on the stream’s potential sale.

Canaccord’s analyst Kevin MacKenzie headlines, “a developer that checks all of the boxes” and “unlocking a giant.” The acquisition of Blackwater was predicated on a rescope project development and an execution plan made by Artemis. The plan was centered on a phased development approach. In the recent pre-feasibility release, the lower initial throughput associated with Artemis’ phased ramp up reduces the CAPEX from C$1.96 billion to a more manageable C$592 million. This, tied with an improved price environment, increases the project’s overall economics to a 34.8% internal rate of return vs. the prior estimated 9.3%.

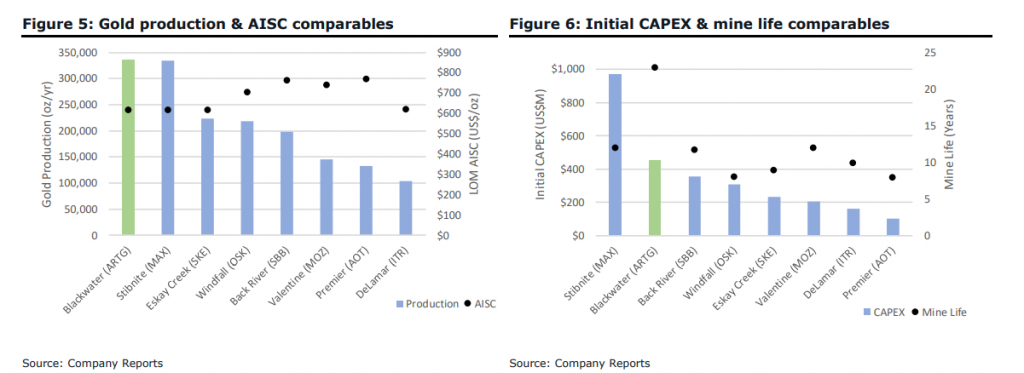

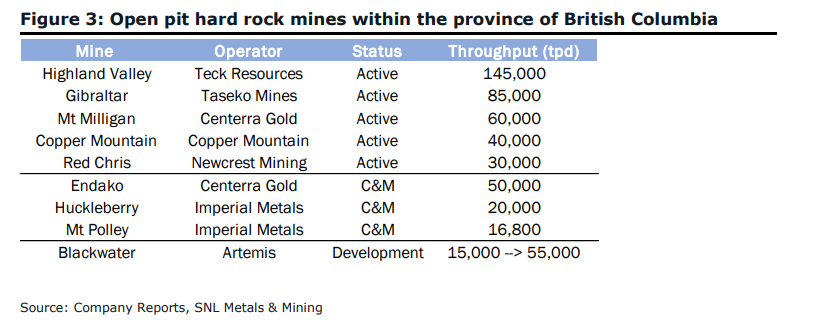

MacKenzie gives his investment thesis in a few different points. The first point he makes in the note is that British Columbia has been recognized as one of the safest and most established mining jurisdictions. The province hosts several large open-pit mines similar in size to the one being developed at Blackwater. MacKenzie says that the key differentiator between Blackwater and its peer is the 23-year mine life, which will produce roughly 366,000 ounces per year, which puts Blackwater at the top of its peers with the typical mine lasting between 8 to 10 years.

The second point MacKenzie makes is robust economics and a clear path to profitability. As stated above, with the recently released results of Artemis’ Blackwater pre-feasibility study, it shows that there is an internal rate of return of 35% and an all-in sustaining cost of U$616 per ounce with the assumption that the long term commodity price is U$1,541 per ounce. Artemis also notes that at a long term price of U$1,800, the internal rate of return goes up to 42%, but even if commodity prices fall to U$1,300 per ounce, they will still have an internal rate of return of 27%.

The path to profitability is clear, says MacKenzie, as Provincial and Federal EA approvals were secured in 2019 by the previous project operator, Artemis has budgeted roughly 18 months to ensure the additional permits and authorizations required to advance the project into construction. Mackenzie says, “assuming a two-year build schedule, we estimate the start of production at Blackwater will commence in early 2025 (includes 6-9 month buffer to current guidance).”

MacKenzie also notes that Artemis is led by Steven Dean, the CEO, and Chairman. He is backed predominantly by the same management team that developed, constructed, and operated Atlantic Gold’s Touquoy mine/greater Consolidated Moose River project, which he calls out Artemis for using the same playbook that Atlantic Gold used, which includes “securing fixed-price construction/performance contracts for the processing plant and associated infrastructure.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.