On Monday Medipharm Labs (TSX: LABS) announced an exclusive medical cannabis partnership with the European pharmaceutical company STADA. Under the agreement, Medipharm will supply GMP certified medical cannabis, manufacturing, logistics, and regulatory support to STADA. At the same time, STADA will be responsible for commercializing cannabis products, which will initially be sold in Germany.

STADA CEO Peter Goldschmidt commented in yesterday’s release, “This partnership with MediPharm demonstrates STADA’s ambition to be the go-to-partner for Generics, Consumer Health, and Specialty Products. With MediPharm, we are collaborating with a very strong partner in the Medical Cannabis field.”

This morning, Canaccord Genuity’s Matt Bottomley raised his 12-month price target on MediPharm Labs to C$2.50 from C$2.25 and reiterated his Speculative Buy rating on the stock. Bottomley says, “in our view, this announcement validates LABS’ strategic focus as a pharma-quality API provider and go-to contract manufacturing partner within international medical cannabis markets by an established and reputable global pharmaceutical provider.”

STADA currently holds distribution into over 120 countries and “has garnered a reputation for providing top quality generics and non-prescription consumer health products.” STADA is presently one of the top five companies in the generic European space and has a top-three position in 20 of its consumer brands across multiple categories. With this amount of leverage and quality distribution networks, Bottomley says, “we believe that should MediPharm execute, the company would be able to leverage Stada’s distribution footprint to establish its own in-roads in European and other markets once these countries begin to embrace medical cannabis.”

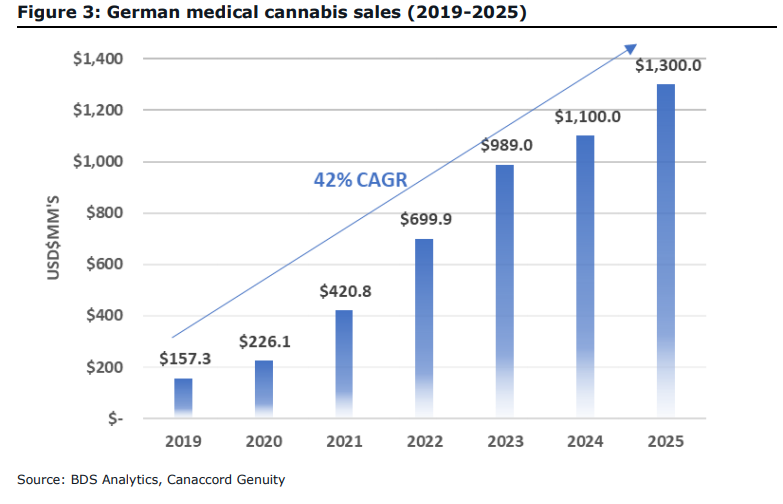

Bottomley adds that this announcement “helps to de-risk LABS international operations,” because it gives confidence in the company’s GMP-quality portfolio. Not only does this partnership allow Medipharm to reach Germany, but the agreement also provides for further expansion across the border to other European countries. It is estimated that the German medical cannabis market will reach $1.3 billion by 2025 and have a 42% CAGR. Bottomley says, “In our view, it could become a cornerstone arrangement for the company within its international customer base.”

The last thing Bottomley touches on in this note is that Medipharm labs has exceeded key catalysts/events for the stock and now “expect any material announcement that shows successful execution on the part of LABS to serve as additional confidence around the potential economic impact of this arrangement.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.