On Monday, Canaccord put out a precious metals industry update, saying, “The war in Ukraine has added a new level of macro uncertainty to the central bank war on inflation.” Even before the war, the indices had been slowly marching towards a correction. Between inflation continuing to be rampant and oil touching $125 per barrel, this sets up for indices to continue on their march into correction territory.

Between all of this, the Federal Reserve continues to try and reel back in inflation with its first expected rate hike in two years to arrive on March 16, with the expectation that they will start to unwind their balance sheet in the second half of the year. Canaccord says that “jittery equity markets in correction territory and the yet-to-be-determined fallout from the war leave the Fed walking a tightrope of trying to rein in inflation without causing a broader market crash or recession,” and believes that the Federal Reserve might be being a bit too aggressive in their actions.

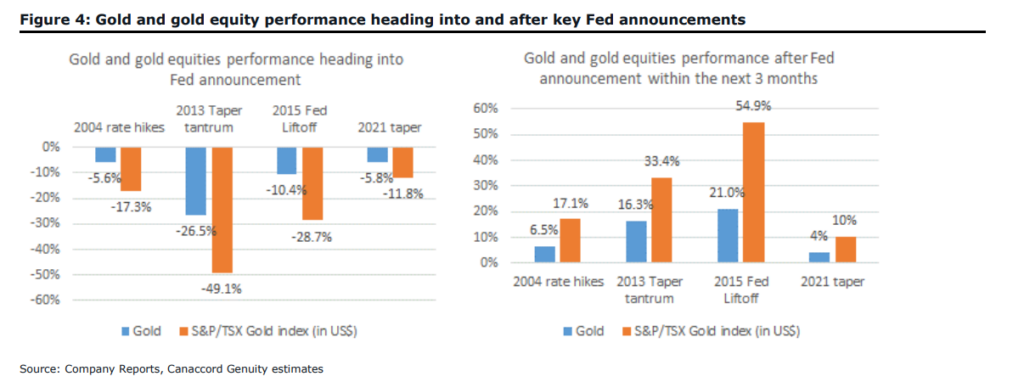

With this, Canaccord expects that gold is prepared for liftoff with it breaching over the $2,000 per ounce and being on a 4-day green streak. They add that usually gold drops on the announcements of the Federal Reserve policy change, and not the actual dates of the policy changes. This happened both during the 2013 taper tantrum and the 2015 rate hike cycle.

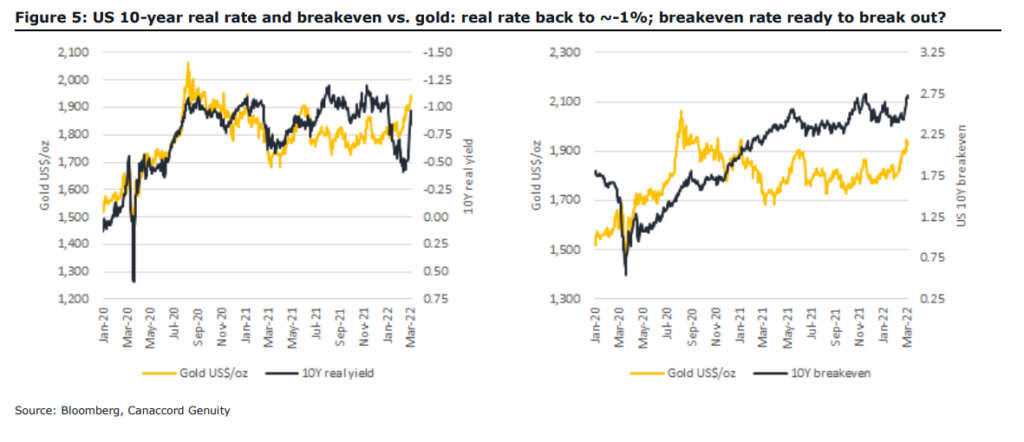

The next thing they say is that there are many flashing signs in the face of rising rates and tightening expectations. The first thing they point to is the US yield curve which has been flattening, while the 10-2 year yield spread is at 24 bps. Additionally, the 1 year out Fed fund futures rate is in-line with the 10-year yield, “which is a form of inversion that has coincided with previous peaks in the Fed’s policy rate” says Canaccord. The last flashing sign is the inversion in the Eurodollar futures curve, which is a market that is usually much deeper and more liquid than the Fed fund futures.

Lastly, Canaccord says that gold remains the premier safe-haven asset, while the gold producers remain cheap. They add that through their regression analysis, gold equities are discounting a gold price of $1,868 per ounce. For this, Canaccord provides a number of top picks, which include Agnico Eagle (TSX: AEM), Endeavour Mining (TSX: EDV), Yamana Gold (TSX: YRI), SSR Mining (TSX: SSRM), Calibre Mining (TSX: CXB), Osisko Gold Royalties (TSX: OR), and Nomad Royalty Company (TSX: NSR).

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.