On May 3, IAMGOLD Corporation (TSX: IMG) reported its first quarter results for 2022. The company announced revenues of $356.6 million, up almost 20% year over year while gross profits rose 66% year over year to $72.3 million. The firms income before taxes also rose a substantial amount year over year to $58.4 million, while adjusted EBITDA was $147.6 million. The company reported earnings per share of $0.05 or a net income of $23.8 million.

IAMGOLD said that it generated $142.3 from operating activities while mine-site free cash flow was $87.5 million. They also reported spending $76.6 million in sustaining capital expenditures while spending $92.1 million in expansion expenditures. The company stated it had $519.35 million in cash and equivalents as of March 31st, 2022 with an additional $498 million available under a revolving credit facility.

In terms of production, the company produced 174,000 gold ounces, compared to 153,000 last quarter. It also sold 181,000 ounces this quarter at an average realized gold price of $1,813. The company said its cash costs per ounce of gold were $1,017 while its all-in sustaining cost was $1,490.

The company provided updated full-year guidance. The company now estimates it will produce between 570,000 and 640,000 ounces of gold, with Essakane producing between 360,000 and 385,000 ounces, Rosebel producing between 155,000 and 180,000 ounces, and Westwood producing between 55,000 and 75,000 ounces.

They believe total cash costs will come in between $1,100 and $1,150 per ounce, while the all-in sustaining costs are expected to be between $1,650 and $1,690.

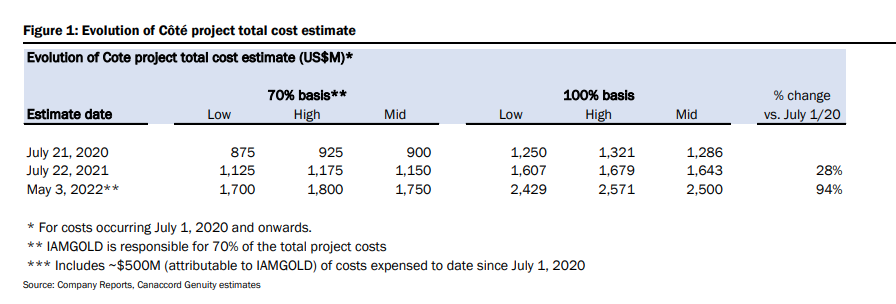

Lastly, the company announced that it projects costs to complete the Côté Gold project at between $1.2 and $1.3 billion while pulling its 2022 and 2023 cost guidance for the mine. They have said they will provide detailed updated costs and schedule estimates before the end of the second quarter.

IAMGOLD currently has 10 analysts covering the stock with an average 12-month price target of C$3.85. Out of the 10 analysts, 2 have buy ratings, 4 have hold ratings, 3 have sell ratings and a single analyst has a strong sell rating on the stock. The street high price target sits at C$6.50.

In Canaccord Genuity’s note on the results, they downgrade IAMGOLD to a sell from a hold and slash their 12-month price target to C$2.75 from C$4.00, saying they have a lot of questions following the Côté update.

On the results, the company performed significantly better than Canaccord’s estimates, with Canaccord estimating earnings per share of ($0.03) and an adjusted EBITDA of $105 million. Gold production and cash costs also came in better, with Canaccord estimating 153,000 ounces at a cash cost of $1,104. Though they say that the results were overshadowed by the Côté news.

They say that the increase in capital expenditures from $710 to $760 million back in January of this year to $1.2 to $1.3 billion is roughly 90% higher at the midpoint.

With this news, Canaccord now updated their IAMGOLD’s year-ending cash position, which they say will be around $170 million with $250 million left to draw on its credit facility. They then expect that the company will draw on that $250 million in 2023 and end the year at a negative cash balance of $270 million.

On this, Canaccord says, “We see few desirable options to plug the funding gap.” As a result they believe that an asset sale could be the way IAMGOLD goes about closing the funding gap, with Rosebel being “near the top of the potential list,” but worry that even a sale of that mine will not close the gap due to the recent challenges.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.