On December 9th, Canaccord Genuity initiated coverage on FuelCell Energy (NASDAQ: FCEL) with an $8.50 12-month price target and a hold rating. Jed Dorsheimer, Canaccord’s analyst, comments on the initiation by stating, “We believe FuelCell Energy has great promise in the grey/blue hydrogen markets for on-premise backup and direct gen solutions (including fuel cell storage and carbon capture technologies), but the recent tripling of the stock over the past month suggests to us that investor enthusiasm has likely exceeded fundamentals in the near term.”

FuelCell currently has six analysts covering the company with a weighted 12-month price target of $4.50. This is up from the average at the end of October, which was $2.50. Five analysts have hold ratings, and one analyst has a sell rating on FuelCell.

Dorsheimer highlights multiple attractive angles for FuelCell. His first point is that FuelCell has a differentiated product. FuelCell has created a modular and scalable energy storage that will hopefully “address a growing need for energy backup and time-based differences in energy delivery needs for on-grid and off-grid applications.” These fuel cells also can capture carbon, with the technology being co-developed by ExxonMobil Research and Engineerings.

Dorsheimer states that FuelCell’s modular stack systems have “multiple niche, specialized markets [that] provide growth opportunities.” He specifically says that this system would be great for space-constrained locations such as urban areas and near existing buildings. The most common users would likely be industrial plants, universities, hospitals, and wastewater treatment plants.

He then highlights that the hydrogen economy is just in its infancy. Dorsheimer says, “We find value in the resurgence toward hydrogen as a solution in multiple markets” but warns that this market is highly nuanced and segmented. He adds, “We also recognize the nascency and thus risk at these early stages.”

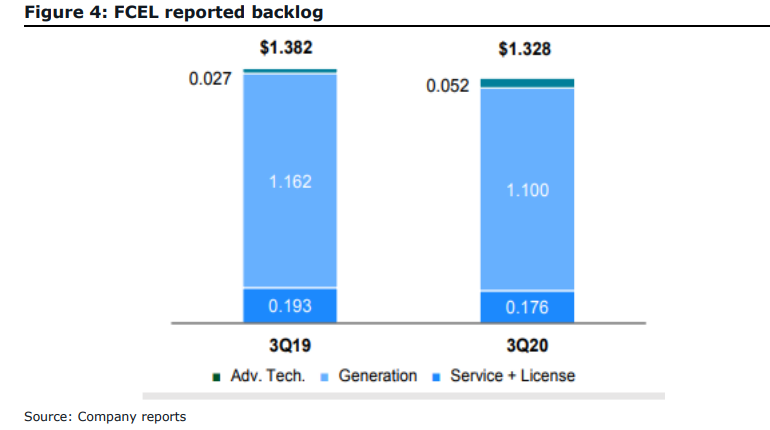

The last two items Dorsheimer points out is that in 2019 FuelCell, “embarked on a rather aggressive and transformational turnaround,” which included all new management, better streamlined operations, and an improved capital structure. This is all helping FuelCell on its path to becoming a profit-generating company instead of the loss generating company it is today. Dorsheimer says, “we see a realistic path to positive adjusted EBITDA in the F2022 timeframe,” as the company works through its backlog of orders.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.