On May 18th, Cresco Labs (CSE: CL) reported its first quarter financial results. The company reported revenues of $214 million, down slightly from the $217.79 million the company reported last quarter. While the company reported gross profits of $113 million, or a margin of 53%.

The company saw its wholesale revenue come in at $95 million and its retail revenue come in at $119 million for the quarter. Additionally, Cresco Labs reported a first-quarter adjusted EBITDA of $51 million. The company reported a net loss of $23.67 million and ended the quarter with $179 million in cash on hand.

Currently, Cresco Labs has 18 analysts covering the stock with an average 12-month price target of C$15.50, a 210% upside to the current stock price. Out of the 18 analysts, 5 have strong buy ratings, 11 have buy ratings and 2 analysts have hold ratings. The highest 12-month price target sits at C$36, or a 615% upside to the current stock price.

In Canaccord’s note on the results, they reiterate their buy rating but lower their 12-month price target from C$12.00 to C$9.50, saying that Massachusetts weighted on this quarter’s results and that the Columbia Care acquisition remains on track.

On the results, Canaccord was estimating revenues of $207 million versus the $214 million actual. They say that the company fared in its 10 states more than the underlying markets, as a sequential decline of 2% was better than the 4.5% decline those 10 states saw. While Canaccord notes that if you exclude Massachusetts, which saw a sequential decline of 7%, Cresco’s sequential revenue growth would have been almost 2%.

On the gross margins, Canaccord says that the results of 52.6% were below their estimate, but above Cresco’s stated long-term target of 50%. Though the company’s SG&A as a percent of revenue grew to 35.5% this quarter, which Canaccord believes was due to the four new store openings during the period.

Additionally, the company ended the quarter with $179 million in cash. Canaccord expects that after the acquisition of Columbia Care, Cresco could go and look for potential suitors for overlapping assets, such as New York or Florida. Canaccord believes that Cresco could get a potential $300 to $400 million in proceeds from these sorts of divestitures and would leave “the company well-positioned to fund its near-term growth initiatives and deleverage.”

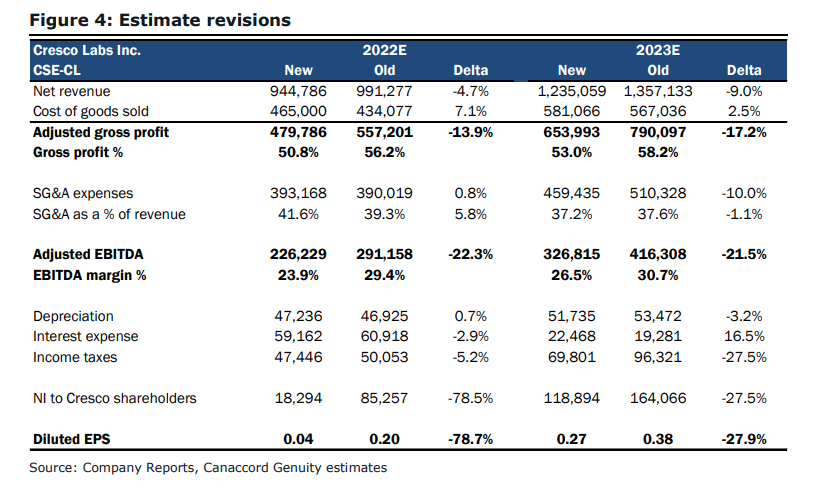

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.