Activision Blizzard (NASDAQ: ATVI) is has seen a solid climb off the monthly lows after reporting better than expected first-quarter financials. The company reported revenues of $2.275 billion, a 27.2% growth year over year, with gross margins coming in at 74.6%. Net margin for the first quarter came in at 27.2% while earnings per share were $0.79. The company beat all estimates.

A few analysts changed their price targets on Activision Blizzard slightly raising its average 12-month target price from $113.29 to $116.57.

Below are the most recent analyst changes:

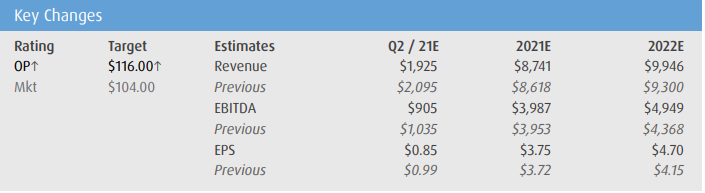

- BMO raises target price to $116 from $104

- BMO raises to outperform from market perform

- MKM Partners raises price target to $120 from $115

- Deutsche Bank raises target price to $118 from $115

- Morgan Stanley raises price target to $120 from $115

- Benchmark raises target price to $125

- Bernstein raises target price to $85 from $82

In BMO’s note, their analyst Gerrick Johnson raised Activision Blizzard to an outperform rating and raised the 12-month price target from $104 to $116 and says that with or without COVID, the franchise strategy stays.

Johnson believes that Activision share’s will outperform as the “market has digested ATVI’s 2020 gains, sellers have taken their profits, and “sell the COVID winners” bears have shaken out.” This comes after the stock has had a volatile start to the year, being up only 2.7% year to date, down 8.8% from its all-time highs.

Johnson admires the restructuring efforts and feels confident that the company is making strides after its recent strong performances of Call of Duty and World of Warcraft. He says, “ATVI is entering its third year of this new strategy with momentum.” They are waiting to see what sort of strategy the publisher develops for its Diablo franchise, as the company announced a free-to-play Diablo Immortal mobile and a remaster copy of Diablo two.

Activision Blizzard has started the year off strong on the mobile gaming front with its internally developed game, Crash Bandicoot On the Run, which reached 9.1 million downloads in the first day. Johnson writes, “This should give the company confidence to dive deeper into the mobile arena, both through partners like TenCent (Call of Duty) and NetEase (Diablo Immortal), as well as on its own with its own internal teams.”

Johnson hints at the idea that Activision should consider creating some sort of NFT as the company has “its own highly engaged collector-oriented fan base, might make a more obvious choice to develop a viable NFT strategy.”

Below you can see the recent key changes to BMO’s model for 2021-2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.