On November 8th, Curaleaf Holdings (CSE: CURA) reported its third-quarter financial results. The firm reported revenues of $317.13 million, up only 2% quarter over quarter, signifying the COVID-19 pull forward had stalled. Although the company did grow revenues 74% year over year, gross profits came in at $144.37, down 7% quarter over quarter. The company reported adjusted EBITDA of $71.36 million, down 15% quarter over quarter but up 69% year over year.

A number of analysts cut their price target on Curaleaf after the results, bringing the 12-month price target to C$26.33 from C$27.93, or a 114% upside. Out of the 15 analysts, 5 have strong buy ratings, 9 have buy ratings and 1 analyst has a hold rating on the stock. The street high sits at C$32.25 from Stifel-GMP while the lowest comes in at C$20.

In Canaccord’s third quarter review, they reiterate their buy rating but lowered their 12-month price target to C$22 from C$24 saying, “Consumer spending headwinds and margin pressure weigh on results.”

Canaccord says that the third quarter results came in below their estimates. Primarily revenue was forecasted to be $329.29 million for this quarter, while gross margins came in about $30 million below Canaccord’s $172.88 million estimate.

Canaccord says that the company has noticed that medical patient registrations in New Jersey and New York have declined “as some have turned back to illicit channels given that cannabis has been decriminalized in the interim.” They say that the third quarter results put the company at the lower end of their guidance.

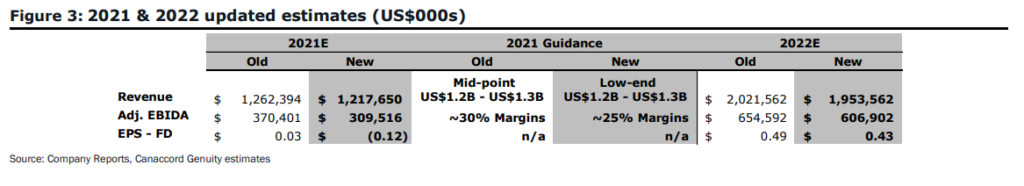

Below you can see Canaccord’s updated 2021 and 2022 estimates which have changed slightly. Canaccord says that the price target cut is due to a higher discount rate range and slightly lower near-term estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.