On February 8th, Enthusiast Gaming (TSX: EGLX) reported its preliminary fourth quarter 2021 results. The company expects fourth quarter revenue of $56.9 million, which represents a 34% year-over-year increase. This would put Enthusiast’s full-year revenue at $167.4 million or an increase of 130% over the last year. They expect gross profits of $13.7 million, a 69% increase year over year. Direct sales are expected to come in at $8.8 million while paid subscribers will be 330,000.

Enthusiast Gaming currently has 9 analysts covering the stock with an average 12-month price target of C$9.21 or a 134% upside to the current stock. Out of the 9 analysts, 3 have strong buy ratings and the other 6 have buy ratings. The street high sits at C$12, which represents a 205% upside. The lowest 12-month price target comes in at C$7 from 2 different analysts.

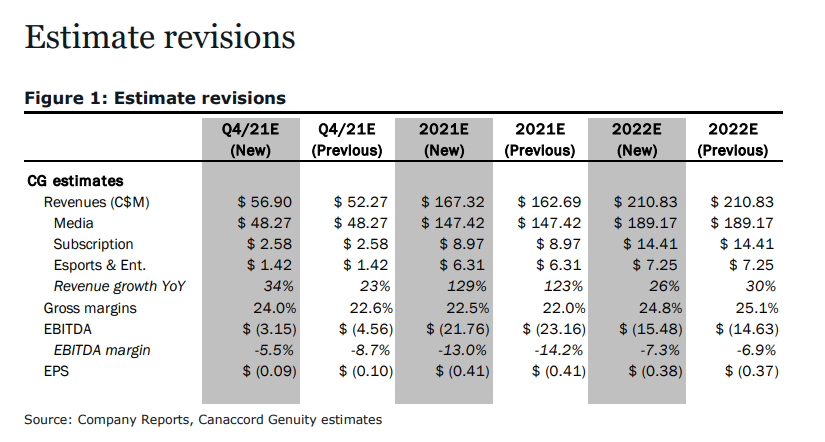

In Canaccord’s note, they reiterate their buy rating but lower their 12-month price target from C$9 to C$7, saying that even though they remain positive on the stock, Enthusiast beating Canaccord’s estimates, they believe this environment is extremely difficult on high growth, negative EBITDA companies. They additionally have modeled deferred payments as share issuances, shifting them from cash outflows to dilution.

For the quarterly results, the company beat all of Canaccord’s estimates. They expected Enthusiast’s revenue to come in at C$52.2 million. They write, “We believe the beat was driven by a combination of strong programmatic CPMs in the seasonally strong period.” Gross margins came in at 24.1%, ahead of their 22.6% estimate.

Paid subscribers were up 80% year over year. Canaccord says the growth primarily came from the addition of U.GG and Addicting Games. While direct sales grew 167% during the same period to $8.8 million, management noted that they had renewals and expansions from some key customers.

Lastly, Canaccord notes that Enthusiast’s cash on hand of $22.7 million and an unused $5 million revolver, puts the company in a sticky situation. They believe that Enthusiast will be limited in their M&A in the near term.

Below you can see their updated fourth quarter, full-year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.