On February 4th, Canaccord Genuity came out with their cannabis fourth quarter 2021 preview. On that note, they lowered almost every single 12-month price target in their cannabis coverage.

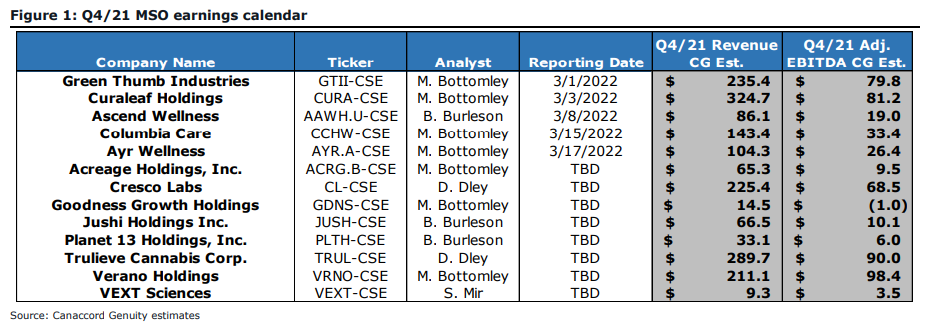

- Ayr Wellness (CSE: AYR.a) price target was lowered to C$57 from C$62

- Columbia Care’s (CSE: CCHW) was lowered to C$11 from C$13

- Cresco Labs (CSE: CL) lowered to C$15 from C$16

- Curaleaf (CSE: CURA) was dropped from C$22 down to C$18

- Green Thumb’s (CSE: GTII) lowered to C$46 from C$53

- Trulieve’s (CSE: TRUL) lowered from C$97 to C$70.

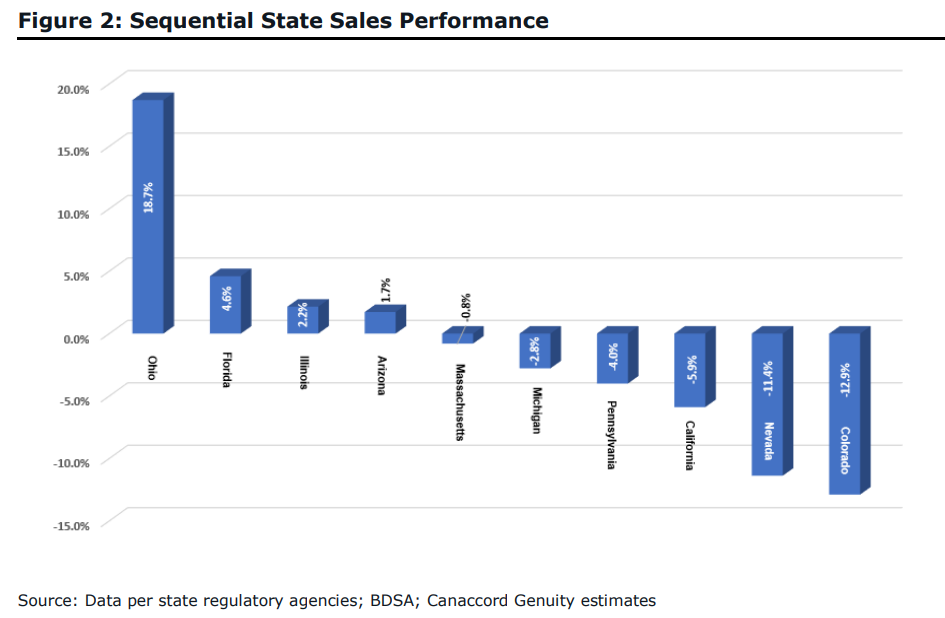

Canaccord says that through their channel checks, they expect a more subdued end to the year with fourth-quarter revenues coming in flatter than at any point in 2021. They believe that this is primarily a function of record-high inflation, making consumers spend more on their other living expenses such as groceries and gas.

Additionally, after speaking to many U.S operators, many have noted that there is a wholesale pricing issue that is expected to continue into 2022 as more capacity continues to come online.

Even with this issue potentially hitting the companies margins, Canaccord expects 2022 to still be a banner year for the sector. They believe that the sector could hit the coveted US$30 billion run rate this year. They add that having exposure to the US cannabis sector currently is a “compelling valuation proposition.”

Lastly, Canaccord believes that the >60% drawdown in the USMJ names seen in the last year comes from “structural challenges in the equity markets given that cannabis remains an illicit Schedule 1 drug at the federal level.” Rather than any sort of concerns around the operational side of the businesses.

Below you can see Canaccord’s fourth-quarter earnings previews.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.