Last night, Teranga Gold Corp (TSX: TGZ) announced the results of the Sabodala-Massawa Gold Complex’s preliminary feasibility study, for which they would be filling a technical report on or before August 31. The complex has 4.8 million ounces of gold, at an average grade of 1.98 g/t gold.

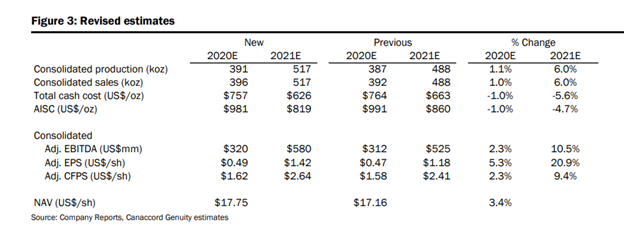

For the first five years of production (2021-2025), the project is estimated to have a production output of 384,000 ounces at an all-in sustaining cost of $671 per ounce, which is better than analysts expectations of ~350,000 ounces annually at an all-in sustaining cost of $715 perounce. The phase one capital expenditures is estimated at $37 million with $29 million to be spent in 2020, with the completion scheduled for the first half of FY2021. Phase two will start in 2021 with production planned for 2023; capital expenditures for phase two is estimated at $219 million with $71 million to be spent in 2021 and $148 million in 2022.

Canaccord’s analyst Carey MacRury calls this news release a “positive, outlining a high-grade, low-cost operation,” with an average all-in sustaining cost of $749 per ounce, identifying it as being “transformational for the company.” Canaccord this morning reiterated their Buy rating while raising their price target from C$17.50 to C$19.00, updating their models to reflect a sooner-than-expected development of Phase two and reflect updated CAPEX costs.

Analyst Carey MacRury moved Teranga into the mid-tier gold producer class, forecasting Teranga’s production average to be 527,000 ounces per year over the next five years at an average all-in sustaining cost of $837 per ounce, which is an improvement from their previous forecast of 491,000 ounces at $870 an ounce. They now forecast higher CAPEX in 2021-22 and roughly $200 million in free cash flow for those years, below the $330 per year estimate they had previously. MacRury also gives three potential catalysts for Q4FY20::

- Updated life of mine plan for Wahgnion.

- Updated 2020 and new five-year guidance.

- Golden Hill preliminary economic assessment.

Alongside Canaccord Genuity upgrading their price target to C$19.00 and reiterating their buy rating on Teranga, Cormark reiterated their top pick rating while upgrading their price target from C$20.00 to C$21.00. Currently, the mean price target is C$17.14, which represents a ~17% upside.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.