After a very busy and dilutive December, where shares outstanding went from 485.5 million to 919 million, an 89% increase, Sundial Growers (NASDAQ: SNDL) is “Debt-free and on the hunt,” says Matt Bottomley, Canaccord’s cannabis analyst.

Canaccord upgraded their 12-month price target on Sundial to U$0.40 from U$0.30 and reiterated their hold rating. Matt Bottomley writes that the upgrade mainly comes from updating their model to include Zenabis’ royalty contributions to start beginning in the second half of 2022.

Sundial currently has four analysts covering the company with a weighted 12-month price target of U$0.40. This is down from the average at the start of November, which was U$0.57. Three analysts have hold ratings, while one analyst has a sell rating.

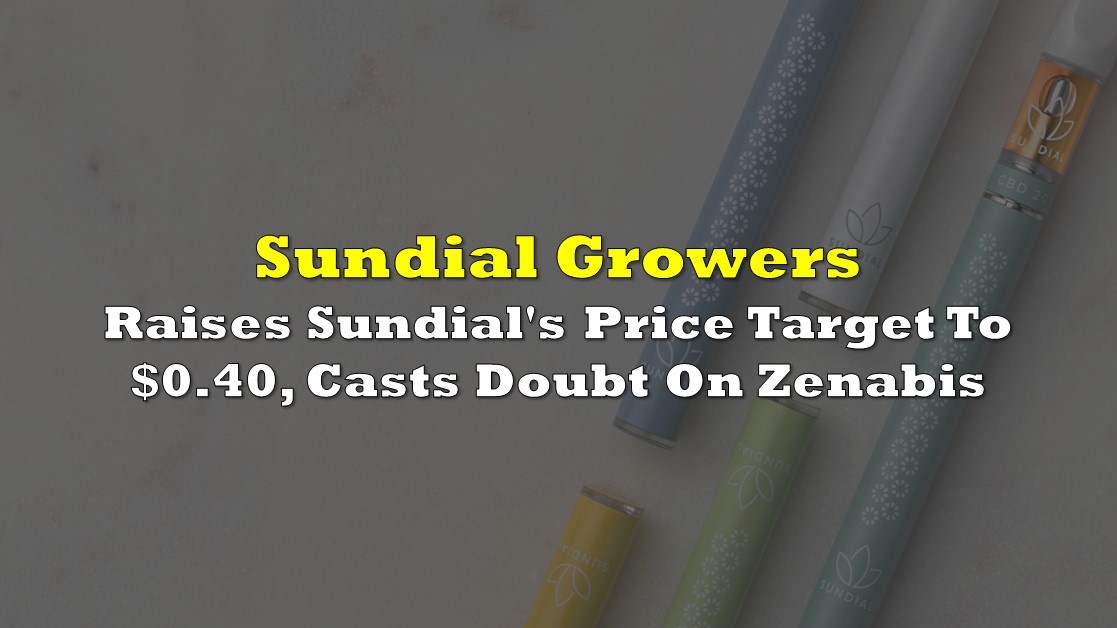

On December 30th, Sundial announced that they made a strategic investment into Zenabis’ debt. They will own C$58.9 million of Zenabis’ senior secured, which bears 14% interest annually. The note has a four-tiered royalty structure that is activated once the company reaches >C$20M in quarterly net cannabis revenues while maintaining certain debt service ratios.

Matt Bottomley says that this investment is neutral and will provide costless cash flow over time. He warns, “the timeline required for Zenabis to meet the necessary debt covenants remains ambiguous and will likely stall Zenabis’ ability to invest in its growth – therefore capping royalty amounts.”

Matt Bottomley writes, “we are cautioned by management’s decision to invest half of its capital in debt securities of a downstream, capital-strapped business immediately after subjecting its investors to dilution as it remedied its own balance sheet.”

He forecasts that Sundial will use the leftover cash to invest in building out their business and writes, “we believe the company is better situated today to capitalize on cannabis-related opportunities as they arise.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

I wonder how the analysts feel after the recent positive developments announced by Zenabis ? Anyone care to comment?

…. crickets…