Magna International (TSX: MG) is expected to report its third-quarter financial results on November 5th before the market opens. Out of 11 analysts, revenue is expected to be US$7.98 million. Another 11 analysts have a consensus of US$0.60 in earnings per share.

There are 10 analysts covering Magna International with an average 12-month price target of US$106.59. Out of the 10 analysts, 1 has a strong buy rating, 8 have buys and 1 analyst has a hold rating. The street high price target sits at US$126.65 while the lowest comes in at US$82.

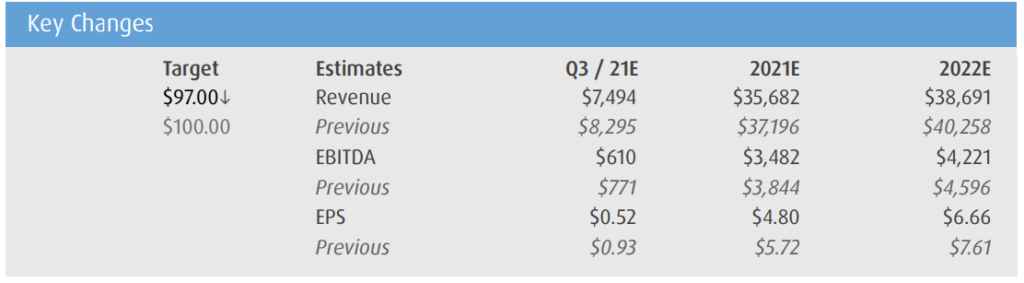

In BMO Capital Markets earnings preview they reiterated their Outperform rating but slightly lowered their 12-month price target from US$100 to US$98, saying that they have reduced their third quarter, 2021, and 2022 estimates.

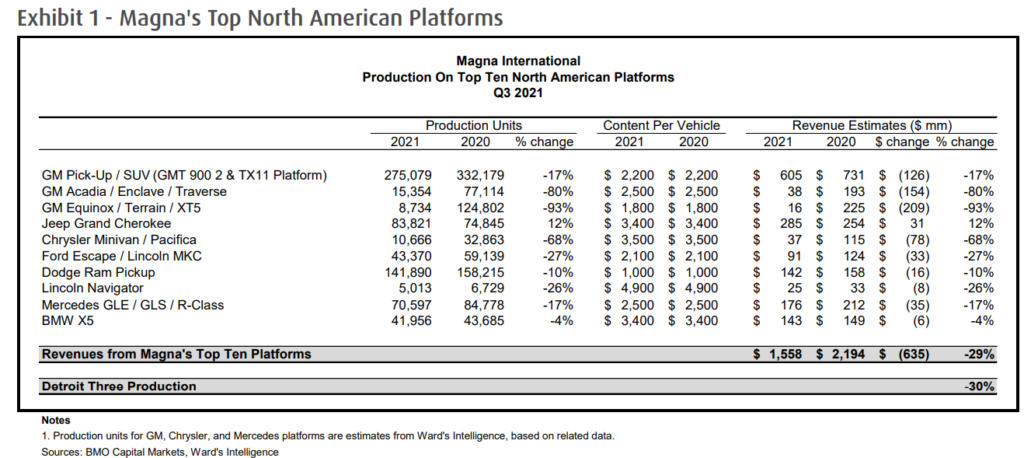

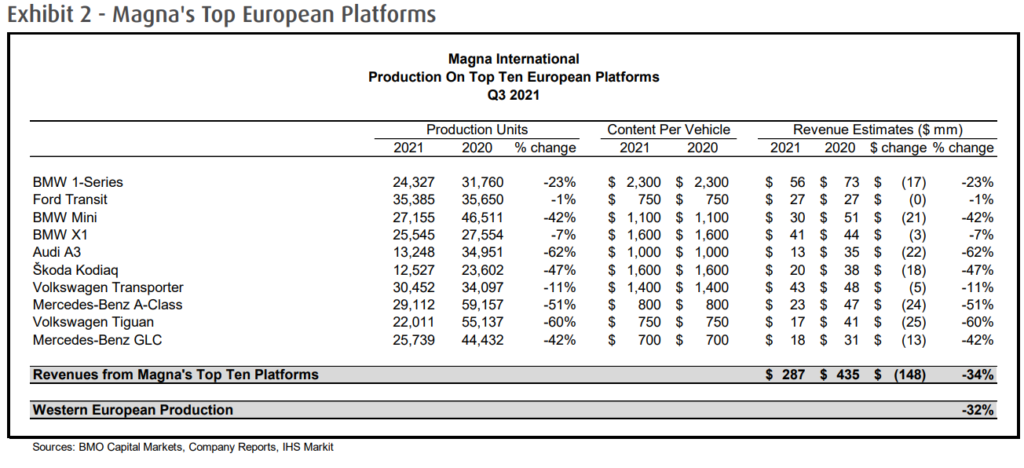

According to BMO’s channel checks, they note that Detroit Three’s production has decreased by 30%, more than their prior 20% estimate. While Western European production decreased by 32% year over year, once again higher than their previous estimate.

They base their forecasts primarily on their North America data which shows that all but one platform has had a decrease in production units year over year. General Motors production has been getting hit the most, which is down between 17 and 93 percent.

The data for Europe does not look that good either, with every single one of Magna’s European platforms being negative on a year-over-year production basis.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.