Eldorado Gold (TSX: ELD) reported their second quarter financials recently. The company produced 116,066 ounces during the second quarter with an all-in sustaining cost of $1,074. The company reaffirmed their full-year 2021 guidance of 430,000 – 460,000 ounces at an all-in sustaining cost of $920-$1,150 per ounce. The company reported revenues of $233.2 million, down 9% year over year, while gross profits decreased 21.2% to $69.4 million for the quarter.

The company has 12 analysts covering the stock with an average 12-month price target of $18.60, down from $18.93 from last month. The street high sits at $24.00 from Haywood Securities, while the lowest comes in at $12.47. Out of the 12 analysts, 6 have buy ratings, 5 have hold ratings and a single analyst has a sell rating.

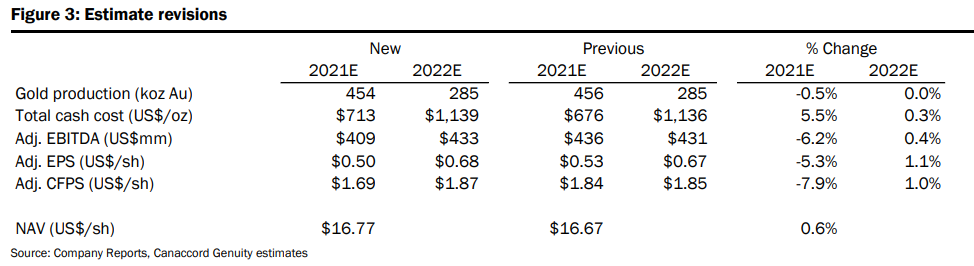

Canaccord Genuity kept both their $15.00 price target and hold rating steady, but revised their 2021 and 2022 estimates off the back of Eldorado’s second quarter results. They say, “overall, we view the quarter as largely in line, with Eldorado pre-releasing gold production earlier in the quarter.” The only number that deviated from Canaccord’s estimate was EBITDA, which came in at $103 million, below their $113 million estimate.

Both production results and product guidance came in line with what Canaccord was expecting, while Canaccord is expecting grades to increase at their Lamaque mine in the second half of 2021. Canaccord Genuity says that the companies balance sheet looks strong with $411 million in cash and $150 million available under their credit facility.

Below you can see Canaccord’s new 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.