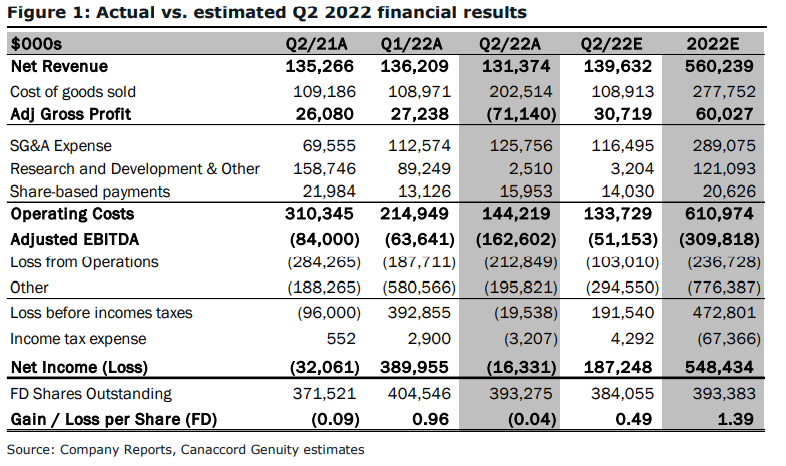

On November 5th, Canopy Growth Corp (TSX: WEED) (NASDAQ: CGC) reported their fiscal second quarter 2022 financial results. The company reported declining revenues of $131.4 million, down 4% quarter over quarter. The company reported negative gross margins due to an $87 million write-down.

The company commented that if you exclude non-cash charges, their gross margins could have been roughly 12%. The firm reported adjusted EBITDA of -$163 million, lower than the -$77 million last quarter. Canopy says that the wider losses were driven by lower sales and a decline in gross margins. The company ended the quarter with $2 billion of cash and equivalents, a decrease of $300 million.

It seems like every single one of Canopy Growth’s 15 analysts cut or downgraded Canopy after their results. This brought Canopy’s average 12-month price target to C$23.22, down from $26.64. Out of the 15 analysts, 2 have buy ratings, 10 have hold ratings, 1 analyst has a sell rating, and the last 2 analysts have strong sell ratings. MKM Partners currently has the highest 12-month price target of C$51, while the lowest sits at C$12.

In Canaccord Genuity’s second quarter review, they slashed their 12-month price target to C$12 from C$25, and downgrade Canopy to a sell from a hold rating, saying, “Canopy prints sizable losses; near-to medium-term turnaround prospects fade.”

For the quarterly results, Canopy Growth came in lower than all of Canaccord’s estimates, resulting in their analyst having strong words to say. The analyst commented on the quarter saying, “As the company’s turnaround initiatives remain challenged, we believe the overall risk profile of Canopy’s ability to steady its Canadian operations and accelerate other international/US growth endeavors is now even further elevated.”

Canaccord estimated net revenues to come in at $139.63 million, while achieving a positive gross profit. They also expected adjusted EBITDA to be about one-third of the actual result.

Digging deeper, Canopy stated that it had the #1 market share in premium flower, thanks to its Supreme acquisition, while the sequential revenue decline was attributed to “insufficient supply of in-demand attributes,” which is troubling, says Canaccord. For the companies “other” segment, which was the primary factor for Canopy’s top-line miss, Canaccord says that there was a material – 40% sequential decline in Canopy’s Storz & Bickel segment.

Below the top-line, Canopy’s negative gross margin and 12% gross margin, when stripping out non-cash charges, are roughly 9% below the first quarter’s gross margin. Canaccord now expects that Canopy will continue to write down inventory as they have >$350 million of inventory on their books.

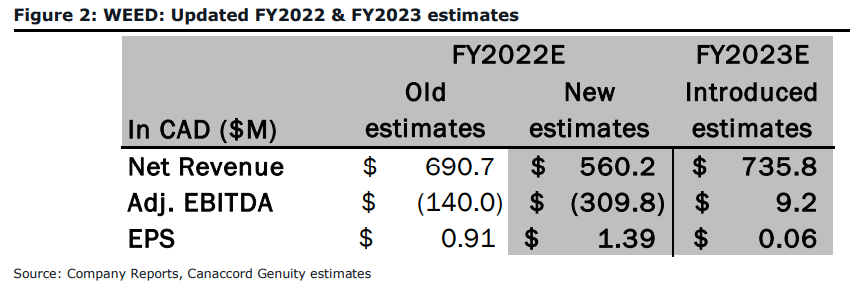

Below you can see Canaccord’s updated fiscal full-year 2022 and 2023 estimates. They are now expecting Canopy’s long-term market share to sit at 13-15%, down from their previous 20% estimate, commenting that “leaders in the space continue to experience market share erosion.” They have also increased their discount rate to 13%-20% due to the increased uncertainty “around the company’s ability to inflect to profitability.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.