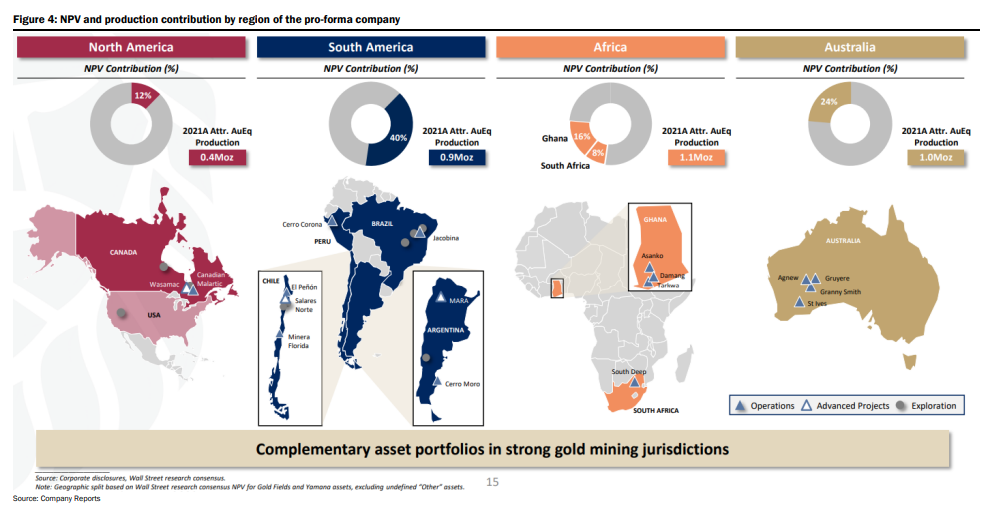

On May 31, Gold Fields (NYSE: GFI) announced that they would be acquiring Yamana Gold (TSX: YRI) at a total valuation of US$6.7 billion, a 34% premium to the current stock price. Yamana shareholders will receive 0.6 of a Gold Fields’ share for each share of Yamana held, and the capital structure will be made up of roughly 61% of Gold Field shareholders and 39% of new Yamana shareholders.

Gold Fields says that this acquisition of Yamana Gold will create “a top-4 global gold major with a diversified portfolio of high-quality, long-life assets with tangible near and long-term growth opportunities,” and that Yamana is “a natural strategic fit for Gold Fields, with its high quality, diversified portfolio of long-life assets located in mining-friendly rules-based jurisdictions across the Americas and with a shared focus on health and safety and ESG performance.”

Lastly, Gold Fields believes that there will be an initial pre-tax savings of roughly $40 million per year and the combined company has the potential to see synergies in financing as well as streamlining overhead costs.

Yamana Gold currently has 13 analysts covering the stock with an average 12-month price target of C$8.73. Out of the 13 analysts, 2 have strong buy ratings, 6 analysts have buy ratings and the last 5 analysts have hold ratings on the stock.

In Canaccord’s note on the acquisition, they downgrade Yamana Gold from a buy to hold and lower their 12-month price target from C$10.50 to C$7.50, saying that the combined company “provides investors with a larger, more liquid, diversified global platform with near-term growth and a solid balance sheet.”

Canaccord notes that gold investors, “tend to take a skeptical view of transaction premiums,” as Gold Fields stock fell over 20% the day of the announcement. They believe that part of this drop was investors digesting “a surprise combination,” but believe that ultimately the transaction will have enough support to go through.

Canaccord says that the pro-forma company would have had a 2021 full-year production of 3.4 million ounces at an all-in sustaining cost of $1,024 per ounce. While management expects that this should grow to 3.8 million ounces by 2024. Pro-forma company will have 14 operating mines across 4 regions, with the majority of production happening in Ghana and South America.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.