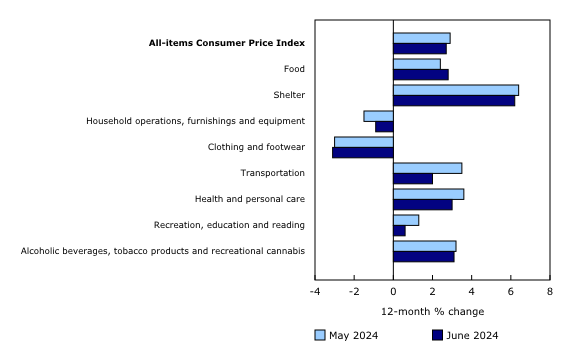

Canada’s Consumer Price Index rose 2.7% year-over-year in June, decelerating from May’s 2.9% increase, according to the latest data. This slowdown was primarily driven by a moderation in gasoline price growth, which rose only 0.4% compared to 5.6% in May.

The core inflation rate, excluding volatile items like gasoline, remained slightly higher at 2.8% in June. This indicates that while overall inflation is easing, underlying price pressures persist in the Canadian economy.

On a monthly basis, the CPI decreased 0.1% in June, following a 0.6% increase in May. This decline was largely attributed to lower prices for travel tours (-11.1%) and gasoline (-3.1%).

Durable goods prices continued to fall, dropping 1.8% year-over-year in June, compared to a 0.8% decline in May. The purchase of passenger vehicles index saw its largest yearly decline since February 2015, falling 0.4%. Used vehicle prices decreased by 4.5%, reflecting improved inventory levels.

Food prices, however, showed an acceleration in growth. Consumers paid 2.1% more for groceries in June compared to 1.5% in May. This marks the second consecutive month of accelerating grocery price growth. Notable increases were seen in dairy products, fresh vegetables, and non-alcoholic beverages.

The Bank of Canada projects inflation to remain around 3% into the second quarter of 2024, before easing below 2.5% in the latter half of the year. The central bank aims to bring inflation back to its 2% target.

These latest figures suggest that while inflationary pressures are gradually easing in Canada, the path to the central bank’s target remains challenging.

Information for this story was found via StatCan and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.