Canada Silver Cobalt Works Inc. (TSXV: CCW) has announced numerous positive assay results which confirm the discovery of high-grade silver in the Robinson Zone of its flagship Castle Silver project in northern Ontario. The company has so far discovered five heavily mineralized veins, as well as 0.3 meters of high-grade visible gold with a gold content of 25 grams per tonne of resource (g/t).

On January 29, the company announced a 0.3-meter intercept at Robinson with a silver content of 89,853 grams of silver per tonne of resource, equivalent to a gold composition of about 1,400 g/t. This degree of gold-equivalent content is highly unusual; the highest gold grade for an underground mine is termed bonanza grade, which is defined as having a density of more than 34 g/t.

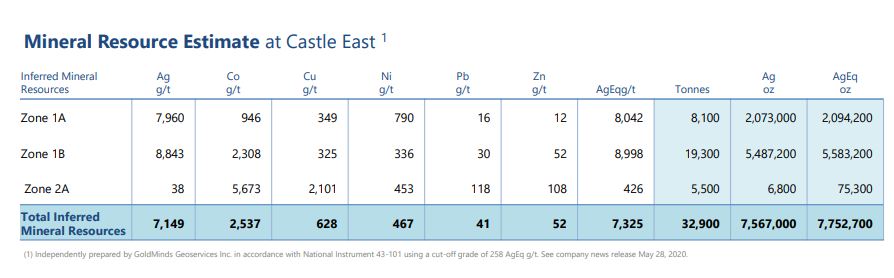

As of year-end 2020, Canada Silver Cobalt had completed 18,000 meters of a planned 50,000-meter drilling program at Robinson. The contemplated drilling depth is 500 – 800 meters. After completing only 3,000 meters of the drilling in Zones 1A and 1B of Robinson, the company commissioned a third party to prepare a NI 43-101-compliant resource estimate based only on that data. In July 2020, GoldMinds Geoservices estimated that those zones contained 7.75 million silver-equivalent inferred ounces. After all drilling is completed, that estimate seems likely to rise substantially.

A Fertile Silver-Mining Area

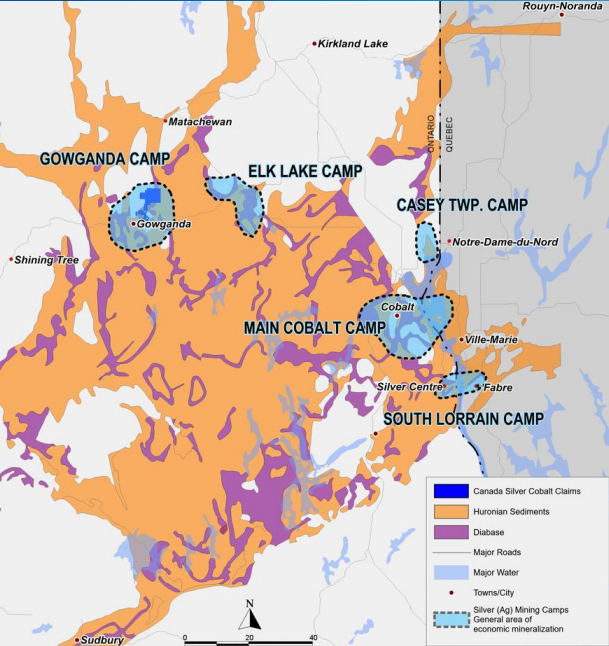

The Castle Mine Property is located in the Gowganda Mining Camp shown on the map below. Mines located throughout the map area have produced more than 500 million ounces of silver.

Solid Balance Sheet

A pre-revenue company, Canada Silver Cobalt had a cash balance of nearly $5 million as of September 30, 2020 and no debt. In addition, the company raised $4.9 million in November 2020 through the sale of shares and warrants in a private placement.

| (in thousands of Canadian $, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2020 | 3Q 2020 |

| Operating Income | ($4,168) | ($887) | ($1,463) | ($2,826) | ($760) |

| Operating Cash Flow | (3,000) | (458) | (1,572) | (1,775) | (694) |

| Cash – Period End | 4,856 | 1,090 | 420 | 686 | 295 |

| Debt – Period End | 0 | 0 | 0 | 0 | 0 |

| Shares Outstanding (Millions) | 112.5 | 93.8 | 91.7 | 90.4 | 83.6 |

As the company expanded its drilling activities, its operating cash flow deficit averaged about $1.7 million per quarter in the first nine months of 2020. At this pace, the company will likely have to issue further equity in 2021 to complete its drilling program at the Robinson Zone.

Mining is among the most unpredictable of all businesses. Despite the impressive drilling results in the first 18,000 meters of its drilling campaign at the Robinson Zone, assay results from the remaining 32,000 meters could prove to be substantially different. In any case, Canada Cobalt Silver will not realize any cash flow for a number of years.

While substantial exploration work must still be done, Canada Silver Cobalt appears to have made a major silver discovery at its Castle Silver Project. In addition, given the finance world’s high level of interest in the silver and other precious metals markets, the announcement of any future constructive assay results could be warmly greeted by investors.

Canada Silver Cobalt Works is trading at $0.60 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and Canada Silver Cobalt Works. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.