As inflation surges, an increasing number of Canadians are countering the heightened cost of living by downsizing their household expenses and even essential living expenses.

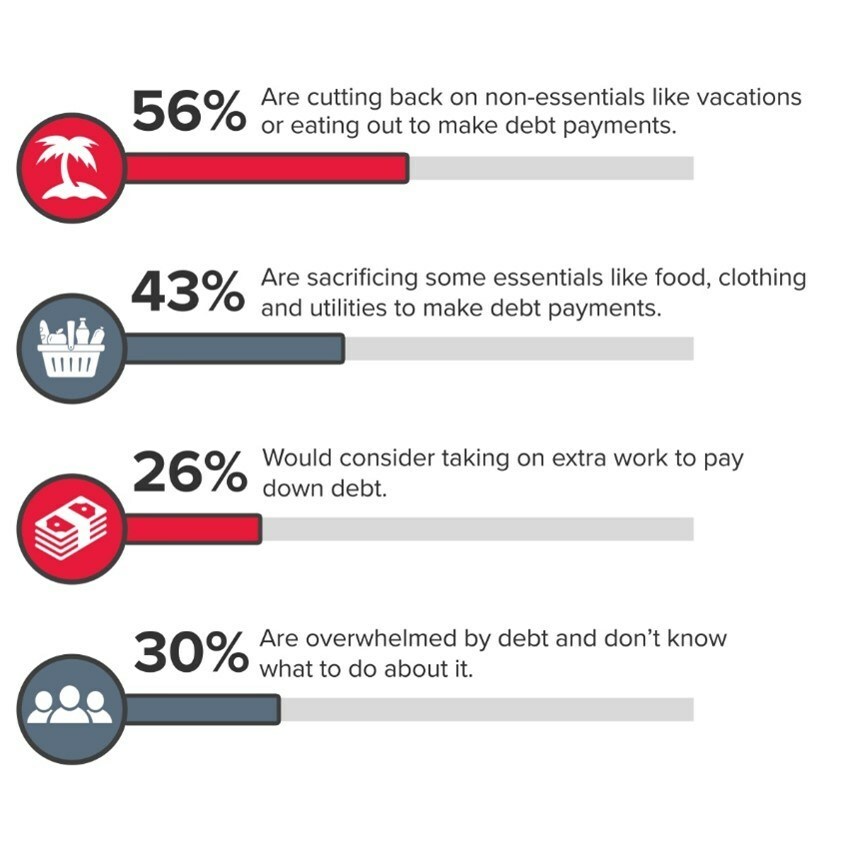

A recent survey conducted by BDO Debt Solutions investigates affordability and debt in Canada, spotlighting Canadians’ strategies for handling the economic crunch. It reports that 56% of respondents feel the necessity to eliminate non-essential spending to survive the inflation, while 30% are so inundated by their debt that they feel helpless.

The web-based poll conducted by Léger surveyed more than 1,500 Canadians and discovered that 37% of respondents plan to slash their debt over the next 12 months via improved budgeting practices. This figure rises to 47% among respondents aged 18-34. Meanwhile, 58% of lower-income households earning less than $40,000 are not just cutting back on non-essentials but also vital necessities like food, clothing, and even utilities usage.

Moreover, the idea of supplementing income streams through supplementary gig jobs is increasingly favoured as a method to endure the affordability crisis and repay debt. About 31% of Canadians are prepared to undertake additional work for more financial autonomy, while 24% of respondents aged 18-34 have already diversified their income via part-time work to counteract inflation.

Information for this briefing was found via BDO Debt Solutions. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.