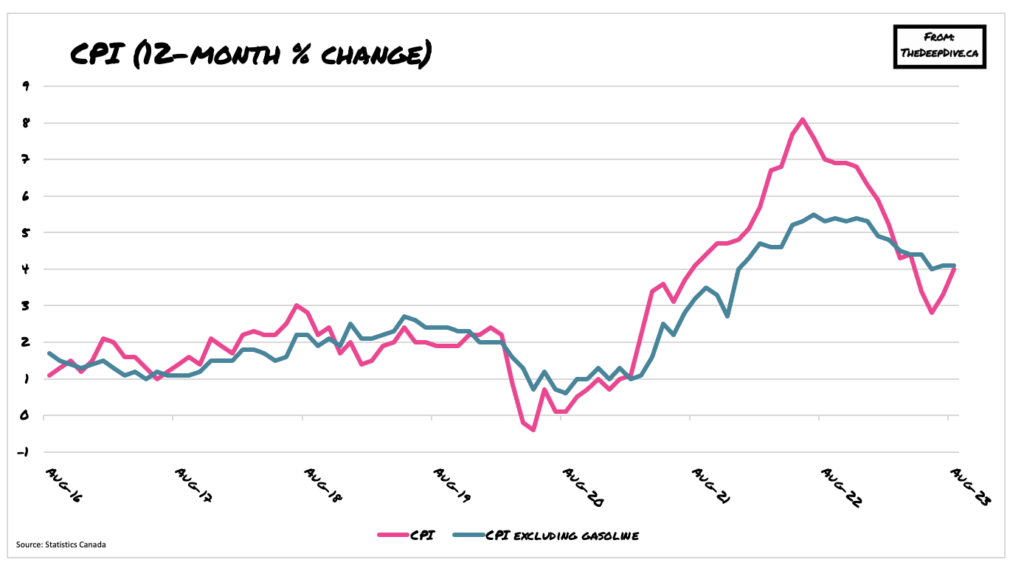

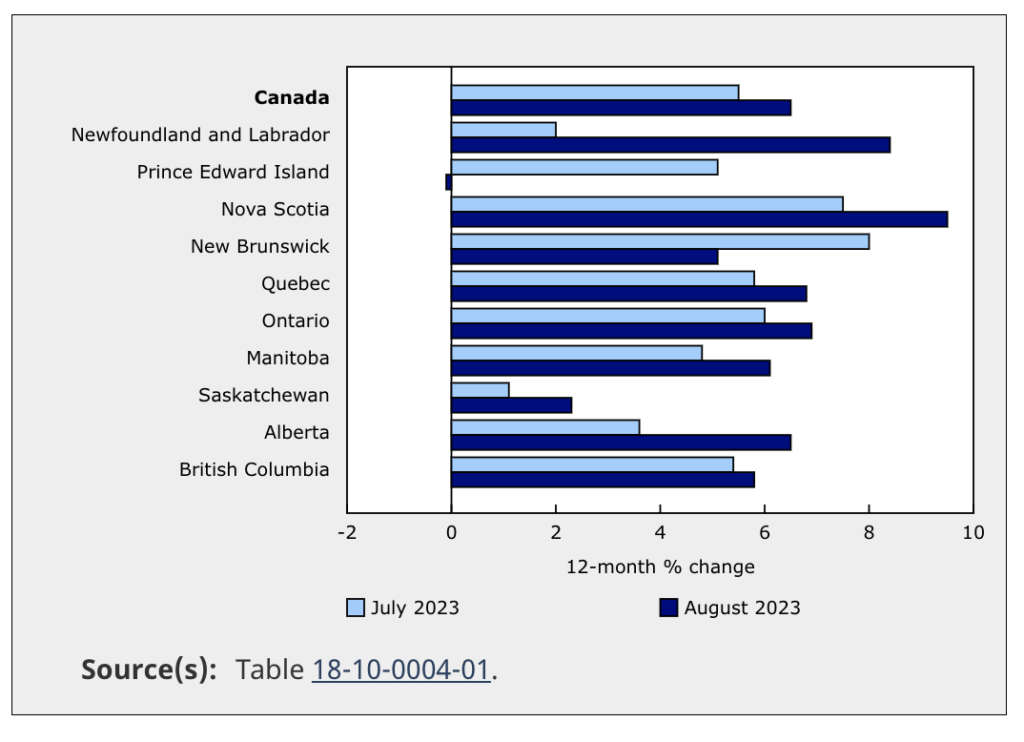

Latest data from Statistics Canada shows consumer prices rose 0.4% month-over-month to an annualized 4% in August, marking an increase from July’s reading of 3.3% and even more worrisome as it surpasses economists’ forecasts calling for a print of 3.8%.

The stark reversal in declining inflation was mostly attributable to a hike in energy prices, as well as persistently rising shelter costs. Gasoline prices aside, the CPI rose 4.1% from August 2022, relatively unchanged from the month before.

It was all crickets from Finance Minister Chrystia Freeland’s twitter account on Tuesday morning, as inflation reappears it’s ugly head in August despite the Liberal government’s hard-working zero effort to make life more affordable for Canadians.

Canada’s plan to bring down inflation is working. pic.twitter.com/dBuneJjA9k

— Chrystia Freeland (@cafreeland) July 19, 2023

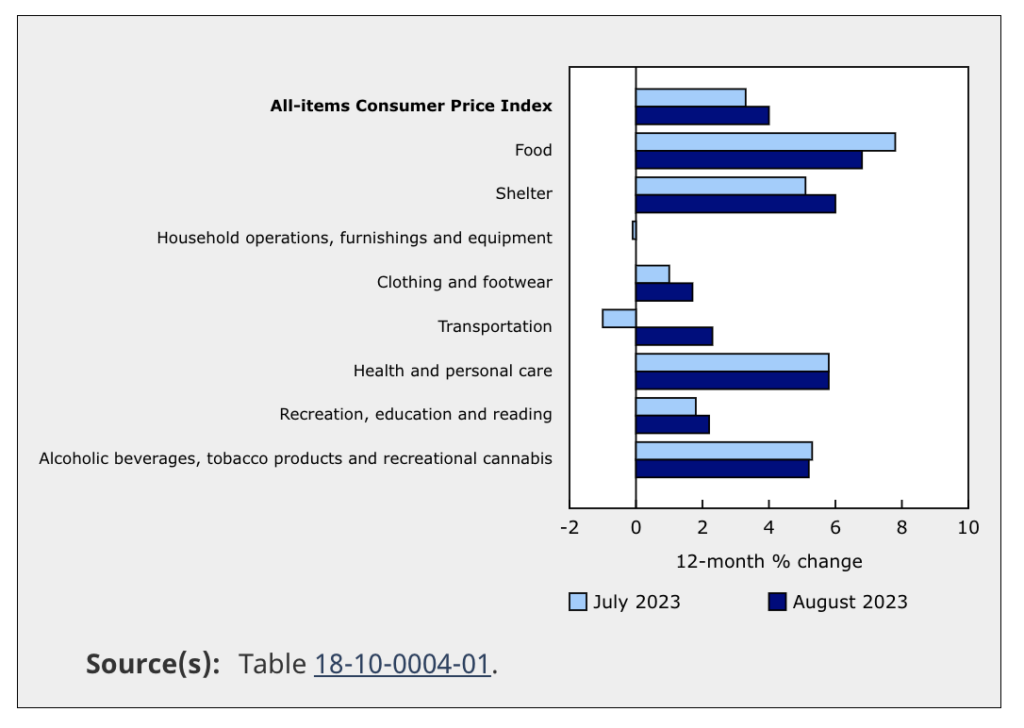

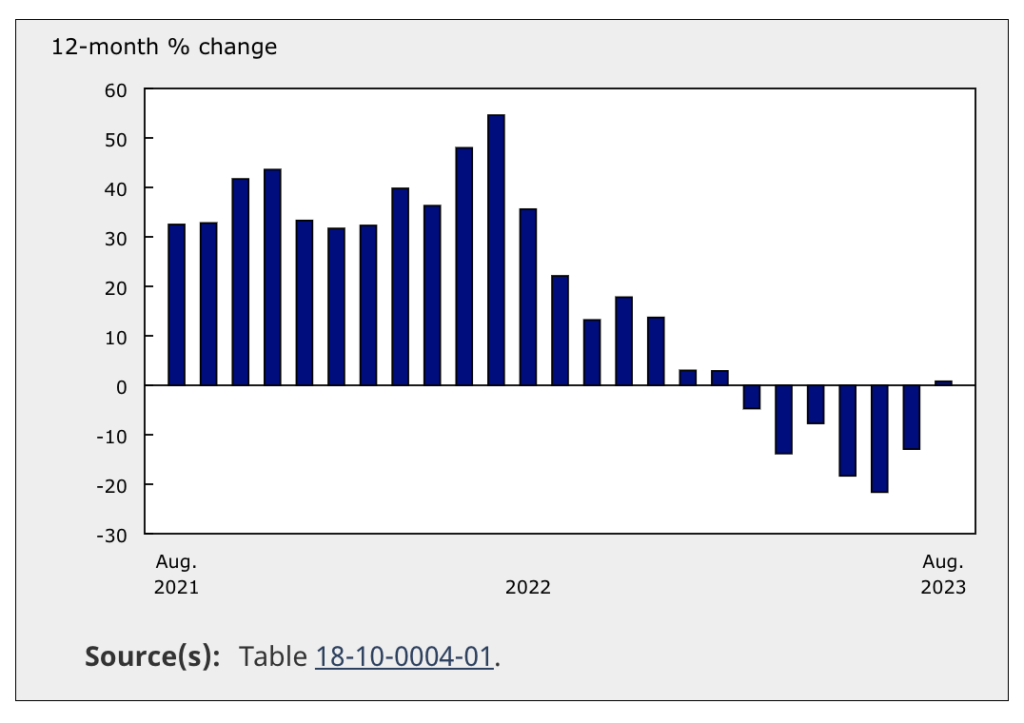

Freeland’s victory cry was short-lived, as anyone and their dog could have guessed that inflation was going to come back with a vengeance in the second half of the year, thanks to increasing energy and housing costs. Diving into Statistics Canada’s latest release, one can clearly see that gasoline prices jumped 4.6% from July and 0.8% from August 2022, due to base-year effects and production cuts by OPEC members.

The shelter index was also out of tune with the Liberal government’s sudden spiritual awakening regarding Canada’s worsening housing crisis, as shelter prices jumped 6% year-over-year last month, marking a concerning acceleration from July’s annual increase of 5.1%. “Faster growth in shelter prices was led by the rent index, which rose 6.5% year over year nationally, after a 5.5% gain in July. Among other factors, a higher interest rate environment, which may create barriers to homeownership, put upward pressure on the index,” the statistics agency wrote.

To not be outdone, the mortgage interest cost index rose 30.9% in August— a faster pace compared to July’s rate of 30.6%.

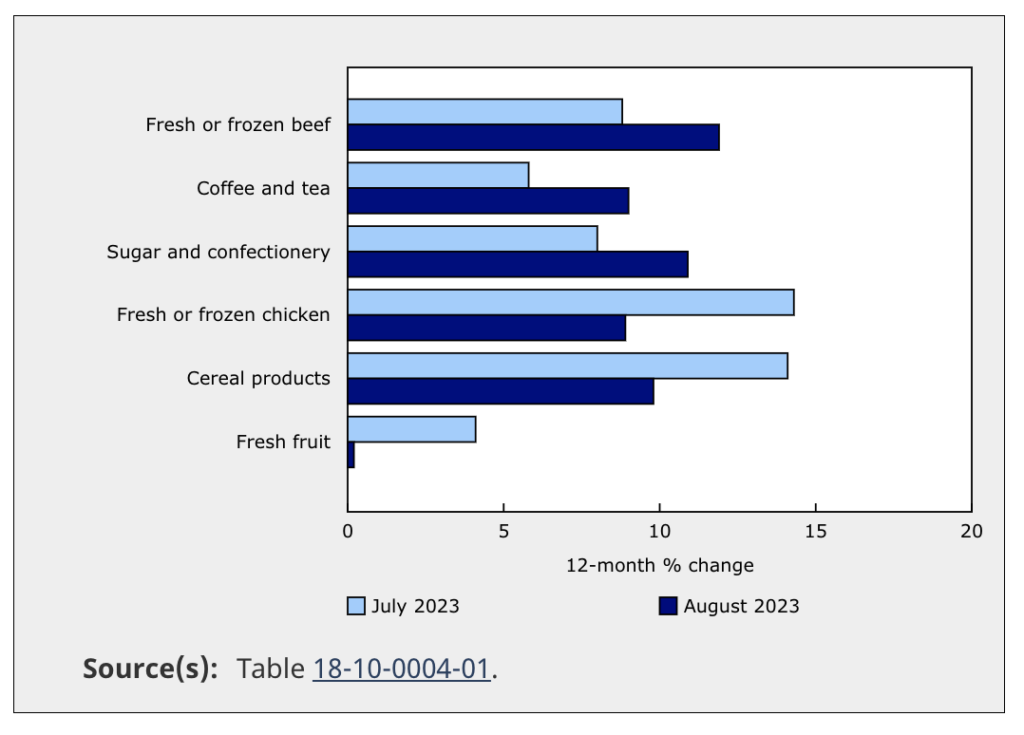

Grocery prices, on the other hand, fell 0.4% last month, but were still 6.9% higher compared to one year ago.

Information for this briefing was found via Statistics Canada and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Not sure why we ignore the increasing gas prices in the CPI? Last time I looked, gas prices are rising nearly everytime I fill up, in North Bay, On. Diesel is $1.89 a liter, a few years ago it was $1.19.