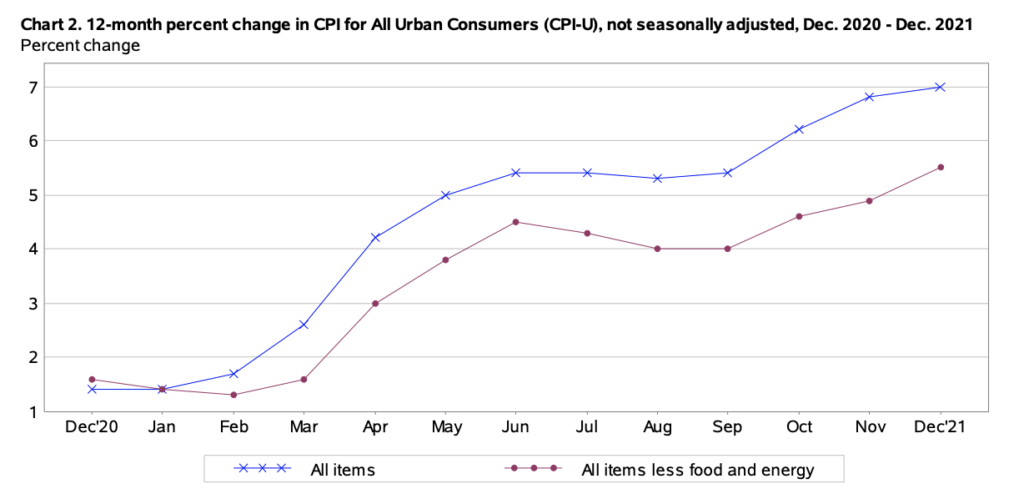

The Federal Reserve has decided to keep interest rates unchanged for the time being, but stressed that a hike is likely imminent come March as inflation skyrockets to the highest in 40 years.

Following the FOMC’s two-day meeting, Fed Chair Jerome Powell once again acknowledged that persistent inflation is out of control, and that interest rates must increase in order to keep the economy from overheating. If current conditions continue to persist, then such a rate hike could come as early as March, particularly as the labour market continues to make strong gains.

A separate statement from the Fed also reiterated that it will begin the process of reducing its balance sheet following the first interest rate increase, but failed to provide a strict timeline or when such a runoff would commence. The Fed’s balance sheet currently sits at almost $8.9 trillion, after more than doubling in size when extensive asset purchases began at the start of the pandemic.

The Fed’s hawkishly sharpened stance comes as consumer prices consecutively soar to 7%— the highest since the 1980, and a jobs market that has rebounded to near pre-pandemic levels substantially faster than forecast.

Information for this briefing was found via the Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.