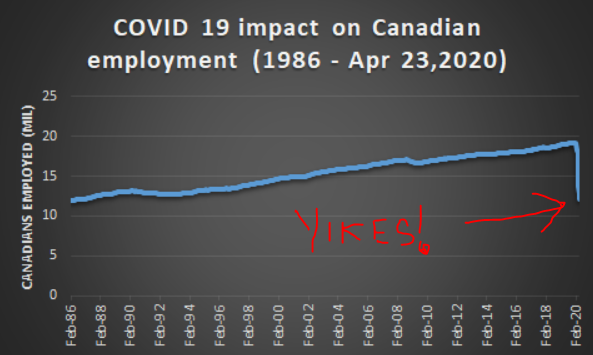

According to preliminary Canada Emergency Response Benefit (CERB) data, the number of unemployment claims since April 6 amounts to the total number of job gained since the 1980’s.

As a response to the coronavirus-induced financial hardships faced by many Canadians across the country, the federal government introduced the Canada Emergency Response Benefit. The CERB is a taxable, $2,000 per month benefit for those who have found themselves unemployed due to quarantine, illness, work disruption, or job loss. Since the initiation of the program on April 6, a total of 7.1 million individuals have applied for the income benefit. Now, under the assumption that all those that have applied are in fact unemployed, it equates to remaining active employment numbers of 12.1 million, which have not been witnessed since October 1986.

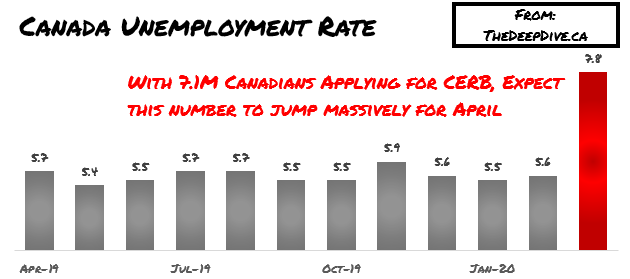

Prior to the onset of the coronavirus pandemic, employment was sitting at 19.2 million, which roughly corresponds to an unemployment rate of 5.6%. Since then (but not before the introduction of CERB), the unemployment rate has climbed to 7.8%. When CERB was implemented, the federal government had set aside $24 billion to last for a duration of 16 weeks, and so far, $22.4 million has already been paid out.

According to Parisa Mahboubi, who is an economist at the C.D. Howe Institute, unemployment numbers are going to further increase by the time May labor data is released. It is also worth noting that since the beginning of the coronavirus-induced economic crisis, the private sector was the hardest-hit by layoffs. However, the upcoming data will reflect public sector layoffs as well, which have more recently been evident.

Information for this briefing was found via Financial Post, Canadian Centre for Policy Alternatives, iPolitics, and Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.