On our last episode, we discussed the Liberal government’s unconvincing and empty threat to tax Canada’s grocery chains if they don’t all submit convincing plans to stabilize grocery prices by Thanksgiving.

Everything that’s left of Canadian news media has been all over this story all year on the behalf of the grocery buying, food-eating public. CBC footage shows a scrum of reporters staked outside the meeting shouting over each other to ask the grocery CEOs if they’re going to lower the cost of food, the way they ask accused murderers on the way into court what it felt like to stab someone, and who they’re going to stab next.

Most didn’t answer, and the ones who did didn’t say much.

Indy muckrakers down at Canadaland, with an assist from Deep Dive contributor (and best selling author!) Mike Miller, got a lot closer to the heart of this story than the rest of the press pack put together a couple weeks ago, when it drilled down on the stock buybacks conducted by Canada’s grocery chains over the past few years as groceries have been getting more and more expensive.

By Canadaland‘s count, these companies are spending $248 million to $1.2 billion per year on stock buybacks. They wheel in a few economists from think tanks that serve as counterpoints to the Fraser Institute mouthpieces that we made fun of in part one, who point out that we’d all be better off if the grocery companies used that buyback money to pay their workers more, or charged less for groceries, showing along the way that they have no idea how any of this works.

It’s called CAPITALISM!

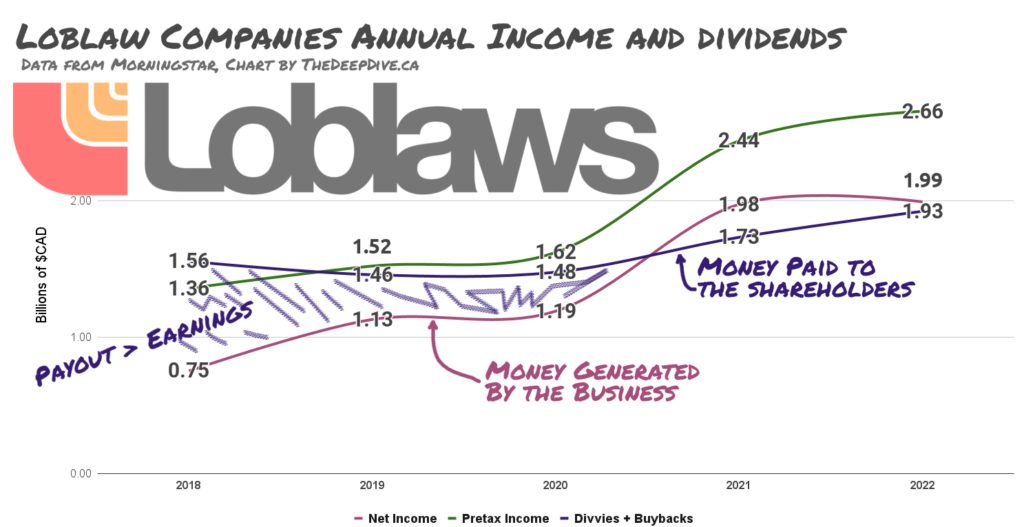

Sure. Loblaws, Empire and Metro COULD use that money to give us all a break on the price of food, or to give their employees a wage bump. They could also spend it trying to genetically engineer a unicorn, but that isn’t what they’re up to. They’re commodified business equities, working with capital (money) put up by shareholders who expect it to create a return (more money). As enterprises, they’re very efficient.

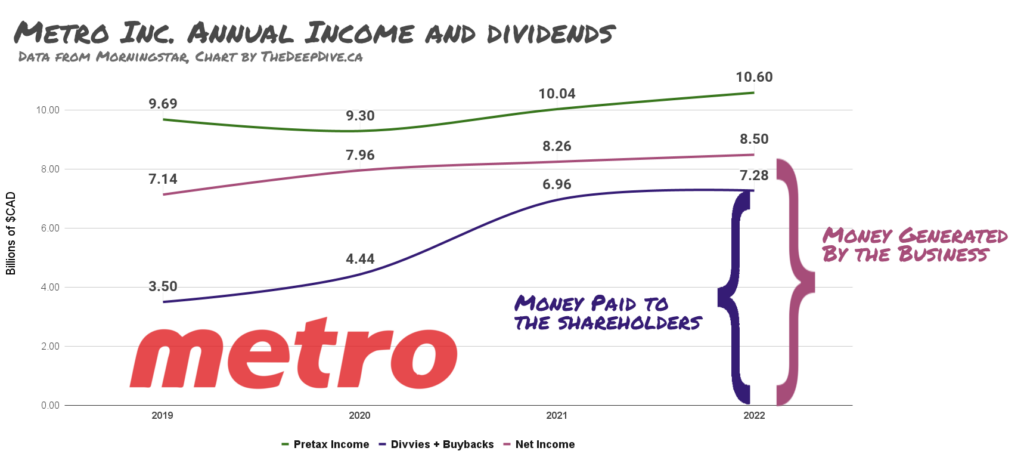

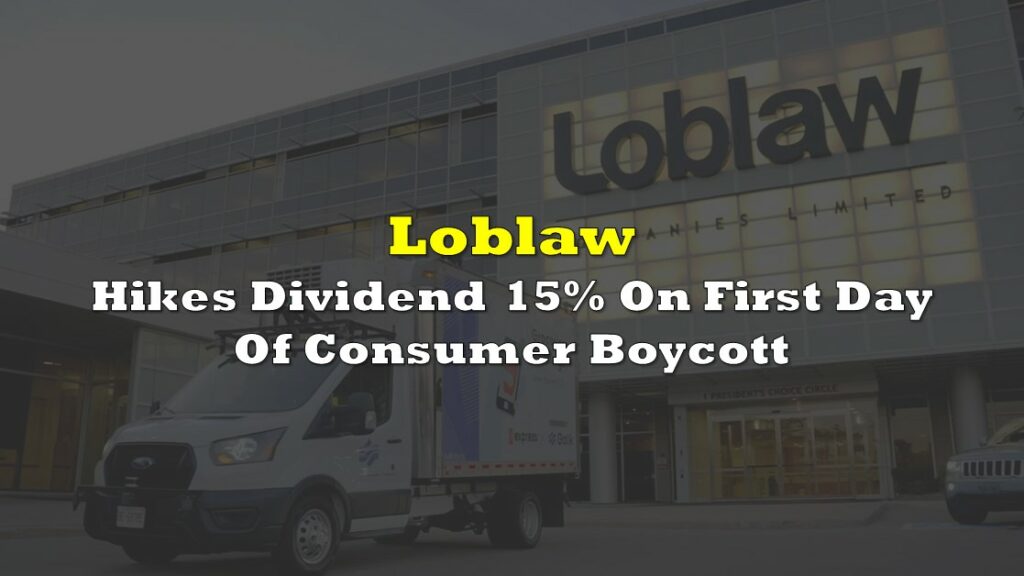

Loblaw managed three consecutive years of dividends and buybacks that exceed its after-tax income, because the income statement is only a third of the picture.

The cash available to Loblaws for dividends and buyback isn’t limited to the cash that the company earns in a year: every green dollar not earmarked for something else can go to the shareholders, and why shouldn’t it? It makes the stock into an absolute beast.

$1.39 billion worth of share buybacks helped generate a 21.5% lift on the value of their stock that year.

Owning Loblaw, Empire, or Metro stock means owning part of the country’s food distribution network. It’s important because it’s necessary, and that’s what makes it valuable. Loblaw, Empire and Metro trade for 3.2x, 1.7x, and 2.4x their respective book values, respectively, because they’ve got a lock on critical supply organs. From an investor’s perspective, that makes them safe, reliable cash machines. They’ll stop making money when people stop eating.

Canadaland is making podcasts and stories about share buybacks (and we’re guilty of it too) for the same reason the government is pretending to address the grocery stores’ part in the cost of food on behalf of the general, hungry electorate: they’re grappling with the inherent unfairness in all of this. Capital interests have effectively built a toll on the way Canadians get their food, and paying it is making us broke and them rich.

The economists in Canadaland‘s buybacks story imply that changing the rules to disallow grocery store stock buybacks would somehow cause the companies to retain more earnings, which it might, if they don’t just use that money to bump the dividend… but so what? It still doesn’t give the stores a reason to lower prices, and it won’t make an unfair system fair.

“Nice money machine you got there… be a real shame if it suddenly belonged to its customers…”

The simple, effective, and permanent solution is to disallow for-profit grocery enterprises.

The think tanks will muster all of the anti-communist sentiment left over from the Cold War to insist that, if grocery stores couldn’t turn a profit, they’d all turn into bread lines, but that just isn’t the case, according to a well-established, made-in-Canada proof of concept.

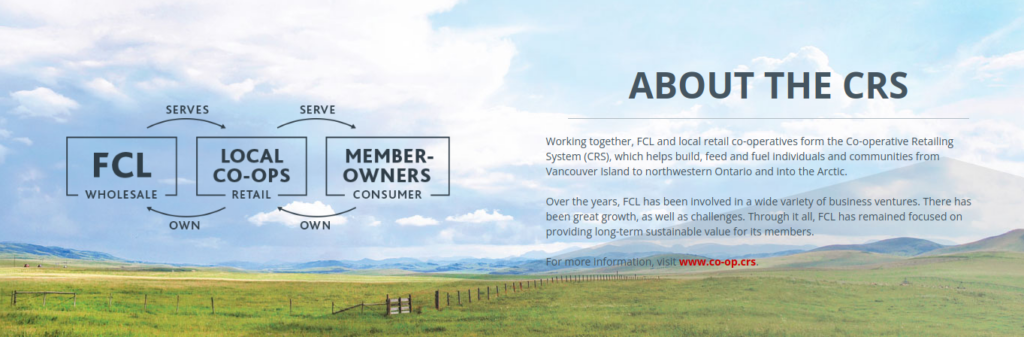

Western Canadians outside of urban centers have been shopping at one of the world’s largest federations of food and fuel cooperatives for more than 100 years. In the beginning, it was the only way to get groceries to frontier areas whose populations weren’t large enough to interest commercial suppliers.

Co-Ops are member-owned “companies” that are set up for the practical purposes of making or buying goods, and selling it to their members.

It’s tough to get good aggregated data on the Co-Op’s total financial footprint, because there are several different networks serving several different regions that are several different sizes. But we can get a good idea from the 2022 annual report of Federated Co-Operatives Limited, the core enterprise that wholesales to the regional member Co-Ops. It did $12 billion in sales in the 12 months ending October 31, 2022.

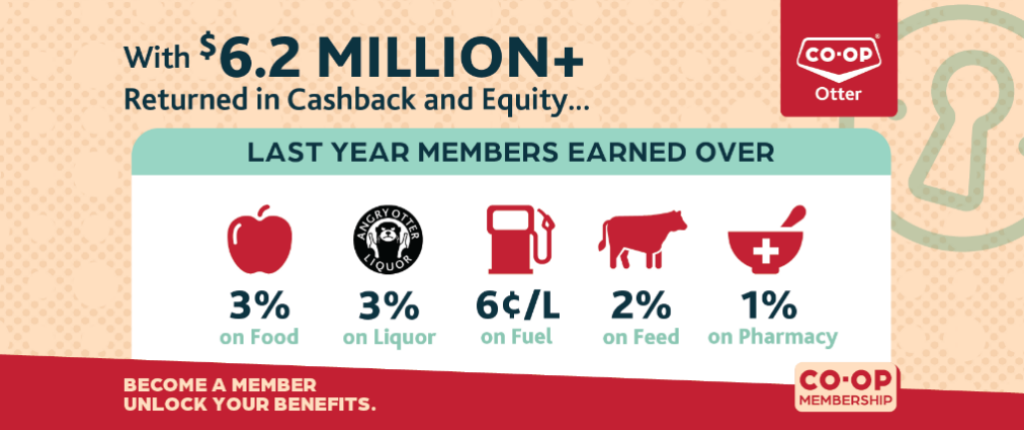

The $410 million in after-tax income it generated was put back into the business, to be used for the benefit of its member Co-Ops. Each of those member Co-Ops is beneficially owned by the people who shop there, and that keeps prices down, because they’d rather not over-pay for groceries. The surplus revenue the Co-Ops generate is returned to their members; usually in the form of a check or gift cards that can be used in kind at the stores.

There’s no reason that groceries have to be run by for-profit businesses, and a government truly interested in reducing the pressure on consumers would legislate them out of business. The co-op model works fine and, if it had a national footprint, the $9.73 billion / year worth of surplus cash that the shareholders of Empire, Loblaw, and Metro suck out of the food supply line to pay themselves could come straight off of the cost of groceries. The capital that’s presently camping on grocery stock for rent might even get deployed somewhere worthwhile.

We don’t presently have any data on the inflation in Canadian Co-Op groceries vs. the inflation exhibited in the groceries at the commercial chains over any period of time.

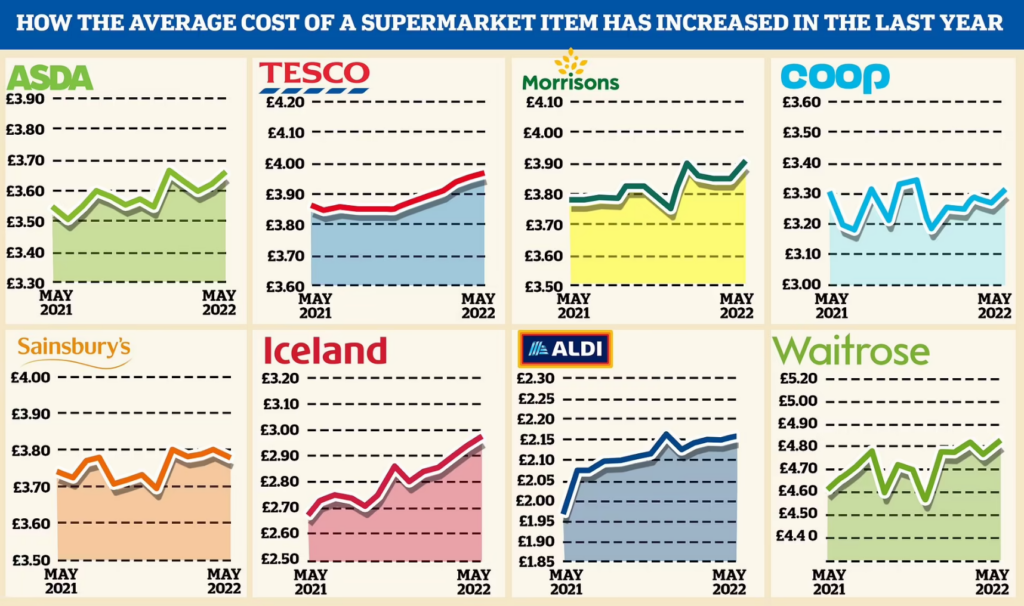

The people over at the UK’s Daily Mail put together a chart that shows markedly less average inflation in the average price of groceries in the UK’s version of COOP stores in 2021-2022, compared to their for-profit competitors…

…but we feel like more recent local data would be more relevant.

SO! using the online flyer of the Co-Op grocery store nearest to Deep Dive HQ, and the shelves at the local Loblaws affiliate, The Deep Dive is proud to offer an unscientific look at the current, comparative state of corporate vs. co-op grocery costs in BC’s Lower Mainland.

Information for this briefing was found via Sedar+, Reuters, Globe and Mail, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

8 Responses

I always said the grocers should never be aloud to own food warehouses or food companies they should be owned by the public. This would enable ma and pa shops back in a level playing field. The prices at the warehouses would be the same for all. Also they should stop the Big grocers from charging crazy high listing allowances to all the food companies for there shelf space. If the general public even had a clue what goes on. They are starving a large portion of the population there right to food at affordable prices.

The big three members of the price and supply-chain colluding supermarket cartel in Canada gouge Canadians as they did during the pandemic because the government allows them to.

All the steps mentioned above won’t work as they use outmoded thinking.

Since we have no REAL competition bureau in Canada, 100,000 Canadians have to organize to picket the crap out of them until the Federal government enacts a 50% tax on their gross earnings at the source to be immediately and regularly redistributed to Canadians until prices fall back in line, however long that takes.

The seven dirtiest words in today’s society are “We have a duty to our shareholders.”

Our Federal government letting its citizens be robbed blind is unconscionable.

Stats Canada says population had grown a million. More customers is more profits.

I’ve thought exactly this as we have started shopping almost exclusively at Otter Co-Op now – we can’t claim monopoly abuse if there’s a cooperative company we can patronize instead.

However, there are some privileges baked into this: they (co-ops) aren’t close to too many people so a car is almost required to shop there. And, there aren’t any in Ontario, where people like Canadaland informs their perspective.

I ate lunch at a B-Corp community owned enterprise yesterday. It reminds me that we can always vote with our wallet. Capital listens to those votes way more than political ones.

Here on the prairies co-op is pretty well all there is in small towns!

You can’t compare regular prices at loblaws to sale prices at coop. That’s comparing apples and oranges

So by that logic, when an apple goes on sale it becomes an orange

Ha ha ha. This is gold…